SMEs undertake heavy lifting for office market evolution reshaping CBDs - Colliers

Contact

SMEs undertake heavy lifting for office market evolution reshaping CBDs - Colliers

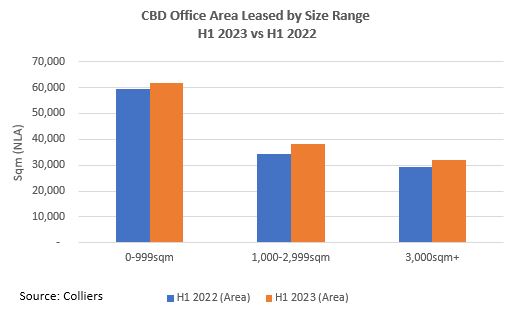

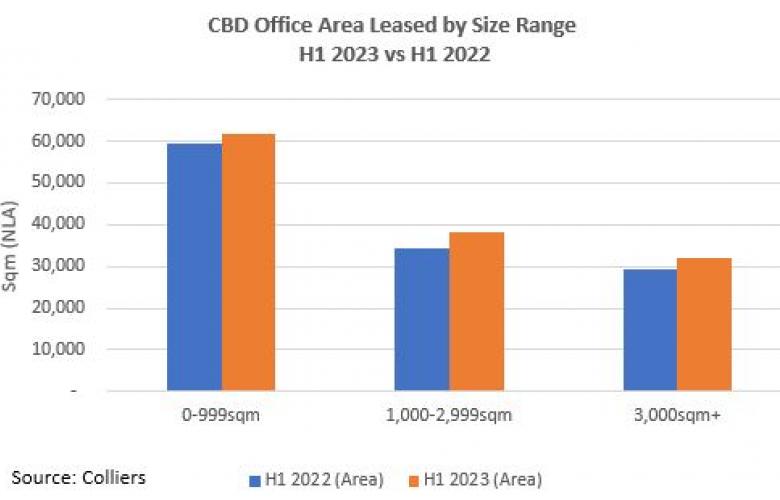

Small to Medium Enterprises (SME’s) accounted for almost 88% of leasing deals nationally over H1 2023, according to Colliers’ research.

In the face of fluctuating economic conditions, workplace expansion and upgrade preferences saw SMEs buoy the office leasing market nationally, contributing 46% to the overall 283,000 sqm leased over H1 2023, with deals for workplaces under 1,000sqm.

By contrast, medium-sized occupiers (1,000 – 2,999sqm) and larger occupiers (3,000+ sqm) were responsible for 26% and 28% of office area leased over H1 2023, respectively.

Despite three years of heightened office leasing activity from SMEs, consistent strong demand from this market segment ensured the total area of office space leased nationally for H1 2023 was 11% more than the area recorded over the first half of the last four years, according to Colliers’ Managing Director of Office Leasing Cameron Williams.

“SME’s are also undertaking the heavy lifting for the office market evolution by reshaping cities, increasing their number of deals by 4.4% and gross area leased by 3.7% across all CBDs nationally over H1 2023.” Mr Williams said.

“Demand for offices in top locations and the ‘pull to precincts’, where employees benefit from public transport access and high-quality amenities, is further elevating areas such as the North Eastern part of Sydney’s CBD, the Paris end of Collins Street in Melbourne and the River Precinct in Brisbane.”

