CBD occupancy rates spike as more Australians return to the office - CBRE

Contact

CBD occupancy rates spike as more Australians return to the office - CBRE

The return to the office is gathering pace in Australia, with the nation’s CBD occupancy rate hitting 71% of pre-COVID levels in Q3 according to new CBRE data.

The return to the office is gathering pace in Australia, with the nation’s CBD occupancy rate hitting 71% of pre-COVID levels in Q3 according to new CBRE data.

This was well above the 54% level recorded in Q3 2022 and highlights that a growing number of employers are succeeding with return-to-work measures.

CBRE’s Australian Head of Office Research Tom Broderick noted, “Companies and employees alike are acknowledging the importance of face-to-face collaboration and the synergy it brings to their operations. Every major CBD market in Australia has recorded increased occupancy rates over the past 12 months, with the smaller markets of Perth and Adelaide having rebounded impressively, nearing pre-pandemic levels on peak days.”

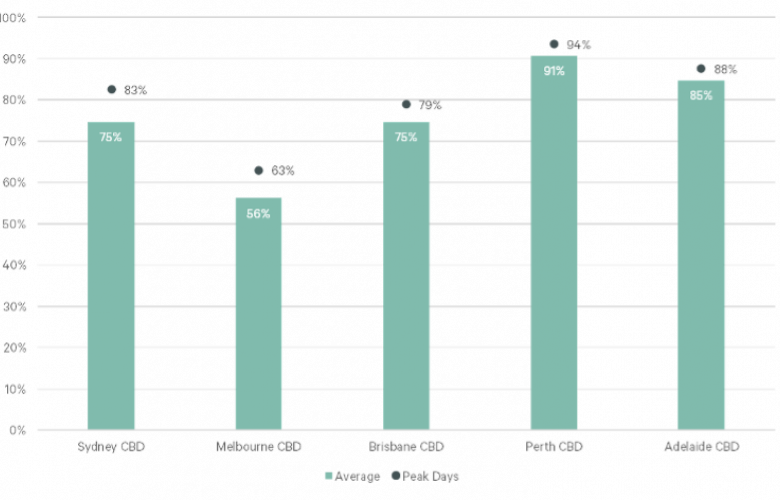

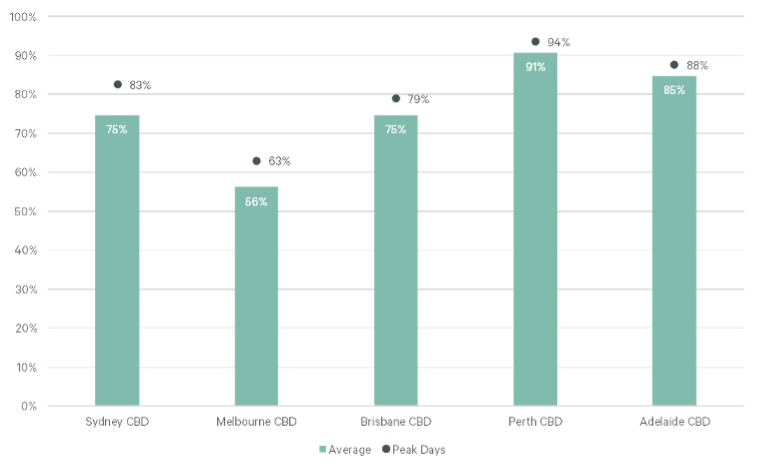

Australian Office Occupancy by CBD Market in Q3 2023 versus pre-COVID levels

Source: CBRE Research

Mr Broderick said Perth and Adelaide had both benefitted from fewer lockdowns during the pandemic, meaning that working from home had become less structural in both cities.

However, Australia’s larger CBDs are following suit with occupancy rates in Sydney and Brisbane hovering at around 75% of pre-COVID levels during Q3 2023.

Melbourne has observed a similar magnitude of improvement, albeit coming off a lower base to record a Q3 2023 occupancy rate which is at 56% of the pre-COVID level.

CBRE’s data highlights that the improvement in national office attendance over the past 12 months had been consistent across the entire work week.

Australia-wide, midweek is still the most popular time for workers to come to the office, with Tuesday-Thursday attendance averaging 76% of the pre-COVID level in Q3 2023, up from 55% in Q3 2022.

Friday attendance rates nationally have risen by 14 percentage points over the past 12 months, but that remains the least popular day to head to the office, with Friday occupancy averaging 60% of the pre-COVID level in Q3.

And employees appear to have shaken off the Monday blues, with Q3 Monday attendance rates averaging 70% of pre-COVID levels.

CBRE’s Pacific Head of Investor Leasing Tim Courtnall said he expected the overall improvement in national office attendance to continue as many large corporations set clearer return to office policies.

“CBRE’s 2023 Global Occupier Sentiment Survey found that 69% of Asia Pacific respondents - versus just 45% from the US - have set a goal for employees to be mostly or fully in-office and this has been reflected in recently introduced policies by some major corporates in Australia requiring a minimum 50% attendance rate during the week or month,” Mr Courtnall said.

“It's been encouraging to see global companies move away from global mandates on their work from home policies and give regional management autonomy to implement country by country policies. This approach will only have positive impact on productivity and company culture.

“Many employers are also looking to incentivise employees to return to the office, with KPMG’s 2023 CEO Outlook finding that 74% of Australian CEOs surveyed plan to reward employees who make an extra effort to come into office with raises, promotions and more interesting work. This combination of push and pull factors driven by top-down policies from corporate leadership will be a key driver to sustained improvements in office attendance.”

CBD trends

Drilling down beyond the national trends, CBRE’s occupancy data does highlight some significant variations by city.

- Perth and Adelaide have exhibited the least variance in office attendance through the work week, with office attendance on Friday only about 3 percentage points lower than the Tuesday to Thursday average.

- Sydney and Melbourne have the most pronounced difference in attendance rates throughout the work week, with average attendance rates on Friday falling by between 20-30 percentage points from mid-week levels in Q3 2023.

- The smaller markets of Perth and Adelaide have led the return to office in Australia. As of Q3 2023, occupancy averaged 91% of pre-COVID levels in the Perth CBD and 85% in Adelaide, while peak days were 94% and 88% respectively.

- Brisbane has also observed a solid return to office, with an average occupancy at 75% of pre-COVID levels in Q3. The public sector has been one of the slowest sectors to return in Brisbane and represents 35% of the tenant base, which is likely a key reason why the city lags behind Perth and Adelaide.

- Sydney has been the biggest improver over the past 12 months, with occupancy averaging 75% of pre-COVID levels across the work week in Q3 2023, up from just 49% a year ago. Peak days are also robust at 83%. While the Sydney CBD has been impacted by tenant contraction and elevated sublease over the past few years, this may reverse if the trend of improved occupancy continues.

- In Melbourne - given the extended lockdowns and a more structural adoption of work-from-home by employees – the CBD has the lowest average occupancy at 56% of pre-COVID levels and 63% on peak days. However, the Melbourne market has observed an improvement, up by 13 percentage points over the past 12 months. Also, the occupancy differs between precincts, with occupancy excluding Docklands estimated to be around 60% and 67% on peak days.

Click here to view and download the report.