Tenants and investors cautious with the office market in a state of flux

Contact

Tenants and investors cautious with the office market in a state of flux

Urban Property Australia Founder and Managing Director, Sam Tamblyn said the level of sub-lease vacancy is likely to remain elevated as businesses reconsider their office space needs with subdued business outlook and decisions to reduce staff numbers with the conclusion of the JobKeeper program.

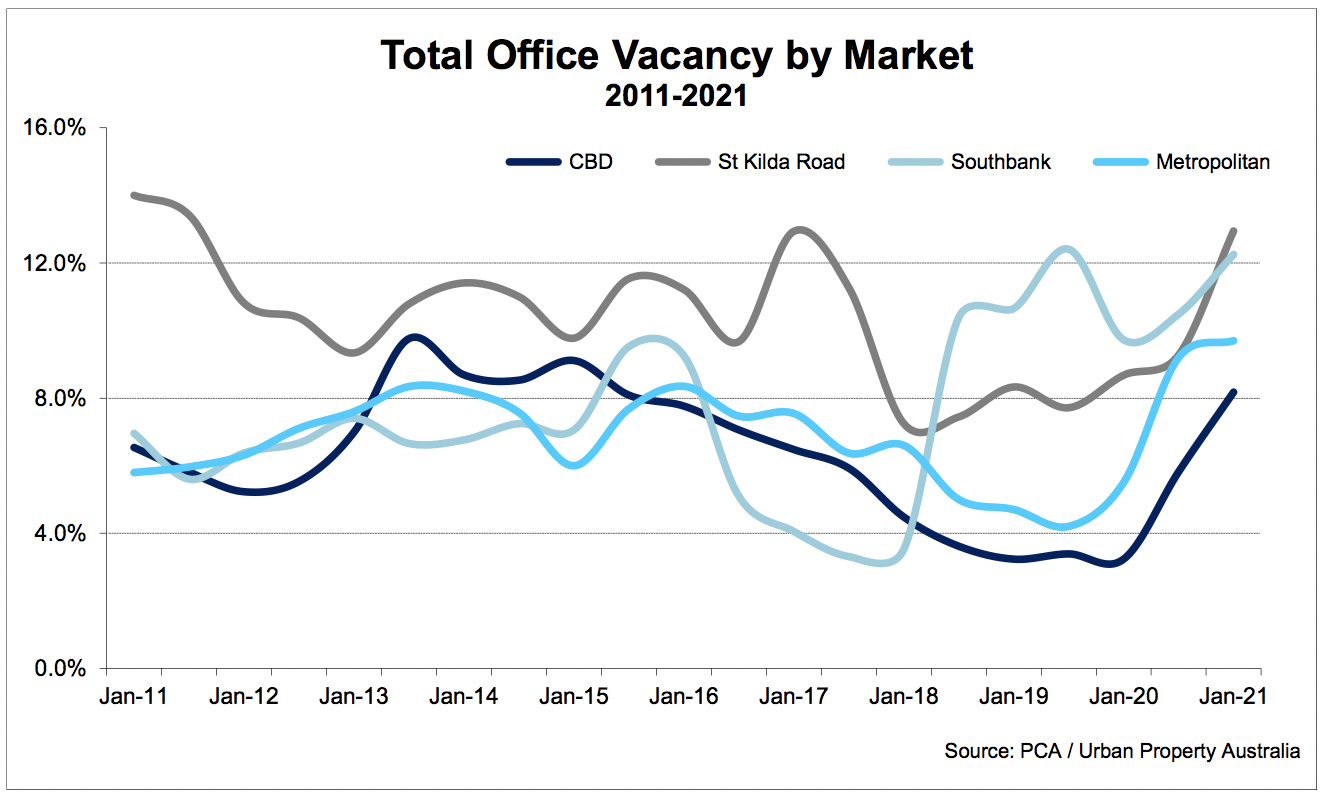

Although Victoria’s total employment has only just surpassed pre-COVID levels having lost approximately 240,000 jobs at the height of the virus, vacancy rates across Melbourne’s office markets have hit 5-year highs.

The total Melbourne CBD office vacancy increased from 5.8% in July 2020 to 8.2% as at January 2021, its highest level since 2015. The pandemic has also resulted in a surge of sub-lease space in the CBD with more than 200,000sqm anecdotally being currently being marketed.

Urban Property Australia Founder and Managing Director, Sam Tamblyn said the level of sub-lease vacancy is likely to remain elevated as businesses reconsider their office space needs with subdued business outlook and decisions to reduce staff numbers with the conclusion of the JobKeeper program.

The impact of the pandemic has also resulted in prime CBD office net effective rents which have declined back to their lowest levels in three years. Urban Property Australia forecasts that prime CBD office net effective rents will decline further through 2021 as employees and businesses remain wary of CBD-based office space.

