A tough 2024 for the office market - RWC

Contact

A tough 2024 for the office market - RWC

According to Vanessa Rader, Head of research at Ray White Commercial, the continued growth in finance has impacted all commercial asset classes with total returns down across most types and pressure on capital return greatest as investment yields rise.

The continued growth in finance has impacted all commercial asset classes with total returns down across most types and pressure on capital return greatest as investment yields rise. While assets such as industrial and hotels continue to show capital growth remaining positive, assets such as retail, healthcare, and office have moved into negative territory. For most of these assets, however, income returns have held up well while continued pressure on occupancy levels has seen these rates decline across office space.

For the office market, the shift in behaviours towards working from home, borne out of COVID-19, have been hard to move. Many of our CBD office markets remain quiet with foot traffic, public transport usage, and car parking usage down, signalling reduced office vibrancy and empty desks. Low unemployment has been fuelling the continued acceptance of working from home, with some businesses having embraced the cost savings which come with downsizing their physical office space.

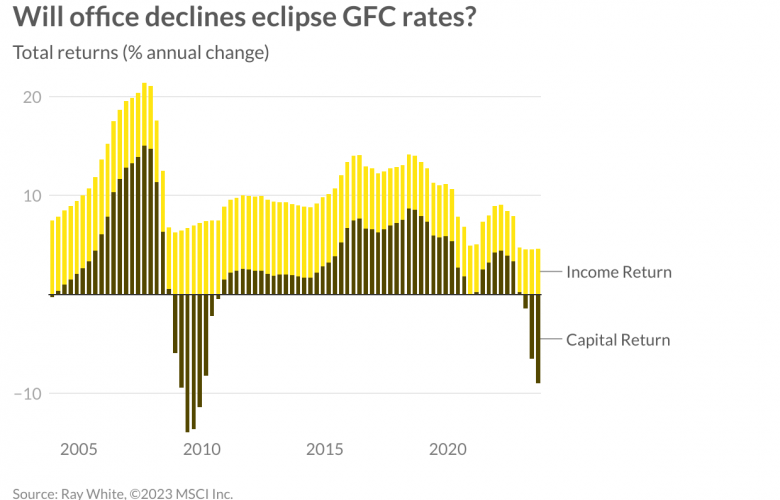

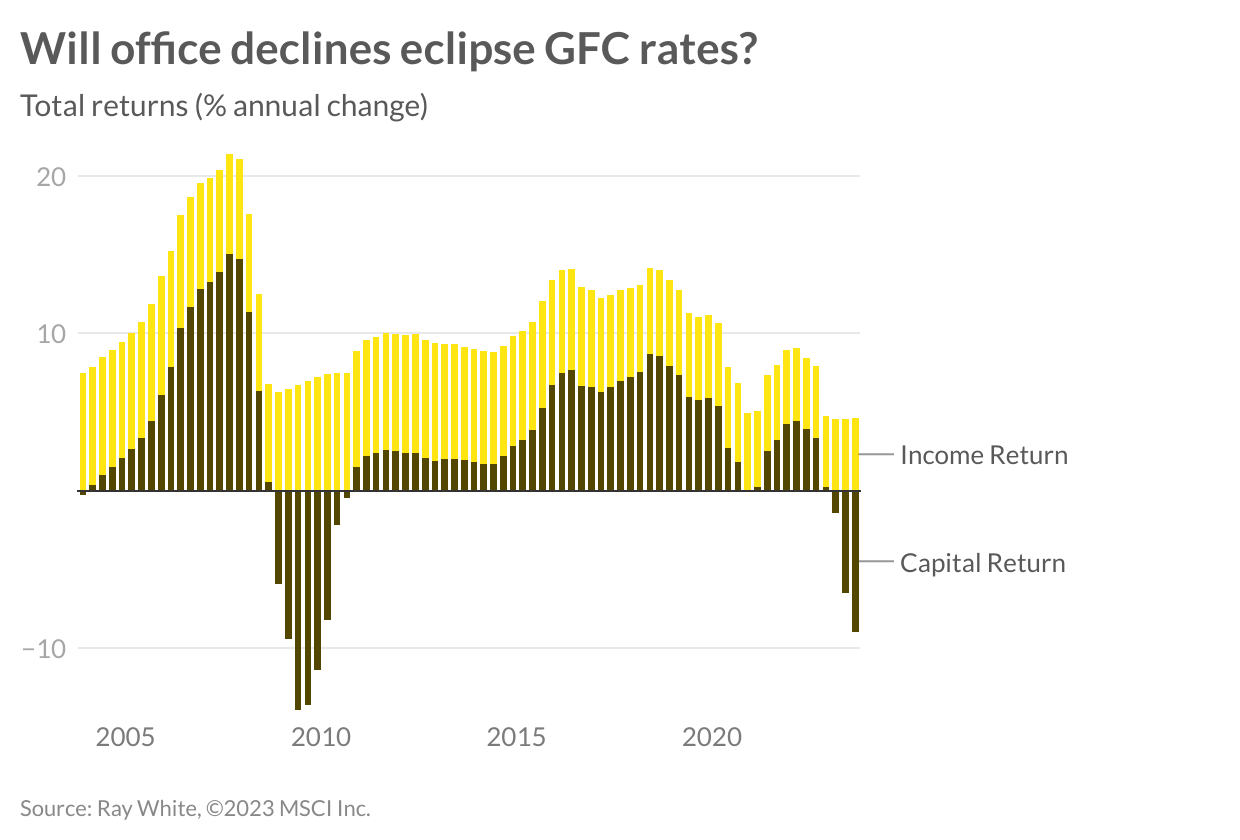

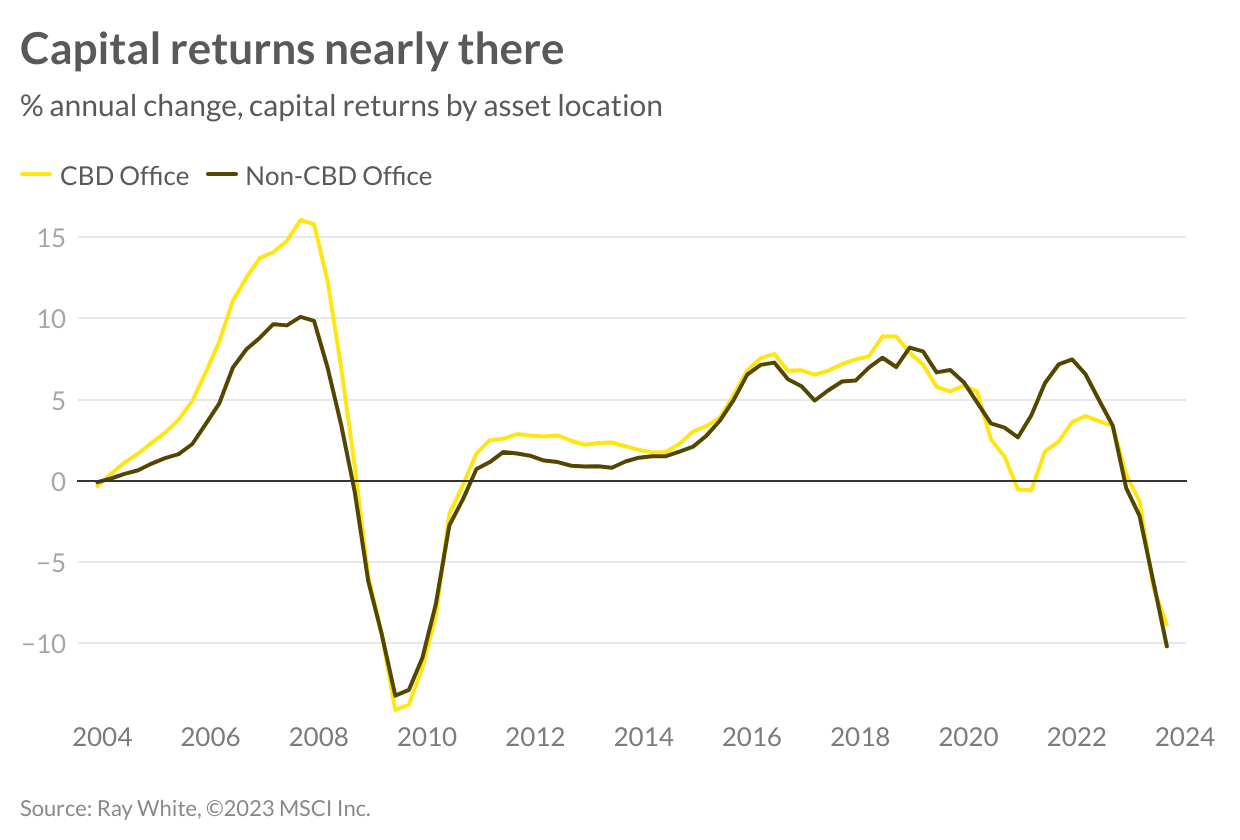

Given these shifts in attitudes towards office space, what will the future hold for many of these assets going forward? Once the trophy asset many offshore buyers looked to secure and REITs or funds were keen to add to their portfolio, uncertainty surrounding growing vacancies and elevated incentives, coupled with increased finance costs, has put a dampener on investment confidence and in turn demand. The latest MSCI data on returns highlights both the decreasing income returns for Australian office assets, while highlighting the extent of capital value decline, recorded at -9.0 per cent in September 2023. The last time we saw such discounting was during the GFC period, with funding difficulty resulting in annual declines of up to -13.9 per cent, albeit after a period of historically high capital appreciation.

