Return to Office Momentum Gathers Pace in Australia and New Zealand says CBRE Occupier Survey

Contact

Return to Office Momentum Gathers Pace in Australia and New Zealand says CBRE Occupier Survey

One-third of Asia-Pacific respondents with at least one office in Australia and New Zealand now expect to expand, and for companies solely based in this region there is even more of a leaning toward expansion (40%) versus contraction (36%),” said Tom Broderick, Head of Office and Capital Market Research, Australia for CBRE.

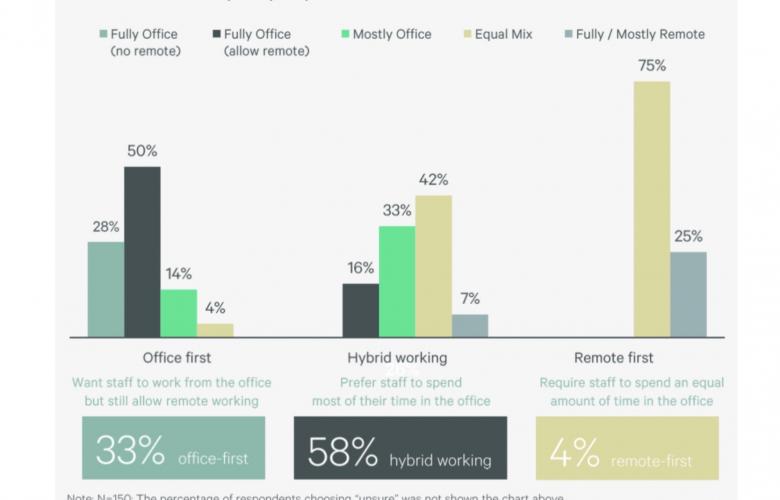

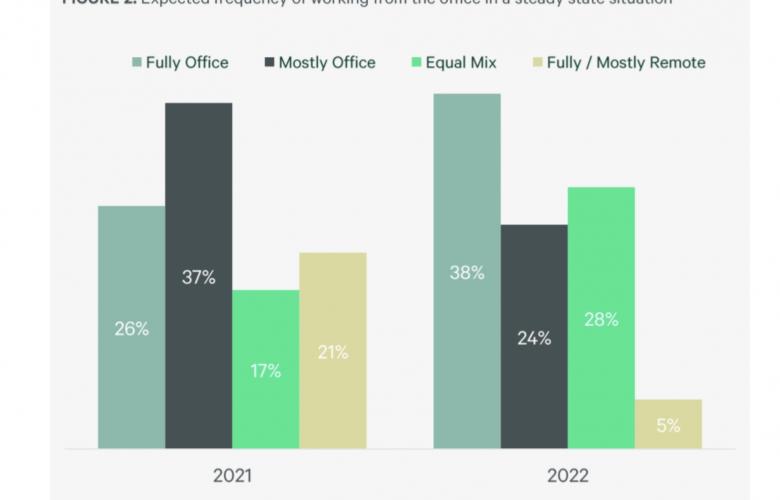

While hybrid working has become the new normal, full time working from home is set to become increasingly rare in Australia and New Zealand, according to CBRE’s latest Occupier Survey.

Undertaken in March/April, the survey highlights that the return to the office is well underway, with more than one-third of respondents now actively encouraging staff to return and a further 35% expected to follow suit by the end of 2022.

Most respondents now expect employees to work from home for some of the time, however the average days per week per employee has dropped to 1.7 days, from 1.9 days in October 2020.

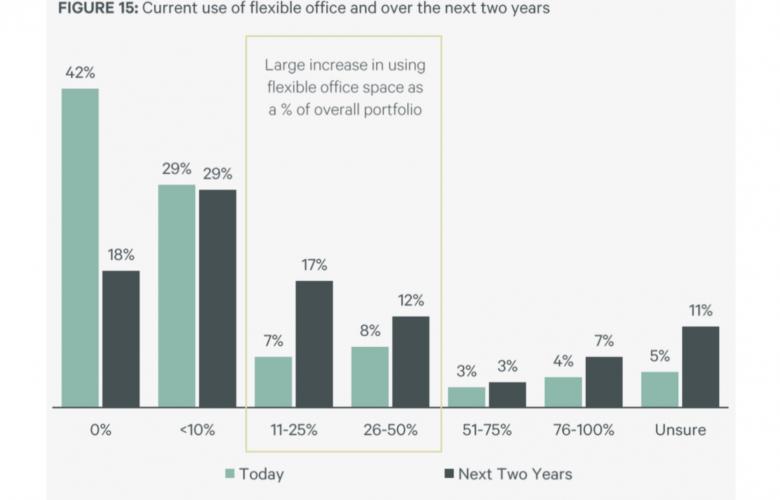

The survey also points to key changes in office related strategies, including an acceleration in unassigned seating, the prioritisation of collaboration space and a greater tenant leaning towards ESG credentialled buildings.

The survey also points to key changes in office related strategies, including an acceleration in unassigned seating, the prioritisation of collaboration space and a greater tenant leaning towards ESG credentialled buildings.

“Less than 10% of Australian and New Zealand respondents expect employees to never - or entirely - work from home, which is a clear shift since early in the pandemic when there was a lack of consensus on hybrid working. In a positive shift, occupiers are also re-examining their office footprints and moving from contraction to expansion mode. One-third of Asia-Pacific respondents with at least one office in Australia and New Zealand now expect to expand, and for companies solely based in this region there is even more of a leaning toward expansion (40%) versus contraction (36%),” said Tom Broderick, Head of Office and Capital Market Research, Australia for CBRE.

The survey also highlights that most occupiers are now building ESG considerations into their decision-making processes.

Some 24% of Australia and New Zealand respondents said ESG would be the essential criteria for selecting a new office and only 9% indicated they had no concrete plans to move their footprint to more ESG-credentialed buildings.

“With many major corporates making net zero emissions commitments, the trend to target ESG-friendly office buildings with higher NABERS ratings has accelerated. However, only about 13% of respondents said most of their office space was in this style of building. If you discount the small number of respondents with no concrete ESG-related office plans, that means almost 80% are looking to move into ESG-credentialed buildings in the future, which is a significant market shift,” said Darren Nugent, Regional Director, Advisory & Transaction Services - Office Occupier, Pacific for CBRE.

Other key themes to emerge from Australian and New Zealand respondents include:

- Unassigned seating is set to accelerate, not reverse, with 58% of respondents having already implemented this or are expecting to have this arrangement in the next two years.

- Overwhelmingly, Pacific occupiers want more collaboration space in their offices (+84%) and space for socialising (+51%)

- Respondents also identified more individual quiet rooms for video calls a key priority, which would be combined with increased investment in worktech. Many of these corporates also wish to increase desk sharing ratios in the future.

To download a copy of CBRE latest Occupier Survey see below contact details: