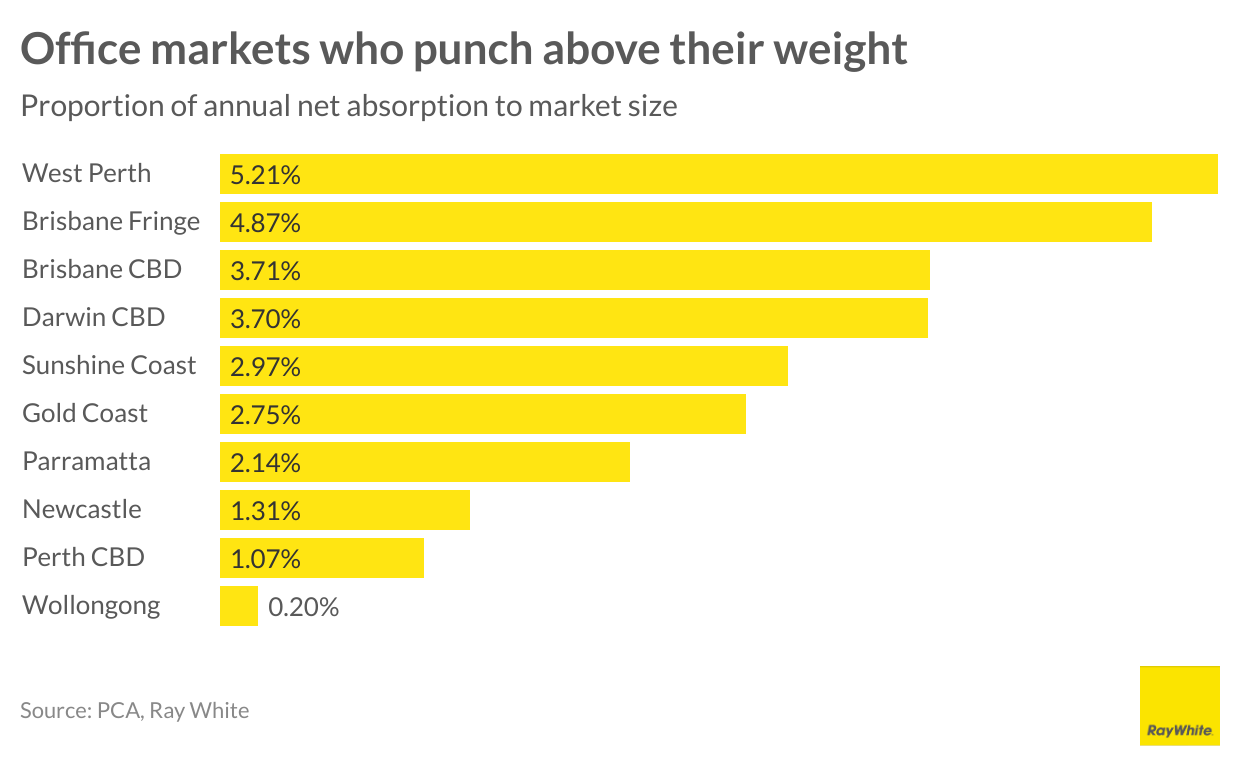

West Perth leads the way - Top 10 performing office markets

Contact

West Perth leads the way - Top 10 performing office markets

Markets such as West Perth, Brisbane Fringe, Sunshine Coast, and Gold Coast all outperformed with high rates of demand to occupy space, says Vanessa Rader Head of research Ray White Commercial.

The Property Council of Australia’s Office market report has recently been released, highlighting the changing profile of CBD and non-CBD office markets in Australia. In the post COVID-19 economy we have seen a number of office locations unable to rebound, with staff continuing to work from home, which has changed the landscape for new take up of stock and movements across the region.

Our largest office markets, being Sydney and Melbourne CBDs, continue to record negative net absorption, as more businesses leave or reduce their space requirements, which has resulted in increases in vacancy to 11.3 per cent and 13.8 per cent respectively. While those markets which weren’t hampered with the same level of lockdown, such as Brisbane and Perth CBDs, continue to see positive take up and have improved their occupancy. The greater trend, however, has been the move out of CBDs into growing employment nodes which have followed population. Markets such as West Perth, Brisbane Fringe, Sunshine Coast, and Gold Coast all outperformed with high rates of demand to occupy space.

