Neighbourhood Shopping Centres High on Investors’ List - Colliers

Contact

Neighbourhood Shopping Centres High on Investors’ List - Colliers

Placing the spotlight on Neighbourhood Shopping Transactions in Western Australia. Colliers State Chief Executive for Western Australia, Richard Cash said “Interest in neighbourhood shopping centre opportunities remained buoyant throughout 2022, with investor demand outstripping supply."

After successfully navigating the choppy waters of the pandemic years, the Australian retail market has faced yet more challenges in 2022; namely rising inflation and interest rates. Despite the macroeconomic headwinds, the retail sector has continued to show its strong resiliency and exceeded expectations in Western Australia, continuing to pose an attractive long term defensive investment proposition.

Colliers State Chief Executive for Western Australia, Richard Cash said “Interest in neighbourhood shopping centre opportunities remained buoyant throughout 2022, with investor demand outstripping supply. Whilst east coast based investors were active participants looking to WA for better buying opportunities/value proposition, the majority of the successful purchasers were based in WA.”

Investors were drawn to the comparatively high yield that Perth offers whilst also providing geographic diversification from the eastern states.

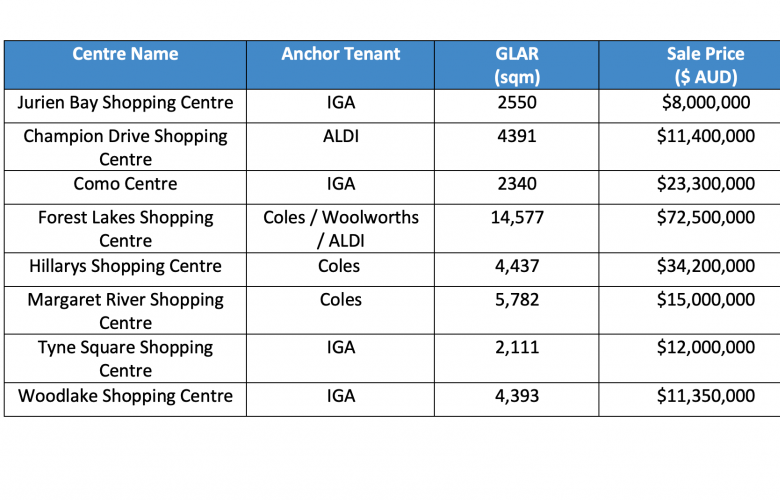

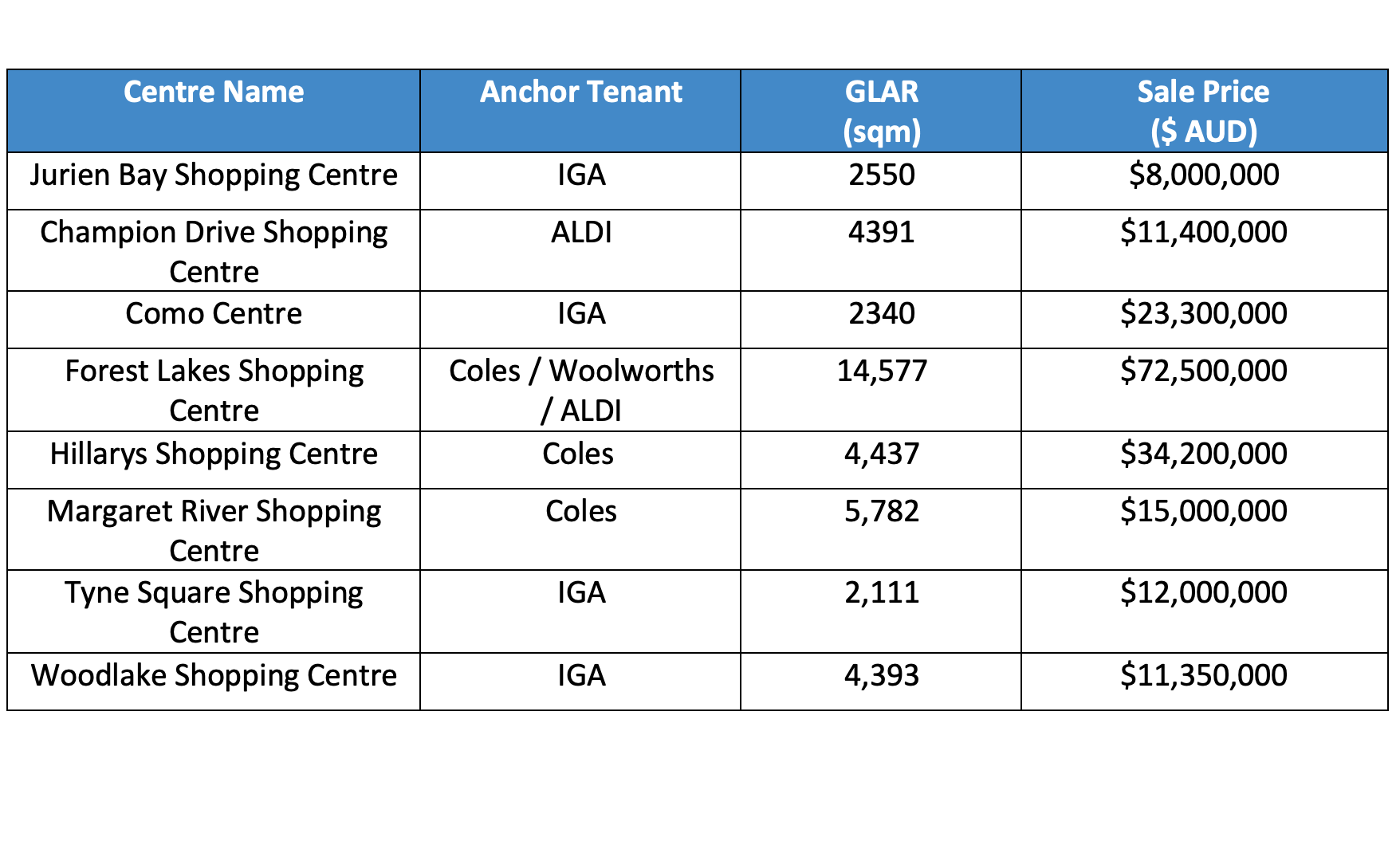

Colliers Director of Valuations & Advisory WA, Zane Gil said “there was a significant increase in neighbourhood shopping centre transactional volumes in 2022, which included nine centres, representing $223 million in value, and reflecting an average capital value of $5,539 per square metre of GLA. This compared to 5 transactions in 2021 which represented approximately $92,100,000 million in value, and reflected an average capital value of $4,178 per square metre of GLA.

