Are service stations still an investor favourite in 2023?

Contact

Are service stations still an investor favourite in 2023?

Despite service station investments taking a hit in 2023, volumes were still 47 per cent higher than the previous peak investment year in 2019, which recorded $730.4 million, highlighting the significant growth in attractiveness of service stations as an asset class. By Vanessa Rader Head of research Ray White Commercial.

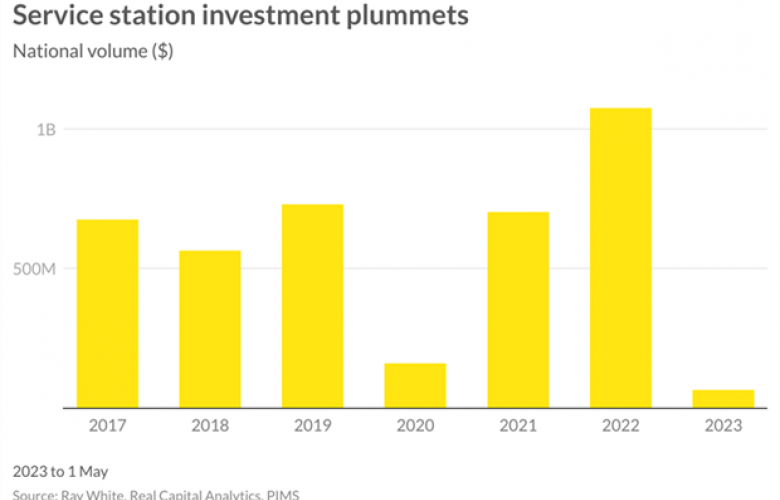

After reaching a new high in sales volume in 2022 of $1.07 billion, service station investment has taken a hit in 2023 recording just $66.8 million in the first five months of the year. While 2022 started off strongly, it was quick to slow down during the second half of the year, with interest rate increases dampening investment demand. Despite this, volumes were still 47 per cent higher than the previous peak investment year in 2019, which recorded $730.4 million, highlighting the significant growth in attractiveness of service stations as an asset class.

While the market continued to purchase in late 2022, we saw a number of investors leave the marketplace, notably the smaller first time buyers looking to capitalise on the “set and forget” phenomenon of these assets. This left more experienced investors who, despite the increased financing costs, looked to the longevity of the lease covenant and fixed increases as a hedge to these growing costs. The pool of buyers was also limited by the higher LVR requirements compared with other asset types during a time where deposit rates have risen.

In our peak year of investment, 2022, we saw volumes dominated by NSW and Queensland assets, with an increased level of demand for WA and SA assets, while Victoria fell short of its historical volumes. The quest to secure an affordable, quality, high returning commercial investment saw continued sales activity in regional markets and regions such as NT and Tasmania also improve. This year, while regional assets continue to trade, activity has transitioned back to prime east coast markets dominated by NSW, Victoria and Queensland. We expect buyers to move back to market fundamentals and more focused on future redevelopment potential of assets for the remainder of the year, this includes closer attention to location. As a result, those assets considered secondary in location, quality or lease covenant may have greater pressure on price, resulting in increases in potential investment yields.

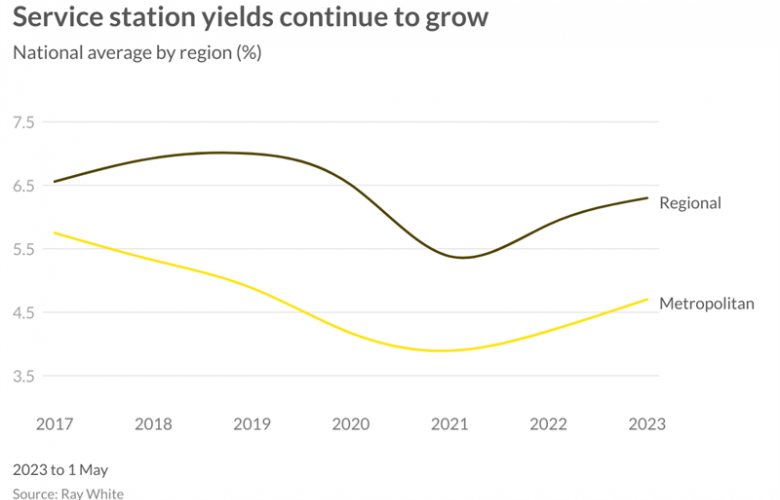

Analysis of yields already showed this growth trend in yields commenced last year as interest rates started their upward momentum. Yield lows were achieved during 2021 with metropolitan assets averaging sub 4 per cent, while regional markets saw significant tightening to just 5.88 per cent. As we transitioned through 2022 and into 2023, with the cash rate moving from 0.10 per cent to 3.85 per cent, investment yields have pushed up to 4.71 per cent in metropolitan areas and 6.25 per cent in regional markets, albeit ranges do extend beyond 7 per cent for some assets.

Looking ahead, the uncertainty surrounding future increases on interest rates has put a dampener on investors' appetite to move quickly on investment opportunities. For many buyers, capitalisation rates need to show further increase to spur on investment decisions, however, we expect to see limited assets come to market as owners continue to hold and reap the rewards of their stable income stream. Distressed assets may start to emerge, however, volumes will remain subdued in 2023 until sentiment shifts occur and confidence is restored regarding financing. This will then drive investment activity into one of the smaller, private investor’s favourite, alternative investment classes - the service station.

By Vanessa Rader Head of research Ray White Commercial.