Lucrative deductions inside childcare centres - BMT

Contact

Lucrative deductions inside childcare centres - BMT

BMT Tax Depreciation outline what depreciation deductions look like in childcare centres and how two different scenarios significantly benefit from a tax depreciation schedule.

Childcare centres have recently come into the spotlight as an attractive investment opportunity for investors.

Investors are eager to enter the expanding market due to its high demand, strong rental yields and lucrative depreciation deductions.

In this article, BMT Tax Depreciation outline what depreciation deductions look like in childcare centres and how two different scenarios significantly benefit from a tax depreciation schedule.

Depreciation in childcare centres

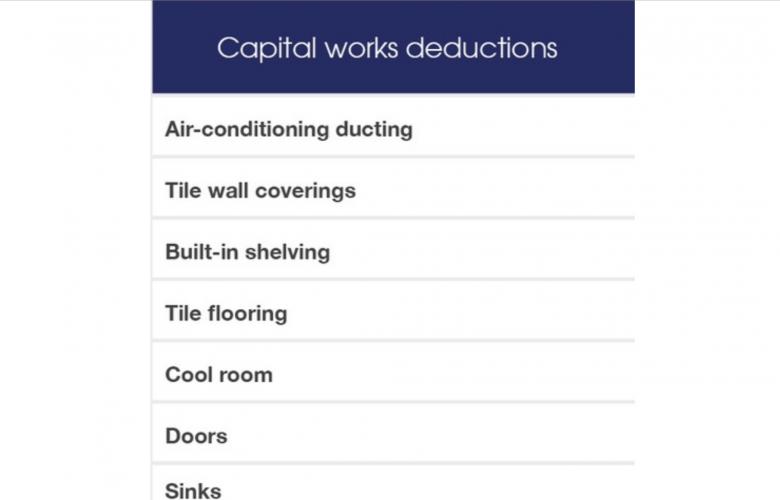

There are thousands of dollars in deductions within childcare centres in the form of capital works (Division 43)deductions and plant and equipment (Division 40) depreciation.

Capital works in a commercial building has a yearly depreciation rate of 2.5 per cent if the construction completion date was in 1982-1984, a rate of 4 four cent per year if construction was completed in 1984-1995 or 2.5 per cent per year if construction was completed in 1987 onwards.

Properties constructed before 1982 will often have deductions available, especially in commercial properties with regular upgrades and renovations. It’s not uncommon for childcare facilities to undergo upgrades every few years to maintain safety standards.

