Sydney CBD sublease space hits record high - CBRE

Contact

Sydney CBD sublease space hits record high - CBRE

CBRE's Sydney Sublease Barometer for July and August has shown sublease space within the city has hit a record high of 157,853sqm, representing a 90 per cent surge in five months.

The impact of COVID-19 on Sydney's office market has been shown in new data from CBRE, which indicates a growing number of large space users are seeking to offload unoccupied workspace to help cut costs.

According to CBRE, the volume of sublease stock had begun increasing last year, with the firm noting much of the increase between Q4 2019 and Q1 2020 related to tenants committing to new developments or leasing refurbished office space.

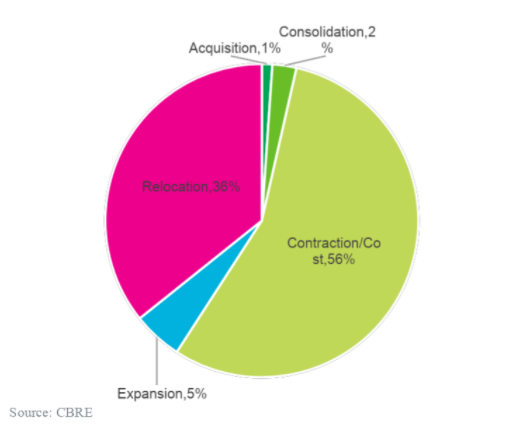

But CBRE Office Leasing Director Chris Fisher said the pendulum had since shifted, with the latest Sublease Barometer indicating contraction and cost-cutting now accounted for 65 per cent of the available stock.

Sydney CBD Sublease Barometer July and August - At a glance:

- Data from CBRE shows 128,545 square metre of sublease stock was available as at 31 July 2020, rising to 157,853 square metres as of August 31, eclipsing the city’s previous high of 119,588 square metres.

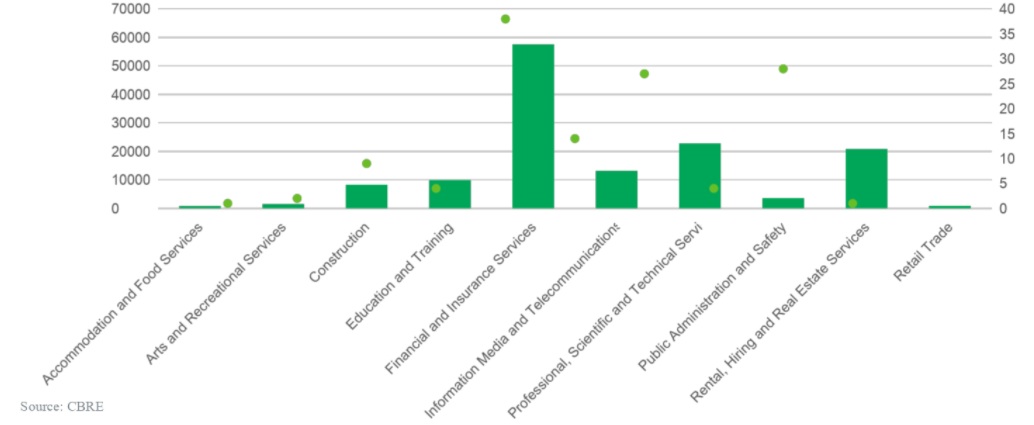

- The Financial and Insurance Services industry has been the main contributor, accounting for 41 per cent of the stock available at the end of August, followed by Professional, Scientific and Technical Services at 16 per cent and Rental, Hiring and Real Estate Services at 15 per cent.

- According to CBRE, 95 per cent of the current sublease stock was fitted and 72 per cent of the stock was in Premium and A-Grade buildings.

Sublease availability by industry.

Sublease availability by industry.

“While the extension of the Federal Government’s stimulus measures has helped to mitigate the softening labour market, tenant demand will continue to be impacted amidst softening economic conditions,” he said.

“Some large space users with low occupancy levels are viewing subleasing as a logical way to cut costs, with the impact of COVID-19 now well and truly being reflected in the city’s sublease statistics.”

Data from CBRE shows 128,545 square metre of sublease stock was available as at 31 July 2020, rising to 157,853 square metres as of August 31, eclipsing the city’s previous high of 119,588 square metres.

The Financial and Insurance Services industry has been the main contributor, accounting for 41 per cent of the stock available at the end of August, followed by Professional, Scientific and Technical Services at 16 per cent and Rental, Hiring and Real Estate Services at 15 per cent.

Motivation for subleasing.

Mr Fisher said 95 per cent of the current sublease stock was fitted and 72 per cent of the stock was in Premium and A-Grade buildings - providing cost-effective opportunities for tenants to secure space and avoid a capital outlay.

“The increase in sublease space is enticing tenants into the market,” he said.

“We are seeing larger, opportunistic tenants seek out cost-competitive leasing options, with an increase in inspection activity for both sublease and direct space which is already fitted out.

"This is leading to an uptick in proposal requests in both market segments, which is expected to result in space coming off the market in the coming months.”

Mr Fisher also noted that sublease stock was providing flight-to-quality and flight-to-centre opportunities for non-CBD tenants seeking to capitalise on the current market conditions.

Click here to download the CBRE Sydney Sublease Barometer.

Similar to this:

Sydney CBD sublease stock hits 10-year high- CBRE

Neighbouring Newcastle buildings sold to Sydney funds manager for $35.3 million

Australian suburbs 'set to bloom' from flex office offerings - CBRE Marketview