Commercial property yields a bright light in gloomy investment horizon, according to m3property

Contact

Commercial property yields a bright light in gloomy investment horizon, according to m3property

Independent valuer m3property states commercial property yields haven’t reached their peak yet.

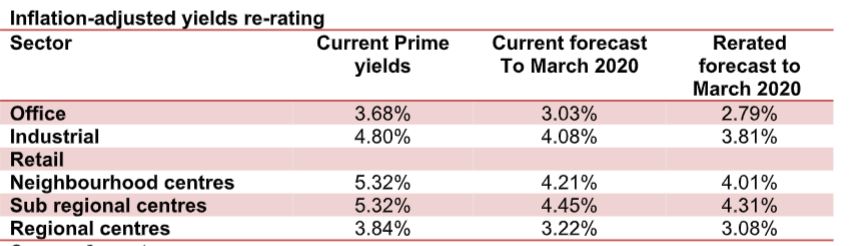

As tight as they currently stand, commercial property yields may still have a little way to go with a rerating a real possibility, according to new research from independent valuer and advisor m3property.

The low weighted average cost of capital, driven by debt - around three per cent – and the more attractive commercial property yields to other asset classes, have the very real potential to drive a re-rating of yields.

The Commercial Property Yield Re-rating white paper states that under this scenario yields would continue to tighten into March next year and stay lower beyond this time frame.

At a glance:

- Low weighted average cost of capital and more attractive commercial property yields could drive a re-rating of yields

- 'Inflation-adjusted property yields are ow more attractie than 12 months ago'

- With 10 year treasury bonds showing a negative yield, a fall in Inernal Rates of Return could result in tightening yields

Author and National Director Research, Jennifer Williams, said with the competition – shares, bonds, and cash – showing lower inflation-adjusted yields, it is likely that we will see a greater inflow of funds into Australian property.

“Just three months ago yields were considered tight and, for most markets, at or over their peaks, but with two recent interest rate cuts and the prospect of more to come, increasing global trade tensions, and tumbling returns on bonds and equities, property is starting to look like a bright light on a gloomy investment horizon,” Ms Williams said.

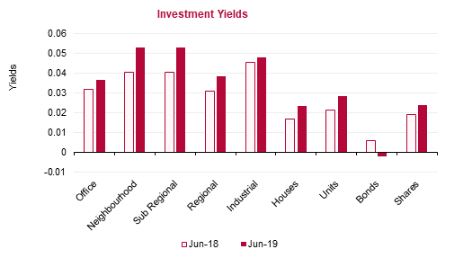

Source: m3property.

She said on an inflation-adjusted basis, 10-year treasury bonds were showing a negative yield, cash term deposits only a slightly positive return, and average yields for shares were decreasing and generally below property yields.

``By contrast inflation-adjusted property yields are now more attractive than they were 12 months ago with all sectors now delivering higher returns headed by sub regional and neighbourhood retail centres, closely followed by industrial,” said Ms Williams.

Source: m3property

Ms Williams said the strong historical relationship between Internal Rates of Return (IRRs) and 10-year bonds also suggested a fall in IRRs was likely and could result in a tightening of yields. While this is yet to happen in this cycle, a lag of up to six-months is possible based on the historical relationship between the indicators.

``Given that currently 10-year bonds and IRRs are at close to their maximum differential over the past six years it seems likely that further tightening of yields will follow,’’ said Ms Williams.

Similar to this:

New home sales see growth for the first time since 2017