Another decrease in vacancy rates highlights Perth industrial market improvement - Knight Frank

Contact

Another decrease in vacancy rates highlights Perth industrial market improvement - Knight Frank

Perth’s industrial market continues to improve with confidence and expectations at levels unseen for several years, according to Knight Frank’s latest research report.

Research from Knight Frank has revealed a reduction in Perth industrial vacancy for the second successive quarter.

Released on Tuesday, February 19, the company's Perth Industrial Market Overview indicated there had been an improved performance across the market, highlighted by activity in the core locations of Kewdale/Welshpool and Canning Vale.

Knight Frank Industrial Sales & Leasing Associate Director, Geoff Thomson, said demand from transport companies and mining-related occupiers had been one of the main contributors to the two successive quarterly decreases in available industrial space.

At a glance:

- Knight Frank Perth Industrial Market Overview has revealed a reduction in industrial vacancy for the second successive quarter.

- Canning Vale and Kewdale/Welshpool are among the areas to show the most improvement.

- Demand from transport companies and mining-related occupiers believed to be behind the decreases.

“There has been a noticeable increase in both sales and leasing activity over the last 12 months and we believe this will continue to accelerate throughout 2019,” he said.

“Investment demand from east coast based trusts and funds has continued, however a lack of suitable investment opportunities has hampered sales volumes.

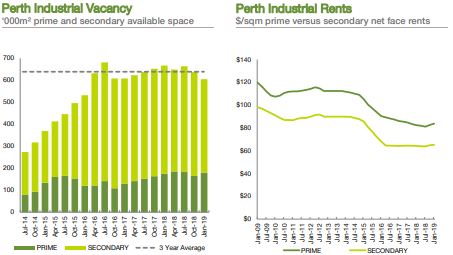

Source: Knight Frank Research

“Once this changes we will see even more sales activity.”

According to Knight Frank, the market still had a total available space of approximately 605,000 sqm, representing a 9 per cent drop from six months prior.

Knight Frank Research Analyst Nicholas Locke said there were currently 128 listed properties on the market, representing the lowest level recorded since October 2016 and well short of the peak of 150 recorded in January 2018.

“Approximately 80,000 sqm of previously listed space was leased or sold to owner-occupiers during the last quarter of 2018, which was a very promising sign,” he said.

“While this was consistent with the pace kept throughout 2018, less new properties have been brought on to the market.”

Similar to this:

Tottenham site bought for $22 million

New Knight Frank Head of Industrial looking forward to 'exciting opportunity'