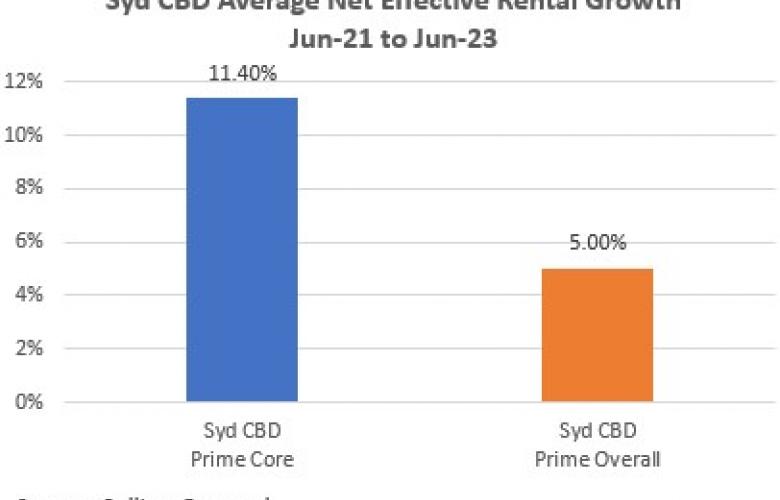

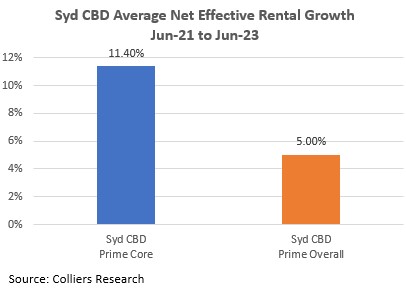

Coveted prime assets in Sydney CBD’s core precinct experienced growth in net effective rents by 11.4% over the past two years, which surpassed the average for the whole CBD (5.0%), and represents the highest rental growth across all precincts and office asset grades, according to Colliers’ National Director of Research Joanne Henderson.

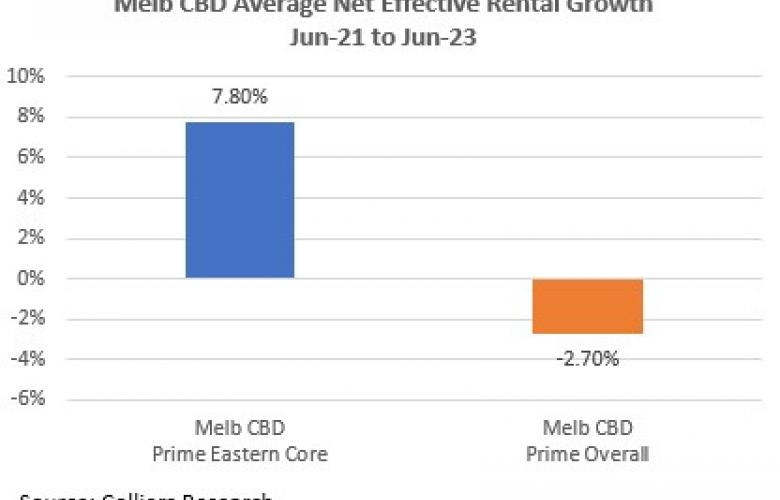

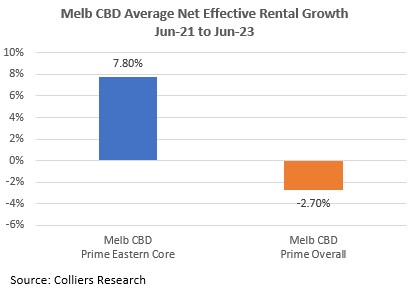

“Occupiers seeking quality, amenity and prestige also enhanced the position of Prime grade assets in the Eastern core of Melbourne’s CBD, which witnessed growth in net effective rents by 7.8% over the past two years, as the average for the whole CBD declined slightly (-2.7%).” Ms Henderson said.

“While the flight to quality is not new to the office sector, Prime grade office area leased across CBDs nationally over H1 2023, was up by 4.3%, compared to H1 2022.”

Demand for quality office spaces underpinned continued growth for Premium net face rents across all CBD markets over Q2 2023, particularly in Brisbane (1.1%) and Perth (1.0%), according to Colliers’ research.

As fierce competitition for active occupiers in softer economic conditions is placing upward pressure on incentives, average prime net effective rents achieved an annual growth rate of 4.3% by the end of June 2023, despite falling by 1.0% over Q2 2023.

Mr Williams said; “Although, SMEs buoyed rents and the office leasing market over H1 2023, we expect a large number of deals for high profile tenants requiring over 5,000sqm of space, to be agreed and announced in H2 2023.

“We are already starting to see green shoots in the uplift of larger deals.”

Nationally, the number of office leasing deals over H1 2023 for 3,000sqm + were up 22%, accounting for an increase in space of 74% for this market segment, compared to H1 2022. This represents the most office area (79,443 sqm) leased to larger occupiers since H1 2019.