Urban Property Australia’s research found that the vacancy rate of the Melbourne metropolitan office market increased to 10.5% as at January 2021, its highest level in 15 years, unfavourably impacted by the record levels of completions and soft tenant demand.

In terms of new supply, around 40,000sqm is scheduled for completion in 2021 in Melbourne’s metropolitan office market with the City Fringe precinct accounting for 76% of new supply projected to be completed this year.

Of all the total stock currently under construction in the metropolitan office market, 48% is already committed. The amount of uncommitted stock in the developments under construction is likely to put further upward pressure of the vacancy rate of the Melbourne metropolitan office market over the next two years.

Looking ahead, Urban Property Australia expects that new supply in the metropolitan office market has peaked for the medium term with tenants cautious to commit to new leases in the current environment.

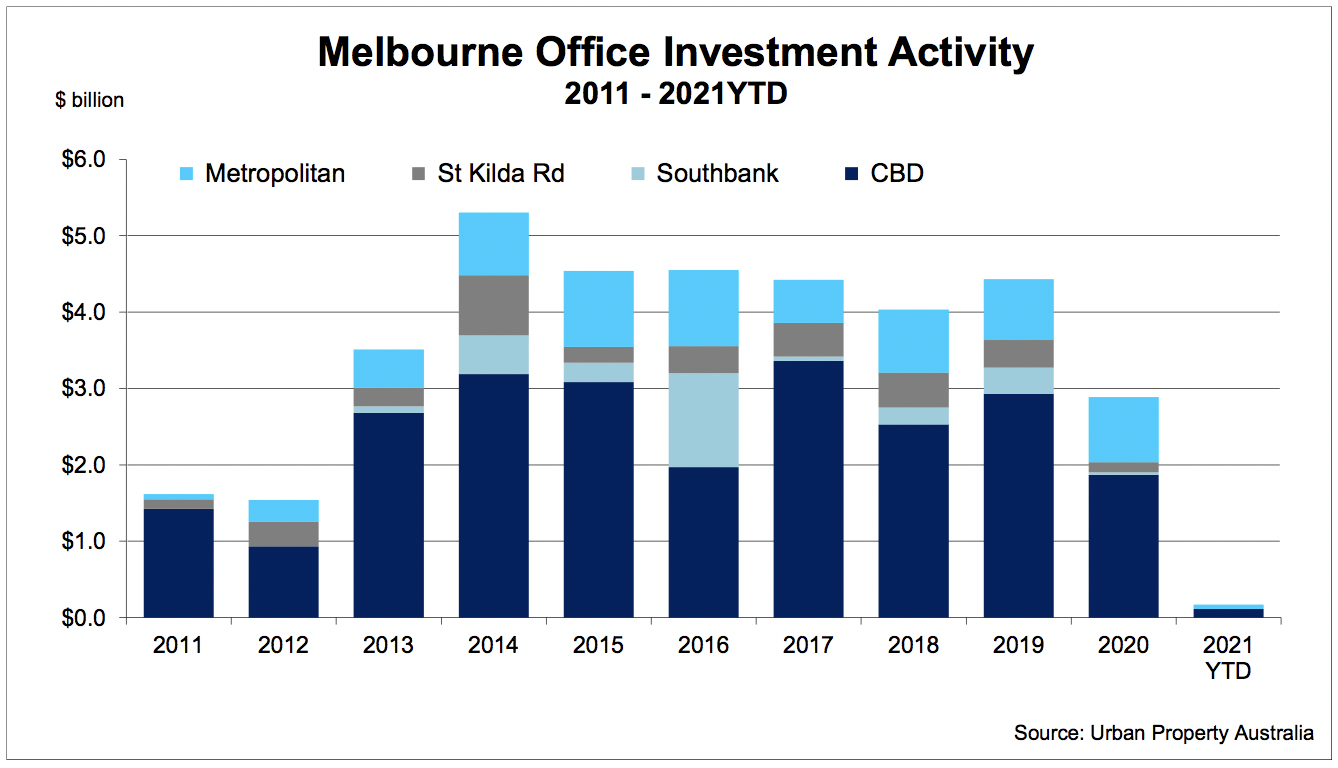

Mr Tamblyn said, “adversely impacted reduction of tenant demand and potentially a structural change of working styles, investor caution has led to a marginal rise in office yields over the 12 months to March 2021.”

Having fallen to historical lows in late-2020, prime metropolitan office yields eased to average 5.5% with secondary yields decompressing to 6.75%. While Urban Property expects investor interest for prime assets with solid income profiles to remain robust, the yield spread between secondary assets is likely to continue to widen as investors become more discerning.

Urban Property Australia has recorded only $57 million of Melbourne metropolitan office sales in 2021 to date, with limited transactional activity this year.

Similar to this:

Urban Property Australia dissects the effect of the pandemic on the Melbourne property market

Economic crisis casts a shadow over Australia’s CBD office markets - JLL

Victorian Commercial Real Estate re-opening for inspections and Auctions welcomed by REIV