Depreciation in farming – poultry farm case study by BMT

Contact

Depreciation in farming – poultry farm case study by BMT

BMT Tax Depreciation looks at the thousands of dollars in depreciation deductions available for all types of farms.

Farming is a vital industry that produces food, materials, jobs and exports. Unfortunately, this crucial industry is often affected by uncontrollable factors. Severe weather such as drought and floods, disease in livestock and economic factors like the rising cost of labor, transportation and other vital resources can greatly impact daily and seasonal operations.

One factor that can help a primary producer’s cash flow is depreciation. There are thousands of dollars in depreciation deductions available for all types of farms. Here, BMT Tax Depreciation will go through what tax depreciation is and how beneficial it is for farmers to claim.

What is property depreciation?

Property depreciation is the natural wear and tear of a building and the assets within it over time. The Australian Taxation office (ATO) allows owners of income-producing residential and commercial properties and commercial tenants to claim this as a tax deduction.

There are two types of depreciation deductions claimable. Capital works deductions (Division 43) are claimed on the building itself and assets considered to be permanently fixed to the property, and plant and equipment depreciation (Division 40) is claimed on the assets easily removable from the property or mechanical in nature.

There are hundreds of different types of farms in operation that all hold depreciation deductions but for the purpose of this article, poultry farms will be the focus.

There are lucrative depreciation deductions available in poultry farms in the form of both capital works and plant and equipment deductions. Some of the more commonly found assets in a poultry farm include animal housing structures, tunnel inlets, cages, ventilation fans, heaters, control systems and much more.

The following case study outlines the depreciation deductions available in a poultry farm located in regional New South Wales.

Case study – poultry farm

Simon owns a poultry farm purchased for $2.1 million in regional New South Wales. Simon’s poultry farm sits across approximately ten acres with five sheds and is considered a small business entity.

Some of the biggest depreciation deductions Simon can claim in the first financial year include:

- $307,428 for animal housing structures

- $7,213 for water drinking systems

- $6,955 for feeding systems

- $13,673 for animal housing environmental control heaters

- $11,889 for ventilation fans

- $8,917 for silos for feed

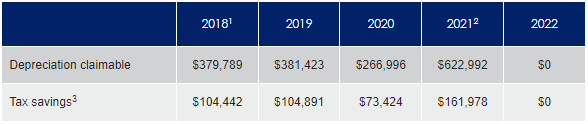

The table below demonstrates the difference depreciation deductions can make to Simon’s taxable income.

- Partial year deductions were claimed in 2018. The first full financial year deductions are represented in 2019.

- Pool balance deducted 2020/21 financial year.

- Tax rate of 27.5% for 2017/18 to 2019/20, 26% for 2020/21 and 25% for 2021/22 onwards.

As at July 2022. Farm was purchase in 2018, no further improvements have been made since purchase. Existing assets and new assets purchased from 2 April 2019 to 30 June 2023 may be subject to instant asset write-off or temporary full expensing.

Because Simon claimed depreciation deductions, he improved his cash flow and after-tax position by $444,735.

For more details on this case study, you can find them here.

Because Simon’s poultry farm is classified as a small business entity it’s eligible for the various business incentives currently offered by the Australian Government. These business incentives allow eligible businesses to claim accelerated depreciation deductions.

BMT Tax Depreciation are the industry experts in helping clients claim maximised and fully compliant depreciation deductions while implementing all available business incentives.

To find out more about what depreciation deductions are available for your farm call BMT on 1300 728 726 or Request a Quote.

The information provided in this article is of general use only and should not be used as a quote or advice. BMT recommend consulting an accountant before making financial decisions. Contact BMT for a specialised tax depreciation schedule.