WA on the rebound, according to Ray White report

Contact

WA on the rebound, according to Ray White report

While there is still some way to go in the recovery of the Perth office market, many opportunistic investors including private funds will look to capitalise on competitive investment yields, particularly given the historically low-interest rate environment.

Investment into Western Australia has slowed during the 2018/19 financial year after a positive prior period, according to Ray White's Western's Australia Commercial End of Financial Year Overview.

The report indicated that the uncertainty had heavily influenced this slow down in activity levels in the market during the lead up to the Federal Election, and caused a halt to the positive momentum as investors opted for a wait and see approach. Additionally, post-election and with the reduction in interest rates, there has been a change in confidence, which will likely benefit the remainder of the 2019 calendar year into 2020.

With financing availability looking to improve, investors once again are drawn to the strong yielding assets available in the Perth market.

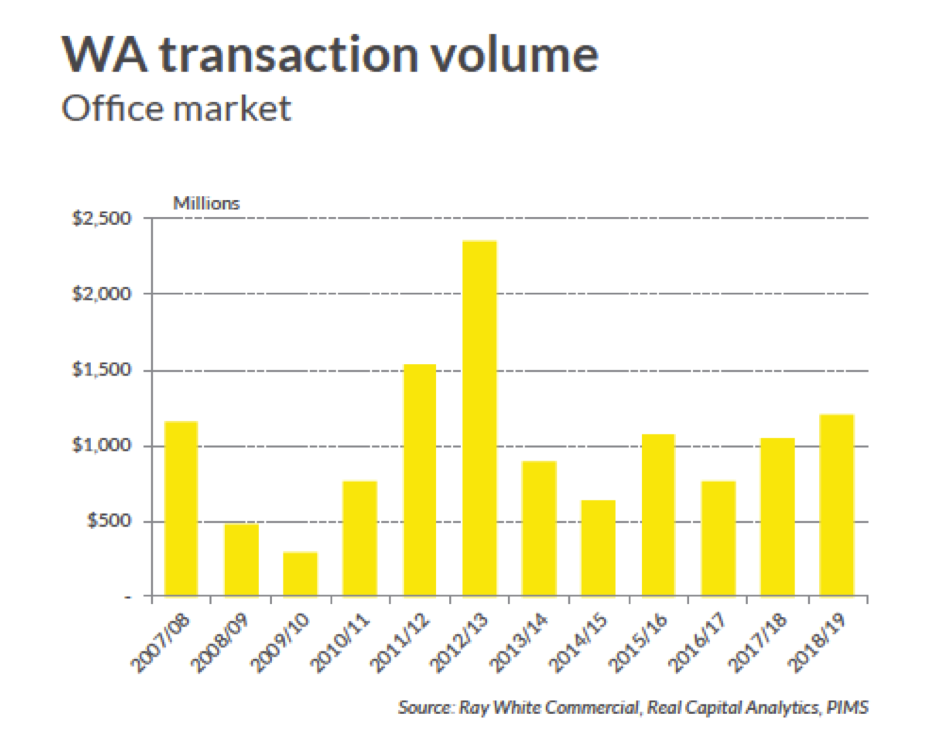

WA transaction volume - office market

The report highlights that investment into the commercial office market continued to improve in 2018/19. This period a total of $1.2 billion changed hands, which represented growth of 13.99% on last year’s increasing result. Like 2017/18 several higher value transactions have occurred in the Perth CBD propping up this result.

Source: Ray White Western Australia Commercial End of Financial Year Overview - Between the Lines.

Similarly, many of these have been by offshore investors who have a long-term view of the market. While there is still some way to go in the recovery of the Perth office market, many investors including private funds will look to capitalise on competitive investment yields, particularly given the historically low-interest rate environment.

At a glance:

- Investment into Western Australia has slowed during the 2018/19 financial year after a positive prior period, according to Ray White's Western's Australia Commercial End of Financial Year Overview.

- The report highlights that investment into the commercial office market continued to improve in 2018/19. This period a total of $1.2 billion changed hands, which represented growth of 13.99% on last year’s increasing result. Like 2017/18 several higher value transactions have occurred in the Perth CBD propping up this result.

- While volumes across most commercial markets have been down this year, the outlook still looks bright. GSP for WA has grown 1.9% last year driven by export growth after the prior year saw negative results; this further emphasises that WA is open for business.

WA transaction volume - industrial market

The sub $5 million industrial value range accounts for close to $690 million this financial year, up over $100 million on last year.

The turnover for smaller assets in the sub $2 million space continues at a high rate as interest continues from both private investors and owner-occupiers seeking their premises.

Across the industrial market, sales activity has recorded its second year of decline to total just shy of $1 billion (-16.33% on 2017/18), due to volumes being down in the larger size ranges with only four transactions over $20 million. However, sub 6.50% average yields are paid for these larger, fully tenanted assets mostly by property funds and trust while offshore buyers are still active in this space.

