Australian commercial sales tip $32.8b in 2018

Contact

Australian commercial sales tip $32.8b in 2018

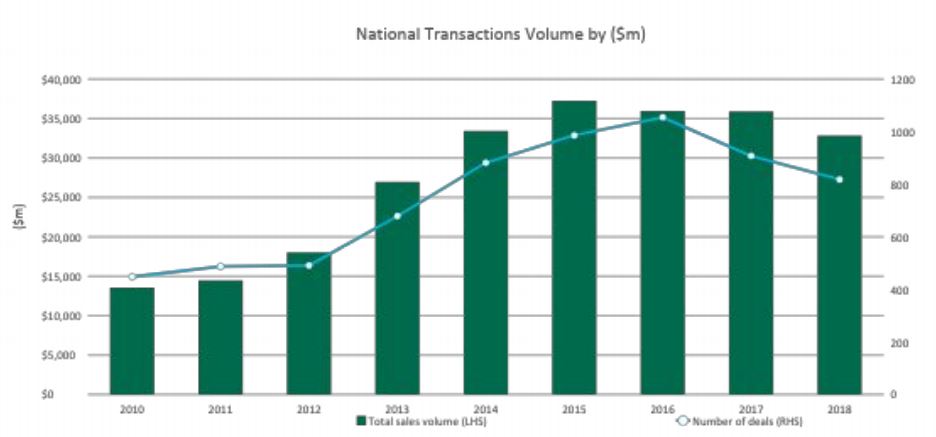

The latest sales data from CBRE has revealed that nearly $33 billion changed hands in 2018, down 9 per cent from the previous year's figure.

A fall in offshore buyer activity is partly to blame for a decrease in Australian commercial sales in 2018, according to CBRE.

Data from the company, which takes into account sales of office, industrial and retail property valued at over $5 million, indicated last year's transactions fell 9 per cent shy of the $36 billion recorded in 2017.

CBRE Australia Head of Research Bradley Speers said offshore buyer activity accounted for approximately 28 per cent of the total transaction volume, slightly down on the five-year average of 31 per cent.

“Despite the slight decrease in offshore buyer activity, the average foreign investment deal size in 2018 was $74 million – significantly higher than the $34 million deal size typically seen for domestic investors,” he said.

Source: CBRE

“This indicates that foreign capital continues to prefer institutional grade stock, with the majority of this coming from the USA ($2.3bn), Singapore ($1.9bn) and Hong Kong ($1.7bn).”

While Chinese investment remained sluggish in 2018, recording its lowest total since 2013 at just over $1 billion, Hong Kong buyers were significantly more active with a 200 per cent increase in capital deployment.

After declines in 2017, both the Americas and EMEA regions increased their investment in Australia at 9 per cent and 34 per cent respectively.

Domestically, data shows Sydney continues to be the preferred destination for investment ($12.5bn), followed by Melbourne ($8.5bn), Brisbane ($5.4bn) and Perth ($2.2bn).

In comparison to 2017, Sydney and Brisbane experienced declines of 17 per cent and 14 per cent respectively, while Melbourne recorded a 12 per cent uplift in investment – driven predominantly by a 50 per cent increase in retail investment.

CBRE Capital Markets Office National Director Flint Davidson. Source: CBRE

Perth reappeared on the investment radar, with overall investment activity growing 6 per cent, marking the highest level of transactions since 2013.

CBRE Capital Markets Office National Director Flint Davidson said a significant level of buyer activity in late 2018 would translate to a strong start for transactions in 2019.

"While stock availability remains tight in Melbourne and Sydney, we anticipate these two markets to be the most sought-after destinations for investment in 2019, while Canberra is also expected to see significant trading this year," he said.

"Brisbane, Perth and Adelaide will continue to benefit from the resources recovery, with limited yield compression seen in these markets for prime stock.”

For more information on the figures, phone or email Bradley Speers or Flint Davidson via the details below.

Source: CBRE

Similar to this:

Retail sector to remain healthy in 2019

Office market expected to be more even in 2019

SA Government-anchored office tower in Adelaide CBD sells for $103.5m