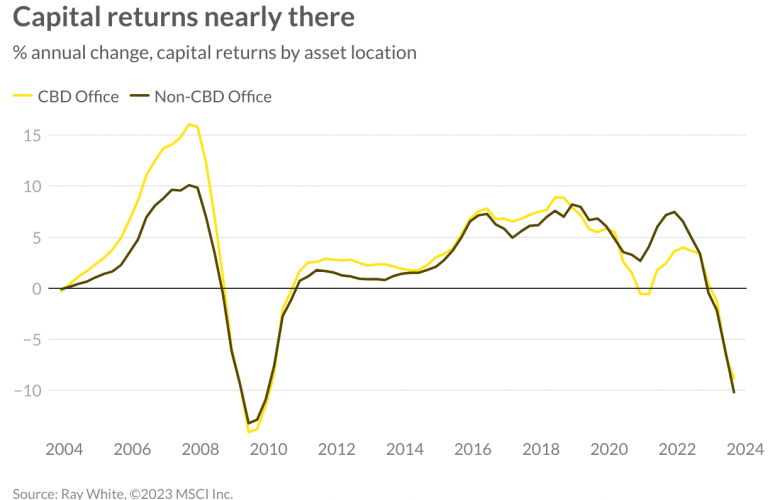

The woes of the office market are widespread, however, some markets are performing better than others. Looking across CBD and non-CBD markets in Australia, the trends are the same, with the rate of capital decline near the worst periods of GFC. Interestingly, however, has been the performance of the non-CBD market during the pandemic period, with returns outstripping those of the CBD which has historically trended ahead. More recently, however, we have seen more activity across CBD markets given the discounting on offer, turning the attention back to CBDs, which is expected to feel recovery ahead of more suburban locations.

Sydney and Melbourne CBDs and suburban hubs have recorded some of the worst returns, while Queensland markets, despite still showing negative returns, have trended at a better rate. A combination of changing attitudes towards working from home and supply dynamics has seen occupancy levels improve in these regions and restore some confidence in the long-term returns of office assets in these locations.