“Some of the standout neighbourhood shopping centre transactions of 2022 were Forest Lakes Shopping Centre ($72,500,000 plus surplus land and surrounding pad sites), Hillarys Shopping Centre ($34,200,000) and Margaret River Shopping Centre ($15,000,000). However, notably approximately 67% of the neighbourhood centres that transacted were anchored by an independent supermarket.”

Encouragingly for the retail sector, the ability of retail rents to maintain pace with inflation is far greater than other commercial property sectors on a two fold basis; with CPI backed lease reviews more commonplace in retail, and turnover rent for major tenants proving a defensive mechanism in the face of rising costs.

Mr Cash said “2022 saw increased buyer appetite for independent supermarket anchored Centres, given the shortage of Coles or Woolworths anchored Centres being offered to market, with many of these centres providing value add opportunities through medium to long term redevelopment, or optimising the tenancy mix to improve overall WALE and net income.”

Mr Cash continued, “there remains significant pent-up demand for contemporary Coles and Woolworths anchored Centres from a wide pool of qualified investors and we expect the pricing of these Centres to remain very strong in Western Australia throughout 2023.”

The Perth market is anticipated to prove resilient to changes in market fundamentals, as the reopening of China ensures ongoing demand for iron ore, whilst yields remain comfortably above the risk-free rate.

Related Reading:

Regional NSW Large Format Retail Centres in high demand as over $40m sold - Colliers

Fabcot Developed Cranbourne West Shopping Centre for sale - Stonebridge & Colliers