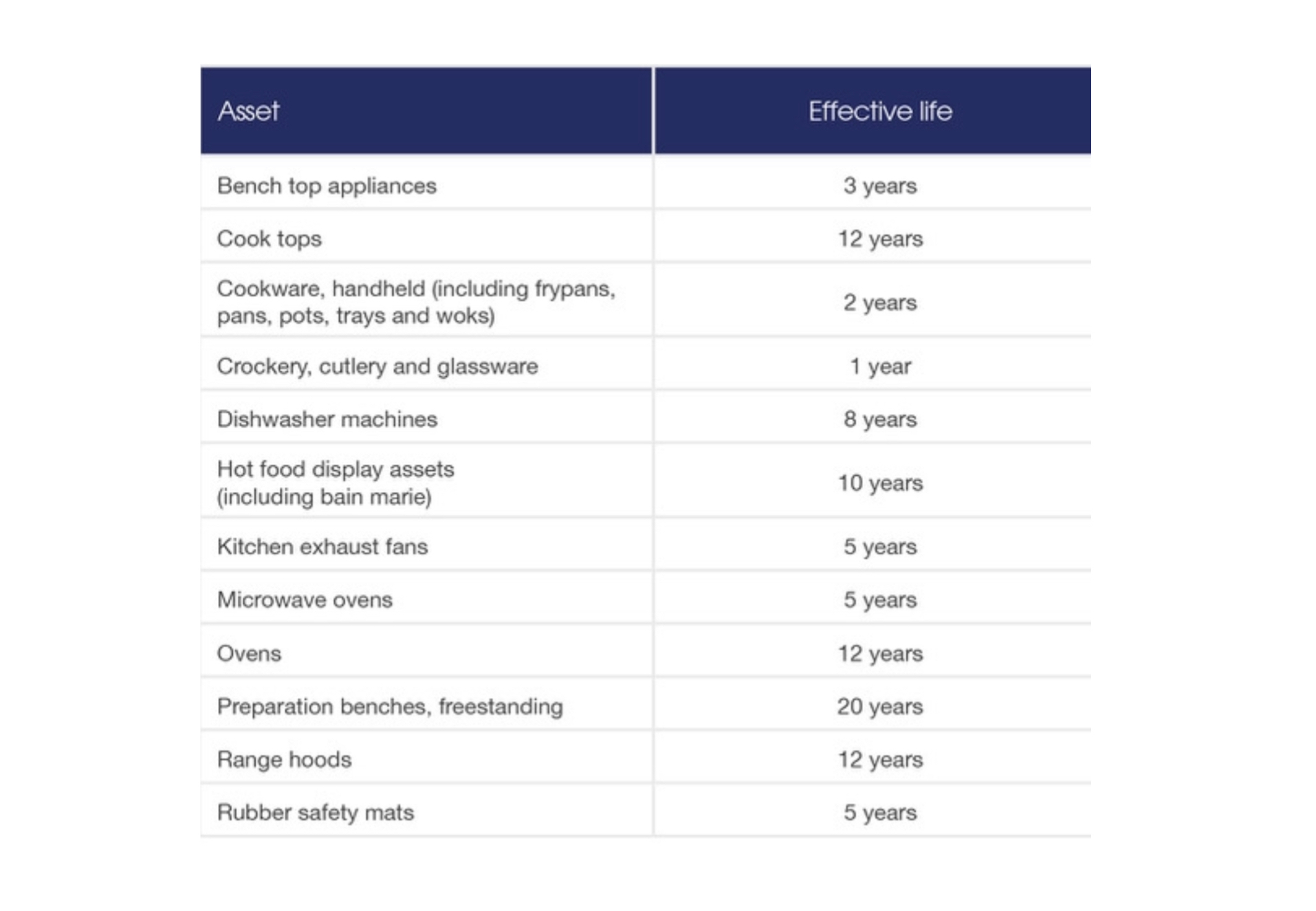

Plant and equipment assets are depreciated over their effective lives set by the Australian Taxation Office. Different assets will have different effective lives based on the type of use and industry.

Plant and equipment assets are depreciated using either the diminishing value or the prime cost (straight line) method. Both methods claim the same amount overall but achieve different short- and long-term cash flow outcomes. There is also low-value pooling available for low-cost and low-value assets.

Typical assets found within a childcare centre include artificial grass and matting, CCTV systems, furniture, carpet mats, sandpits, kitchen assets and playsets – all of which qualify for depreciation.

Government-introduced incentives

The Australian Government introduced incentives to support business and investment by accelerating depreciation deductions, which are available until the end of the 2022/23 financial year.

Eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year it is first used or installed ready to use for a taxable purpose.

There are other accelerated depreciation incentives available for eligible businesses including increased instant asset write-off and the backing business investment.

In the following case studies, we demonstrate the first-year depreciation claim available in two childcare centres with different scenarios.

Childcare depreciation deduction case studies

Scenario 1: Childcare centre located in Perth which underwent renovations and upgrades.

Sunshine Daycare is a childcare centre in Perth which has just been extensively renovated.

Renovations included expanding the outdoor play area and toddler rooms, installing new bathrooms, kitchen and baby change room fit-outs. The flooring, play equipment, indoor and outdoor furniture, CCTV systems, toys and appliances were also upgraded.

The owner of Sunshine Daycare updated their existing tax depreciation schedule and organised a site inspection before and after the renovations were complete.

The owners of Sunshine Daycare updated their existing schedule once the renovations and upgrades were complete which allowed them to claim the full cost of new qualifying assets in the fifth year and boost capital works deductions.

Because Sunshine Daycare removed assets with remaining un-deducted value during renovations, the owner was able to scrap the remaining value and recouped a further $62,188 in deductions.

When competing renovations, it’s important to organise site inspections before and after to ensure all deductions, including scrapped assets are identified accurately.

Scenario 2: Childcare centre located in Melbourne with existing assets.

Bright Beginnings Centre is a childcare centre located in Melbourne. The owner was claiming deductions themselves but since growth in the centre, they hired an accountant who recommended they order a tax depreciation schedule.

The owner of Bright Beginnings Centre was pleased with the results.

The owner of Bright Beginnings Centre claimed a total of $96,286 in the first full financial year.

Before ordering a tax depreciation schedule the owner of Bright Beginnings was failing to claim maximised deductions which meant missing out on thousands of dollars each year.

To claim every available deduction in a childcare centre, organising a tax depreciation schedule and site inspection is essential.

BMT Tax Depreciation conduct site inspections to ensure claims are maximised and fully compliant with current ATO regulations. BMT also apply government incentives where applicable.

To learn more about the deductions within a childcare centre call BMT on 1300 728 726 or Request a Quote.

The information in this article is general in nature and shouldn’t be taken as a quote or a guaranteed outcome.

Click here to read article on Retalk Asia: Life sciences real estate reaches 100 million sq. ft. with major hubs like Shanghai, Beijing, Tokyo, Singapore, and Melbourne; US$18 billion of funds has been raised to invest in life sciences real estate.

Sign up here to receive COMMO newsletters and breaking news sent straight to your inbox.

Related Reading:

Click here to read other Medical Real Estate News

Childcare dominates new year with CBRE brokering 7 deals in 30 days

Highly rated AMIGA Montessori Centre business for sale by CBRE

Brand-new Medical Centre for lease in Victoria’s Highest Growth Municipality by CBRE

Two WA childcare centres sold to Australian Unity $13.495 m through LJ Hooker Commercial Perth