History repeating: CBRE outlines the investment drivers for Australia's healthcare sector across the next 12 months

Contact

History repeating: CBRE outlines the investment drivers for Australia's healthcare sector across the next 12 months

A newfound appreciation of medical services for many, coupled with strong, long-term investment trends has made current and future acquisitions across Australia's healthcare sector highly compelling, according to CBRE's Healthcare and Social Infrastructure team of Sandro Peluso, Jimmy Tat, Josh Twelftree and Marcello Caspani-Muto.

Even amidst one of the most challenging economic environments in Australian history, CBRE has reported continued activity across the healthcare investment market.

The firm's Healthcare and Social Infrastructure team expects healthcare-related businesses to be the first to return to regular trading (at least what can be deemed as such for now) once social distancing restrictions are lifted and notes that for many, comparatively minimal fluctuations to income across between April and July have been witnessed.

CBRE Healthcare and Social Infrastructure team member and Commercial Property Director Sandro Peluso said given personal healthcare is something which can be delayed, but never avoided, he believed the sector would continue to perform strongly with several key investment drivers within the market.

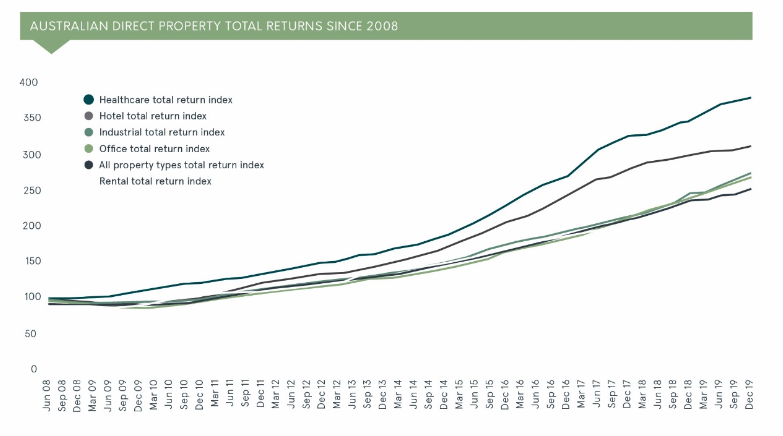

"Generating greater returns than several ‘staple’ asset classes over multiple years, the healthcare market is far from a short-term success story," he said.

The sector is also underpinned by a track record of success, having performed strongly throughout the world’s previous economic downturn, the Global Financial Crisis (2007-2009)."

The ‘healthcare’ category is based on the IPD Australia Quarterly Healthcare Index, which provides a broad measure of investment returns for the healthcare property market in Australia and tracks the investment performance of 105 healthcare assets – representing $2.9 billion, MSCI 2019. Source: CBRE

Key investment drivers

1. Population growth and age

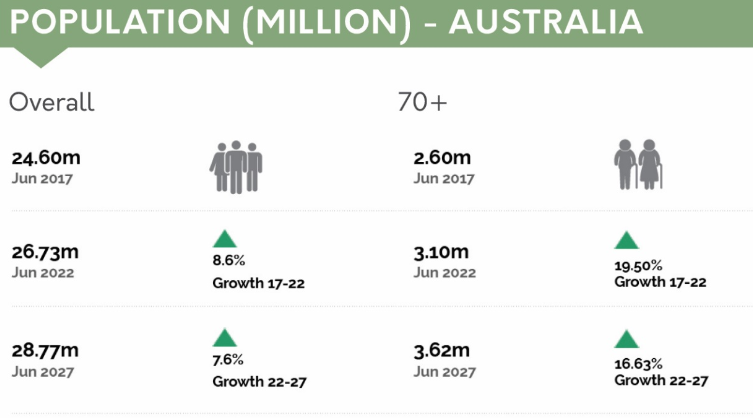

According to data from the ABS, Australia is forecast to experience a population growth of 19.5 per cent within the 70+ age bracket by 2022.

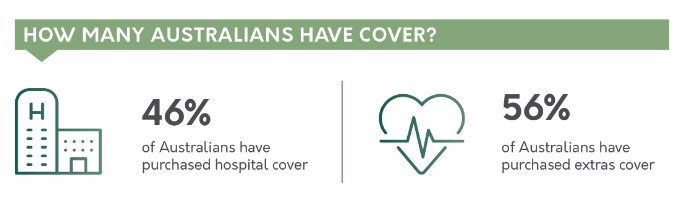

As a result of the nation’s aging population – and even with a minor decline in Australia’s overall private hospital coverage ratio – Australian Prudential Regulation Authority (APRA) reported a steady increase in hospital treatment episodes and premium revenues in FY19 (Source – APRA 2019).

Marcello Caspani-Muto from CBRE's Healthcare and Social Infrastructure team said shifting demographics required consistent and increased government expenditure, for both public and private sectors

"The economic impacts of an ageing population are further enhanced by consistent global medical advances, increasing average life expectancy," he said.

"Our country’s population is also projected to double, totalling 46 million by 2075, while in the shorter term it’s forecasted to reach 36 million by 2050.

"Setting aside the average age of the population, with a greater number of residents comes a greater need for medical services."

Australia’s Population Projections. Source: CBRE via M3 Property

2. Government Support

According to the ABS, 86 per cent Australians are utilising bulk billing, meaning a sizeable number of residents have access to healthcare services than ever before.

Mr Peluso said swells in demand for healthcare were not new and have long been monitored by both the government and medical professionals,

"The already stretched public system is heavily reliant on the nation’s private services to keep demand serviceable," he said.

"As a result, both sides of government have made clear their intentions to fund the sector and improve the affordability of health insurance, making medical services more accessible."

Source: CBRE

3. Favourable Lease Terms

CBRE notes that in most scenarios, healthcare assets typically offer a longer lease term or WALE than more traditional ‘core’ asset classes.

Mr Caspani-Muto said For private and institutional groups, this results in decreased investment risk, while also allowing greater flexibility in terms of divestments and acquisitions across what could be a range of economic cycles, adding the sector held other financial advantages.

"Healthcare leases often feature fixed rental reviews ranging from 3-4 per cent while lease incentives are also viewed as minimal," he said.

"Other investment drivers include those which are common amongst the country’s broader investment market, including record low costs of capital and comparably stronger yields for foreign investment groups given the weak value of the AUD.

What does this mean for the healthcare investment market in the next financial year?

Mr Peluso said in a market where commercial and residential sales volume has plummeted and is estimated to be the lowest volume of stock on record since 1991, quality healthcare and social infrastructure investment opportunities are few and far between.

"As uncertainty for the what the future may hold will remain healthcare’s essential service status and past performance is likely to see a raft of emerging market entrants who have not traditionally played within the space look to gain a foothold," he said.

Similar to this:

Oakleigh childcare investment sold for $8 million through CBRE