Potential shift of focus for foreign office investors in 2019, says JLL

Contact

Potential shift of focus for foreign office investors in 2019, says JLL

JLL's Australian Office Investment Review & Outlook 2019 suggests the value proposition in Brisbane, Adelaide, Perth and Canberra is becoming more pronounced as prime grade yield spreads to Sydney and Melbourne.

A more diverse pool of overseas office investors could create greater interest outside of Sydney and Melbourne in 2019, according to JLL.

The agency released its Australian Office Investment Review & Outlook 2019 on February 5, which indicated opportunities beyond the two dominant centres could become more prevalent throughout the next 12 months.

Research from JLL revealed that Sydney and Melbourne office markets represent 78 per cent ($226 billion) of Australia’s office market investable universe, which is valued at $288 billion in total.

Australian Office Investment Review & Outlook 2019 - at a glance

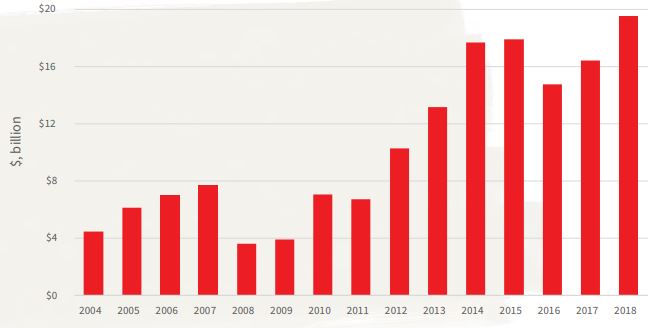

- Australian office transaction volumes surpassed $19 billion in 2018 for the first time on record.

- Prime yields across most Sydney and Melbourne office markets have reached new benchmarks in this cycle.

- Counter-cyclical investment strategies becoming more prevalent.

However, JLL’s Head of Office Investments Rob Sewell said other markets were beginning to attract overseas interest.

“While Brisbane is already on the international radar, we will see more cross-border investment into Perth, Adelaide and Canberra," he said.

“Tangible signs of a leasing market recovery in Brisbane and Perth has increased the prevalence of counter-cyclical investors."

The JLL Report states that while investment volumes in Australia hit an all-time record in 2018 at $19.53 billion, the result was heavily influenced by Oxford Properties acquiring the IOF portfolio at $3.4 billion.

Australian office market transaction volumes. Source: JLL

Mr Sewell said JLL expected office volumes to be "10 per cent to 20 per cent lower in 2019".

“We expect the Sydney and Melbourne markets to be development led opportunities," he said.

"The emerging development pipeline in some office markets will generate fund-through or take out opportunities for core capital sources.

"This will be the primary source of core long-dated lease product across Sydney and Melbourne in 2019."

According to JLL, offshore investments accounted for 48.4 per cent of all transactions by value, or $9.46 billion.

Mr Sewell said offshore investors will remain active in 2019, with Japan set to play a greater role.

“Volatility in the Australian dollar could stimulate investment activity, as the price point becomes more favourable for certain capital sources," he said.

"A further correction in the AUD against the USD will influence the decision-making process of USD denominated funds.

"Australia is well placed from the lack of deal flow in most of the Asian cities so well capitalised funds see Australia as a place they can grow."

Source: JLL

Similar to this:

Office market expected to be more even in 2019

SA Government-anchored office tower in Adelaide CBD sells for $103.5m

'Iconic' Gold Coast office development site sold for 3.4 million