Commercial office depreciation deductions

Contact

Commercial office depreciation deductions

Lucrative depreciation deductions are available for both commercial property owners and tenants, making it appealing to both parties.

Commercial real estate is a $2 billion-dollar industry expected to grow throughout 2019 and beyond.

Lucrative depreciation deductions are available for both commercial property owners and tenants, making it appealing to both parties.

Buildings and the items within them depreciate as a result of wear and tear over time.

The Australian Tax Office (ATO) allows owners of income-producing properties to claim depreciation deductions under two categories. The first is capital works (division 43) which covers structural items like the building, bricks and car parks.

The second category is plant and equipment (division 40) which includes easily removable assets such as desks and blinds.

Visit BMT’s tax depreciation calculator for an estimate of the deductions you may be entitled to.

Rates of depreciation available to commercial and residential plant and equipment can vary significantly, even when considering the same type of asset.

For example, in a commercial office, carpet is likely to have more foot traffic and subsequent wear and tear than carpet within a residential setting only exposed to minimal traffic.

Knowing your tax depreciation entitlements will ensure you maximise the returns on your investment and increase your cash flow.

Commercial office case study

Let’s look at an example of how depreciation claims can significantly increase a commercial office owner’s cash flow.

The following scenario shows a large business with an aggregated turnover of over $50 million i.e. they are not eligible for small to medium tax concessions.

Within a commercial office, plant and equipment assets such as carpets, lighting, floating floorboards, office furniture, blinds, shelving and even greenery all have a depreciating value that can be claimed.

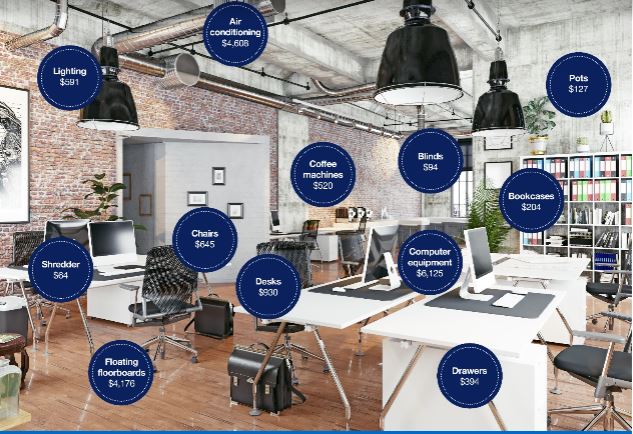

The image below provides further insight into some of the plant and equipment depreciation available for an office fit-out and the enormous financial benefits claiming depreciation deductions can reap for the owner of this commercial office.

The figures in the graphic are first year plant and equipment depreciation deductions, calculated using the diminishing value method. Assets can be added to the low value pool (once their value declines to over $300 and below $1000). An immediate write off can apply to assets once their value declines below $300.

Let’s assume this owner purchased the property and assets at a total cost of $713,199.

The original capital works value at purchase was $615,600, so they can claim $15,390 during the first financial year in division 43 depreciation deductions.

The owner can also claim a total of $18,478 in various plant and equipment deductions, shown in the graphic, during the first year.

This means in just the first year, this commercial office owner can claim a total of $33,868 in depreciation deductions.

But wait, there’s more. After claiming the first-year depreciation deductions, there’s still an enormous total remaining undeducted value of $679,332 available to be depreciated over the effective life of the property (forty years).

That’s close to three-quarters of a million dollars this owner could claim in deductions on just one commercial office and the building structure, resulting in a significant difference to their cash flow.

Find out more about BMT Tax Depreciation by visiting their website.

Where the diminishing value method is used, assets that have declined in value and have a remaining depreciation value of between $300 and $1,000 can be added to a low value pool and continue to be depreciated over time at a rate of 37.5%.

While this case study shows a scenario for a large business, rules can vary subject to the size of the business and below we look at some of the small and medium business rules that apply.

Instant asset write-off

Small business owners can benefit from tax breaks designed to improve their operational cash flow.

One such tax break is the ‘instant asset write-off’ which is available for businesses with a turnover from $10 million to less than $50 million.

The instant asset write-off allows businesses to purchase and claim a deduction in the same financial year, on assets costing below $30,000 such as a vehicle or equipment.

This rule has been extended to 30 June 2020, with assets above the threshold subject to general depreciation rules.

Depreciation rules are complex, particularly for commercial properties, so it’s important to consult a tax depreciation specialist. BMT has prepared depreciation schedules for commercial properties including primary production, manufacturing, retail centres, mining, office towers, medical centres, traveller accommodation and many more.

Commercial reports are quoted on a case by case basis depending on the industry, size, use and assets required to be included.

Click here to learn more about BMT’s commercial capabilities.

This is a sponsored article

Similar to this:

How scrapping boosts commercial property cash flow