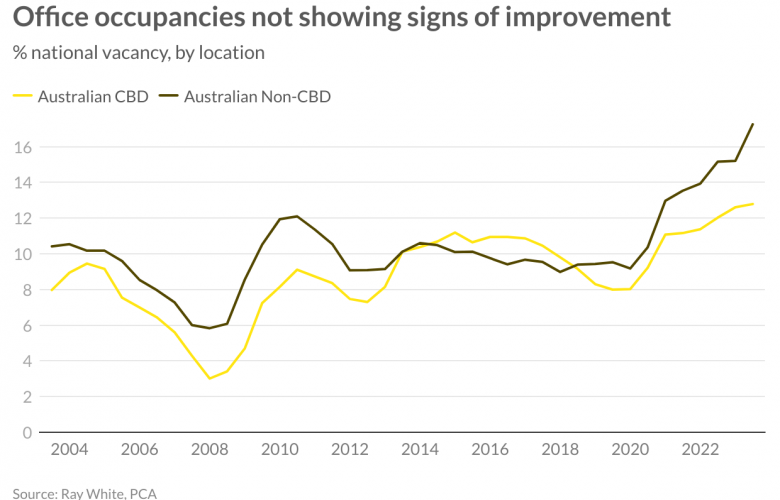

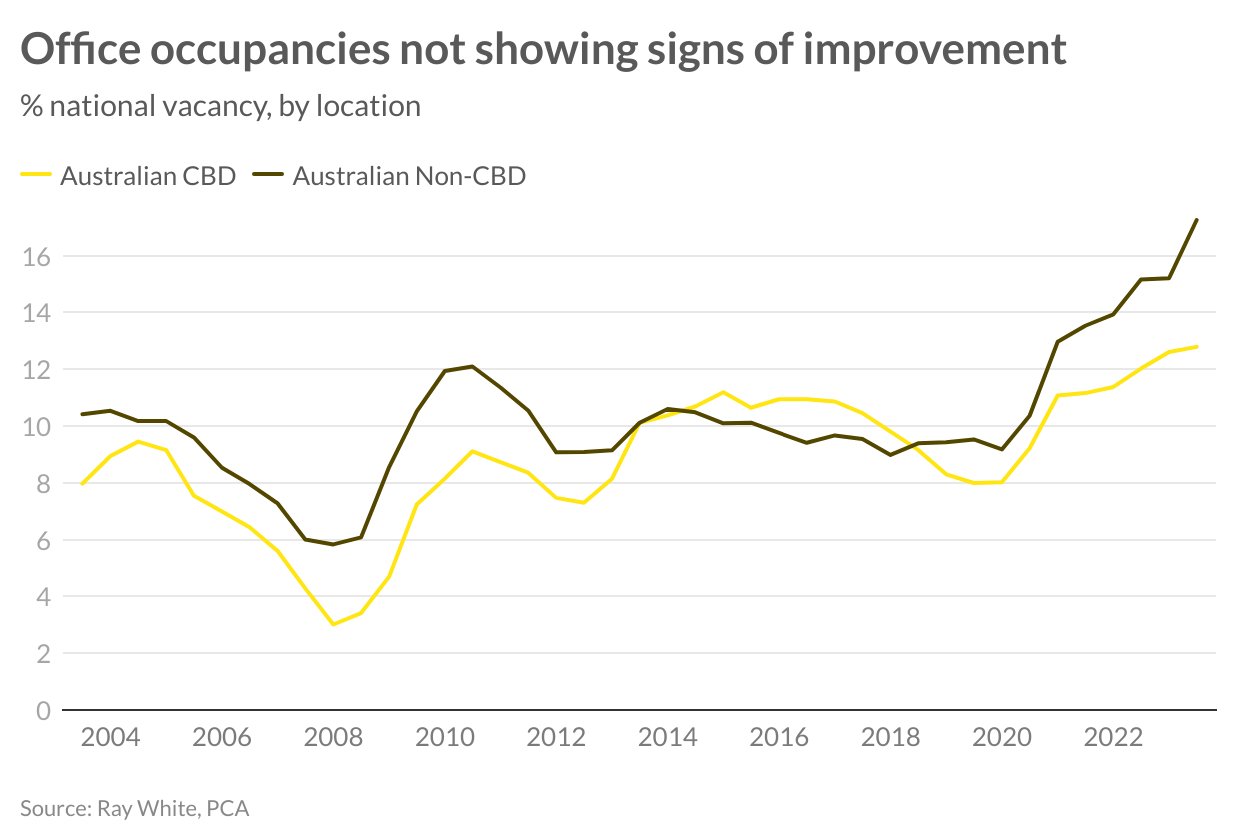

While we are in this period of negativity for the office market, unfortunately the outlook for 2024 is expected to show much the same. Vacancy levels across the Australian markets continue to trend upward and are well ahead of long term averages, moving into early 1990s territory where capital returns fell to as low as -20 per cent during a time of recession, high unemployment, and inflation.

These high rates of vacancy are trending well ahead of the poor results felt post GFC and their lack of moderation highlights concern regarding the recovery of the asset class in any timely manner. The recovery in office vacancies will vary from city to city, however, the overarching sentiment is poor keeping rates at an elevated rate over the next 12 months. These high rates will result in continued pressure on effective rents, however, the flight to quality trend will maintain, putting a greater spotlight on the future of secondary office assets. Fundamentally, quality office assets will rebound and will again gain trophy status. The safe haven of Australia will pique foreign buyer interest once again, however, at a price more aligned to market conditions and yield rates which factor in the appropriate risk rate and higher cost of finance.