Possibility of shorter pathway back to pre-COVID-19 commercial property sale volumes: JLL

Contact

Possibility of shorter pathway back to pre-COVID-19 commercial property sale volumes: JLL

A new report from JLL has shown a "clear hierarchy" emerging in the recovery of Australia's property market from the pandemic, as the industrial & logistics and commercial office sectors demonstrate their resilience.

New research from JLL has prophesied the potential for an earlier pathway back towards pre-crisis transaction volumes for commercial property than experienced in the GFC.

According to Australia and New Zealand take their first steps towards the next normal, the unprecedented policy response in Australia has provided some downside protection to the economy.

JLL Head of Capital Markets for Australia, Fergal Harris said while transaction volumes are likely to fall sharply in 2020, the unprecedented policy measures had provided support to global equity markets, limiting the denominator effect relative to the GFC in 2008/09.

JLL's Australia and New Zealand take their first steps towards the next normal report - At a glance:

- The unprecedented policy measures that have provided support to global equity markets means there is the potential for an earlier

pathway back towards pre-crisis transaction volume levels than seen in the GFC. - The next phase of the office sector cycle will be led by the expansionary activity by organisations in the technology, healthcare and public administration industry sectors.

- Shopping centre owners will need to have a deeper understanding of the retailer business model to ensure a good tenancy mix and create the framework for positive trading performance.

- A structural increase in the e-commerce penetration rate supports the underlying demand for the industrial & logistics sector.

“The pace of the economic recovery will have significant implications for commercial property," he said.

"Transaction volumes in 2021 and 2022 will be highly dependent on the economic recovery and the performance of other asset classes.

“Across Australia’s commercial real estate investment assets, a clear hierarchy is emerging, with prime grade industrial & logistics and commercial office proving to be the most resilient sectors.

"The greatest income risk is in the retail sector, while secondary grade assets across all sectors are expected to experience higher vacancy and income challenges."

Mr Harris said the main shift was likely to occur in pricing relatives to secondary assets, with lending criteria expected to become more onerous due to financiers easing back loan-to-value ratios (LVR) and seeking higher interest coverage ratios for secondary grade assets.

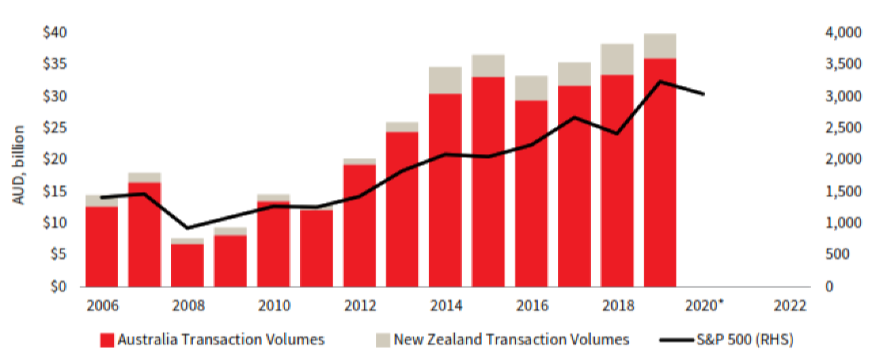

Australia/New Zealand commercial property transactions. Source: JLL

“Credit market conditions will also play an important part for liquidity of real estate markets going forward," he said.

"Private debt markets are continuing to operate for well-rated borrowers.

"For core assets, we have only seen a 10 to 25 basis point movement in post-COVID-19 pricing for a 5-year loan.

“Pricing margins have moved out more significantly for assets with income risk and development finance.

"Non-bank lenders are reviewing this part of the market closely as there will still be good lending opportunities and the potential to make attractive risk-adjusted returns."

The pathway back to commercial property volumes

As part of the report, JLL reviewed the GFC impact on Australian commercial property transaction volumes to plot a pathway for the 2020 to 2022 period.

The firm notes that in 2008, Australian commercial property transaction volumes were only 41 per cent of the level recorded in 2007.

According to the report, if a experienced a similar observation for 2020, then Australian transaction volumes would be approximately $12.5 to $16.5 billion. (Australian commercial volumes reached an all-time record high in 2019 at $36 billion)

Based on the current pipeline and a few potential mega-deals which inflated the 2019 figure, JLL estimates transaction volumes for 2020 are likely to be lower and in the range of $10 - $12 billion.

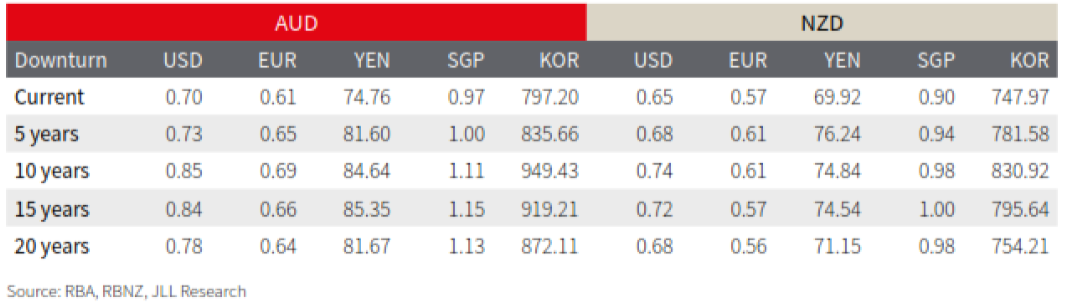

AUD and NZD versus other currencies.

JLL’s Australian Head of Research, Andrew Ballantyne said after the financial crisis, it took until 2012 for transaction volumes to recapture 2007 levels, due partly to a correction in equities that led to an overweight position in real assets, otherwise known as the denominator effect.

“Interestingly, the recovery in direct property transaction volumes followed a similar trajectory to the S&P 500, which captured its 2007 peak in April 2013," he said.

“While equity markets have remained volatile, the rebound post the March correction has happened relatively quickly.

"As a result, the denominator effect is less relevant this time and we may have a shorter pathway back to pre-crisis transaction volume levels."

Mr Ballantyne added two investment themes were likely to endure as we emerge from the health crisis – higher allocations to real assets and a portfolio tilt towards the Asia Pacific region.

“Offshore investors will continue to be attracted to Australia due to potential GDP growth, low volatility of returns and our real estate transparency," he said.

“As foreign exchange risk is one of the key considerations for cross-border real estate investors, we have assessed the AUD/NZD against a number of currencies over the past 20 years.

“The depreciation of the AUD/NZD against a number of major currencies makes the entry point, from a foreign exchange perspective, attractive for offshore capital sources."

Click here to view the full report.

Similar to this:

Adelaide office market shifting from east to west - JLL

Neighbourhood centres demonstrating resilience in 'challenging' retail landscape - Savills