Uncork hidden cashflow in your winery

Contact

Uncork hidden cashflow in your winery

As Australia's wine industry continues to grow, it’s important for viticulturists and winemakers to understand their tax entitlements, including depreciation deductions.

With some of the oldest grapevines in the world, the Australian wine industry has a rich and vibrant history.

Australian winemakers work with the elements to create exciting flavours that are celebrated both domestically and internationally.

As the industry expands, it’s important for viticulturists and winemakers to understand their tax entitlements, including depreciation deductions

As a building gets older and items within it wear out, they depreciate in value.

The Australian Taxation Office (ATO) allows commercial property owners and tenants, such as winemakers, to claim deductions related to the building and the plant and equipment items within it.

These deductions can help boost your cash flow and alleviate pressure during low yield periods.

Small and medium business owners can also use the instant asset write-off rule for any depreciable plant and equipment asset or fit-out installed with a value of less than $30,000.

Along with small to medium business rules, there are specific depreciation rates for winemakers.

Visit BMT’s tax depreciation calculator for an estimate of the deductions you may be entitled to.

Grapevines that are planted and first used in a primary production business before 1st October 2004 can be claimed as a special depreciation deduction.

According to the ATO, the decline in value of a grapevine is worked out at a rate of 25 per cent, provided you own the grapevine, the grapevine is established on land that you either own or lease and that it’s used in the primary production business.

The deduction is based on the capital expenditure incurred in establishing the grapevines.

This can include preparing the land, planting the vines, and the vines themselves.

Winemaker case study

Let’s take a look at an example of how claiming depreciation can boost a winemaker’s cash flow.

This winery in this scenario features assets such as oak barrels, barrel racks, crushers, grape harvesters, irrigation systems and silos, all of which have significant depreciable value.

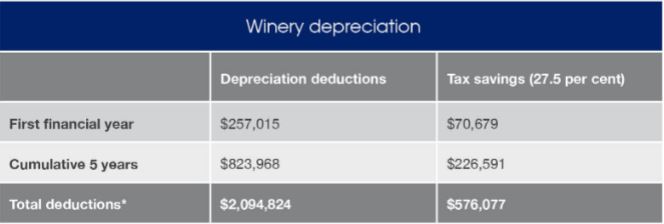

The table below outlines the first financial year, the cumulative five years and the total depreciation deductions available to the winemaker.

Source: BMT

In the first financial year, the owner is able to claim $257,015 worth of depreciation deductions, a total tax saving of $70,679. In the cumulative five years, the depreciation claims increase to $823,968, a total saving of $226,591.

Over the lifetime of the winery, the owner will be able to claim over two million dollars in depreciation deductions which will improve their after-tax position by $576,077.

As you can see, property depreciation can make a significant difference to a winemaker’s cash flow each financial year.

To find out the depreciation deductions available on your winery, Request a Quote or call 1300 728 726 today.

To learn more about BMT’s commercial capabilities, visit bmtqs.com.au/commercial-capability

This is a sponsored article.

Similar to this:

How depreciation can boost a farmer's cash flow

Scrapping can boost a hotel’s cash flow - BMT Tax Depreciation

BMT still finding an average of $8,893 in depreciation deductions