1. West Perth

The largest suburban office precinct in Western Australia, this market has had a hard few years given the high vacancy rates of Perth CBD. With competition from the CBD in terms of quality, price driven by high incentives has seen West Perth vacancies be at a prolonged high. However, we have seen vacancies fall over the last three years, as the attractiveness of this market grows, given its parking and affordability compared to the improving Perth CBD market. This market has recorded 21,738sqm of take up over the last year, the third highest in the country behind Brisbane CBD and Fringe, an outstanding result given its market size of approximately 411,000sqm.

2. Brisbane Fringe

The high population growth in Queensland has had a positive impact on the office market across the State. Brisbane Fringe recorded the second highest net absorption of all Australian office markets of 63,625sqm, however this is the largest non-CBD office market in the country with over 1.3million sqm of stock. Improvements in this location indicative of a changing appetite for locations which can offer parking and affordable, quality accommodation options.

3. Brisbane CBD

Brisbane is the fourth largest CBD in the country and has attracted the greatest level of take up over the last 12 months. Vacancies currently sit at 12.9 per cent in a market which has averaged 14.3 per cent over the last ten years. Improvements in employment demand in the city borne out of a growing population has resulted in the need for new and expanding businesses to absorb existing stock.

4. Darwin CBD

Darwin CBD is the smallest of the CBD markets in Australia. With only 226,514sqm of stock this market is subject to many fluctuations in results, vacancies sat at 19.7 per cent two years ago, while the current result of 14.3 per cent highlights an improvement in local demand.

5. Sunshine Coast

The coastal Queensland markets have been high performers over the last couple of years, benefitting from growth in population and increased new business starts. The office market is still emerging with a number of newer, quality offerings, which are eagerly sought after, resulting in strong levels of take up. Vacancy for the Sunshine Coast sits at just 4.0 per cent the lowest rate recorded since the start of data collection in 2008.

6. Gold Coast

The Gold Coast is another strong performer capitalising on population and new business growth. This market is approximately 454,000sqm in size and has achieved nearly 12,500sqm of take up over the last year. Demand continues to increase particularly for A-grade assets, however, there has been little new stock added over the last few years resulting in vacancies falling to a 16 year low of 6.0 per cent.

7. Parramatta

Sydney’s largest non-CBD market, this precinct continues to grow with high quality A-grade assets continuing to be added to the market as total stock approaches a million square metres. The geographic advantage being in the centre of Sydney, transport coupled with the modern accommodation options has made this an attractive option for many larger tenants, notably business, finance, insurance occupiers. While this market has been hampered by COVID-19, with tenants reducing their footprints, coupled with a strong supply pipeline, this market remains the most active in Sydney recording more than 20,000sqm of absorption.

8. Newcastle

Newcastle is another coastal location showing quality results. Population movements out of Sydney to regional areas have benefited this location. Affordability and new business starts have been aiding the improvement of this small office market.

9. Perth CBD

The second most active CBD in Australia, Perth has benefited from limited lockdowns and is not facing the same work from home mentality of the eastern states. This has kept the CBD vibrant and office markets growing in occupancy. Mining, engineering, and construction continue to grow their footprint, however, professional services such as finance have increased their holdings capitalising on the incentives on offer after a period of prolonged high vacancies.

10. Wollongong

The smallest of the NSW office markets, population movements continue to benefit this office location. With new supply added over the last year, Wollongong has done well to keep absorption positive in the face of high vacancy. This market has historically had difficulty in attracting larger, national businesses, with local demand the major space user, which may see current stock levels slow to be absorbed.

Related Reading:

Westralia Square full floor leased to global leader in the energy industry brokered by Colliers

Two West Perth buildings for sale for the first time in 20 years by Knight Frank

Sydney overtakes Tokyo as the most expensive city for office fit-outs says JLL report

West Perth office building sold $13.1m by LJ Hooker Commercial Perth