How to make sense of property values in the time of COVID-19, when there is no market

Contact

How to make sense of property values in the time of COVID-19, when there is no market

Urban Property Australia Founder and Managing Director, Sam Tamblyn examines how commercial property price trends will be determined in the wake of COVID-19.

With transactions becoming scarce and financing tightening, valuers will have to attach less weight to market evidence which transacted prior to the emergence of COVID-19 in March and instead heavily evaluate transactions which do occur post the outbreak of the virus, Urban Property Australia says.

In response to the COVID-19 pandemic, restrictions on population movement, public gatherings and social/leisure activities have forced many businesses to close, leading to some tenants unable to continue to pay rent as a result of the government’s “hibernation strategy”.

UPA Founder and Managing Director, Sam Tamblyn, said cap rates would "certainly soften" through this crisis with the value of property determined by the stability and strength of the current income of assets.

“The outlook of cap rates softening reflects Urban Property Australia’s assumptions of lower market rental growth in the future, restricted trading conditions and vacancy downtime increasing compared to the conditions prior to the outbreak of the virus,” he said.

Retail has been one of the sectors adversely affected by the COVID-19 crisis. Source: Depositphotos

“Detailed analysis must be undertaken to establish the cashflow outlook for all properties, with the risk of vacant space substantial in today’s market in light of reduced future tenant demand.”

“Valuers now also need to consider the performance of specific industries of tenants in assets with tourism, hospitality, education and retail generally having been adversely affected in extreme ways, for example.

"In light of reduced tenant demand, and likely increased incentive levels in the short term, net effective rents will fall.”

While the effect of every economic downturn is different, COVID-19 has already resulted in unemployment rising, businesses closing, travel bans, business confidence levels falling to record lows, tenants requesting rent-free periods and mortgage holders applying for a payment holiday.

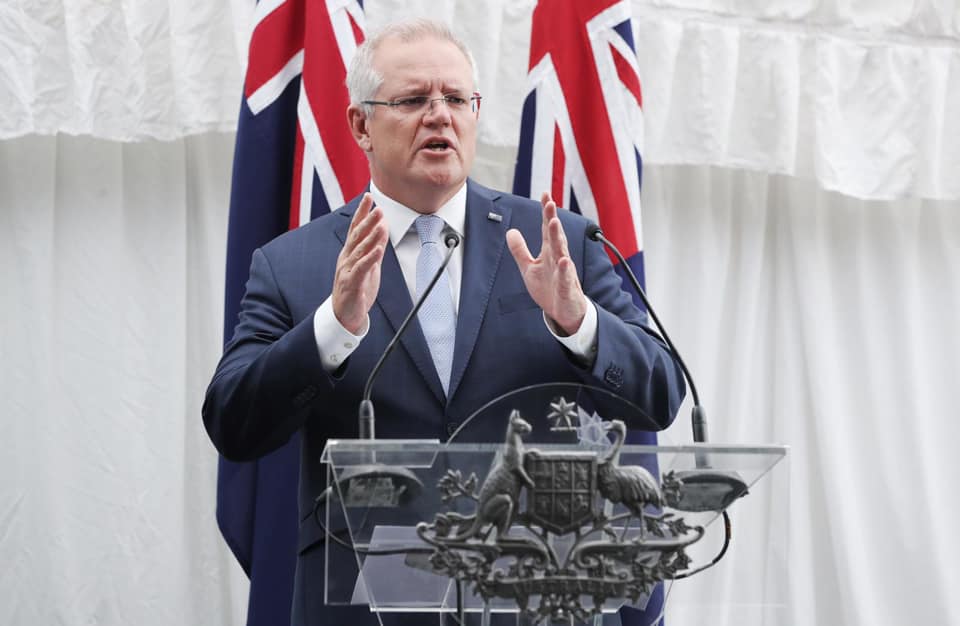

Australian Prime Minister Scott Morrison has introduced a range of stimulus measures in the wake of COVID-19. Source: Scott Morrison Facebook.

Australian Prime Minister Scott Morrison has introduced a range of stimulus measures in the wake of COVID-19. Source: Scott Morrison Facebook.

Mr Tamblyn told WILLIAMS MEDIA Australia's commercial market had so far handled the crisis "reasonably well" considering the speed at which it had unfolded.

"Through the combination of government stimulus packages, the response of various regulators and action of industry bodies, the market has not gone into shock," he said.

"The largely observed collaborative approach from both landlords and tenants to work through these challenging conditions will ensure that values will not collapse, albeit there will be some tenants and landlords who will be adversely impacted as a consequence of the resulting change of COVID-19."

He added that while the short term outcome has been handled as best as possible, there were some risks in the medium term.

"Finance will be constrained for some time which is likely to result in a fall in construction activity with developers until to meet higher funding conditions, whether those are pre-sales, tenant pre-commitments or increased equity levels," he said.

"We have also witnessed an increased level of scrutiny on the current income of assets and the underlying sectors of those tenants and whether those tenants will be susceptible to the COVID crisis in the medium to long term.

"The analysis of the current income is likely to result in a risk re-rating of certain assets with values likely to be adversely impacted as a result."

Click here for more insights from Urban Property Australia.

Similar to this:

What lies ahead for Australia's commercial sector in 2020?