Landlords can save almost $70 per week this Christmas

Contact

Landlords can save almost $70 per week this Christmas

While retail tenants are hoping strong spending in the lead-up to Christmas will boost the coffers after months of tough trading, landlords are looking to depreciation for their holiday bonus.

Retail profits generally peak during the holiday season, however, it’s common for business owners and landlords to have significant outlays during this period too.

With this in mind, it’s important to be aware of the depreciation benefits of owning a commercial property - it could save you almost $70 a week.

Depreciation deductions can be claimed for the wear and tear of a building structure via a capital works deduction and for the plant and equipment assets within the property.

The Australian Taxation Office (ATO) allows owners of any commercial property in which construction commenced after 20th July 1982 to claim capital works deductions.

If your property was built before this date, there may still be plant and equipment deductions available so it’s important to consult with an expert.

Plant and equipment depreciation is calculated based on the individual effective life of each item as well as their condition and quality.

Immediate write-off and pooling rules may also apply if an asset is below a certain value.

This is particularly the case for small and medium sized business owners and tenants, who are also eligible to claim significant depreciation deductions.

Click here to request a commercial tax depreciation schedule

Often tenants can claim on any fit-out they install from the starting date of their lease.

Depending on lease conditions, a tenant may be required to remove these assets prior to vacating.

In this instance, scrapping can be applied in which the tenant can claim any remaining depreciable value.

Assets left behind by a previous tenant may also be available to be claimed by the landlord.

Given both parties can simultaneously claim deductions, it’s important to contact a specialist Quantity Surveyor to arrange a tax depreciation schedule.

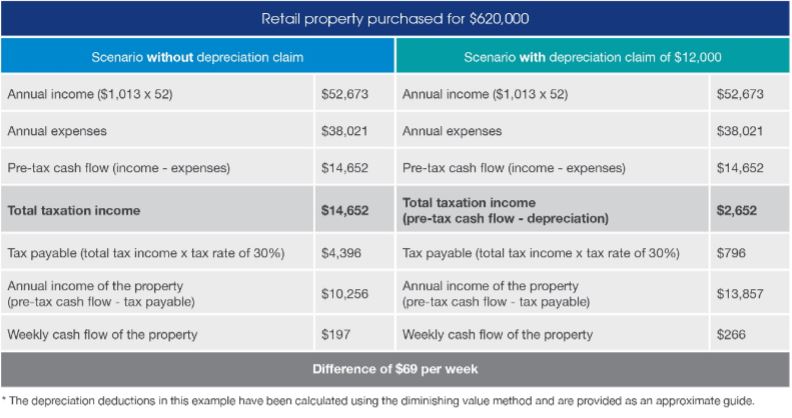

Let’s look at an example of how one commercial landlord saved thousands by ordering a tax depreciation schedule.

The landlord owns a retail property purchased for $620,000.

The property generates an annual income of $52,673, while the expenses total $38,021.

The following scenario shows the landlord’s cash flow with and without depreciation.

After ordering a tax depreciation schedule, the landlord discovered they were entitled to claim $12,000 in depreciation deductions in the first financial year.

By claiming property depreciation, the landlord increased their weekly cash flow from $197 to $266, improving their after-tax position by an additional $69 per week.

A BMT Tax Depreciation Schedule lasts forty years, considers industry-specific legislation, provides a range of depreciation methods and includes a property inspection.

The schedule is 100 per cent tax-deductible.

Maximise the cash return from your investment property or business and Request a Quote today.

Article provided by BMT Tax Depreciation.

Similar to this:

Commercial office depreciation deductions