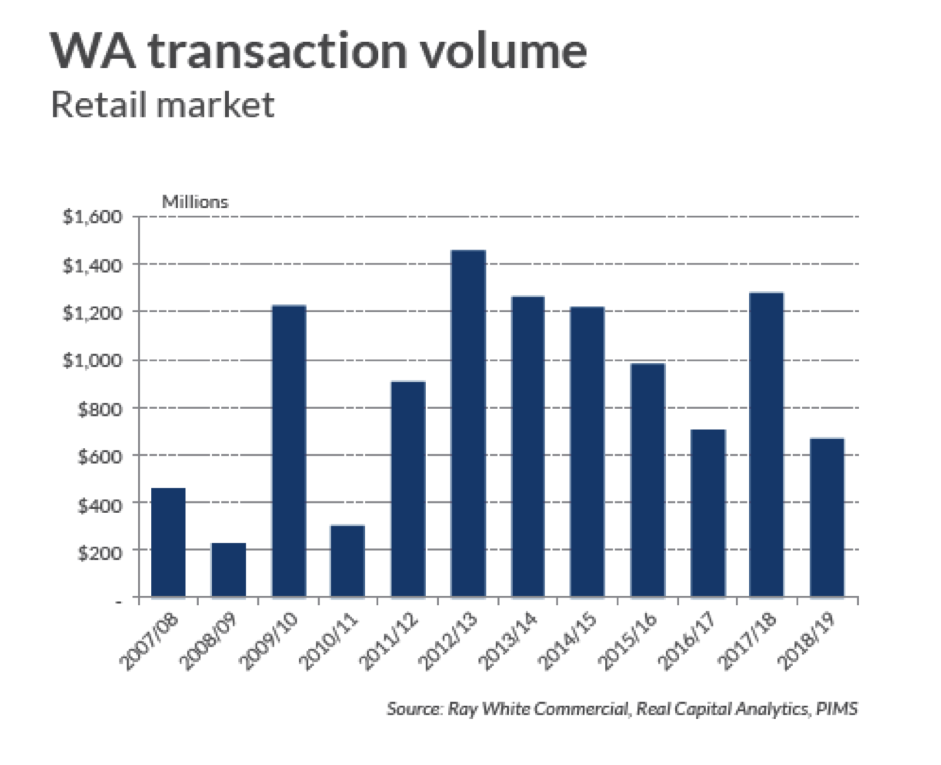

WA transaction volume - retail market

The retail market continues to suffer from a reduction in trade turnover and custom levels with many smaller retailers struggling to remain in business. Retail sales in the food and grocery segments continue to grow while there is a limited positive change in the spending levels.

Many owners have repositioned their smaller retail assets to offer accommodation for office, childcare, and medical uses to counteract growing vacancies.

Source: Ray White Western Australia Commercial End of Financial Year Overview - Between the Lines.

Fast-casual dining is also being integrated into centres as consumers have a desire to eat, play, and shop within their local communities. This financial year, the volume of sales for retail assets fell by -47.54% to just $670.40 million. While smaller assets continue to be sought after by private buyers.

The largest sale recorded this year being Warnbro Centre in Rockingham along with three other WA centres sold by Vicinity Centres as part of a 10-property portfolio sale for $573 million to SCA Property Group.

WA transaction volume hotel and leisure market

A limited supply of stock has ensured that hotel and leisure volumes remain similar to last year’s result, up 3.86% to $239.45 million, dominated by the $200 million sale of Westin Perth to Malaysian Investment Trust, YTL Hospitality.

The recently completed, five-star hotel was one of the first added to the market, this sale represented value at approximately $470,000 per room. Occupancy levels have declined due to the increase in room nights to average approximately 72% while average daily room rates remain affordable at $166.

WA transaction volume - development sites

There is still some way to go until the development site market grows. While the population is growing, its slow pace has been absorbing existing stock with no rapid requirement for greater housing stock across Perth.

Employment growth from last year mirrors this slowdown, which is another catalyst for increased housing demand, while it continues to improve, it is at a more subdued pace.

Recent deals by Blackburne and Cedar Wood’s in Subiaco, highlight an appetite for residential sites.

Realside pays $37.85M for Perth’s The Colonnade.

Only $144.98 million has changed hands across WA as development site sales during 2018/19 down -58.50% on last year, well down on the peak of the development sales market in 2014/15 period where volumes approached $800 million. The primary buyers are smaller, local players looking for a longer-term hold while offshore buyers have retreated from this segment.

WA transaction volume - medical/childcare

With low-interest rates and demand for smaller commercial investment stock, there has been a large push into the childcare and medical asset space.

In 2018/19, these assets volume achieved $116.58 million, while this is down -3.23% on last year’s results.

Childcare sales have been below last year as many quality assets have been tightly held, also growing LVR’s by banks has made entry into this asset class slightly more complicated than prior years.

Source: Ray White Western Australia Commercial End of Financial Year Overview - Between the Lines.

Similar to this:

Colonnade in Perth sold for $37.85 million

Murray Street office for sale to capitalise on strengthening Perth market

NSW childcare assets in line for post-election boost - Ray White