Consumers remain cautious despite strong retail recovery - CBRE

Contact

Consumers remain cautious despite strong retail recovery - CBRE

CBRE retail data for the third quarter indicates consumer confidence has shown a strong recovery from the depths of April but remains in negative territory.

Australian retail trade is on the rise in 2020, but investment activity in the sector continues to be constrained, new research has found.

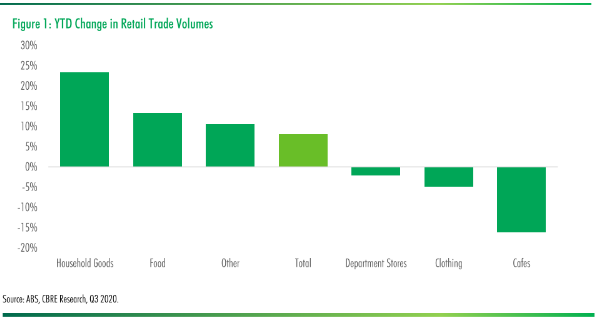

CBRE's Retail Marketview Q3 2020 indicates retail sales grew by 9.2 per cent y-o-y (3mma) in the 12 months to August 2020.

According to CBRE, changes to consumer behaviour had contributed to the sector's overall resilience during the pandemic period.

CBRE Retail Marketview Q3 2020 - At a glance:

- CBRE data indicates retail sales grew by 9.2 per cent y-o-y (3mma) in the 12 months to August 2020.

- Investment activity in the nine months to Q3 2020 totalled $2b, down on the $4.6b recorded in Q1-Q3 2019.

- Yields expanded a further 6bps for Prime CBD retail in the third quarter, totalling 35bps yield expansion since Q4 2019.

"Spending has shifted towards online shopping faster than expected," the report reads.

"Non-discretionary spending has grown as price-sensitive consumers opt to eat at home.

"CBD-based retailers have found their customers working from home more often, impacting foot traffic."

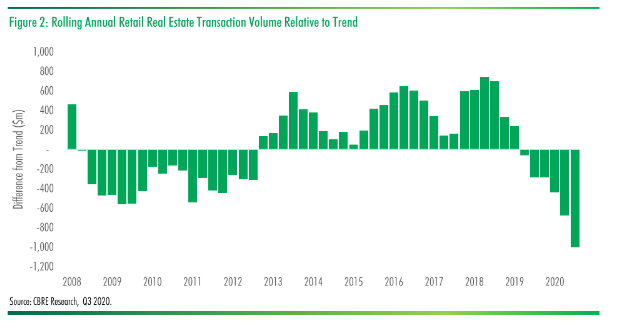

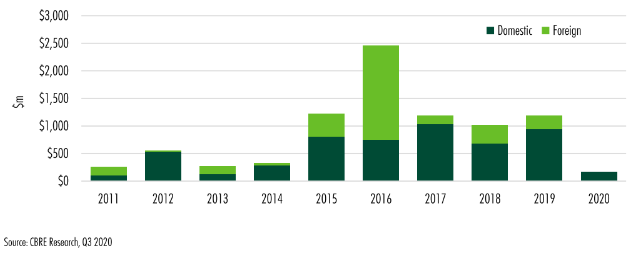

In contrast, deal volumes within the sector remain negatively impacted by the pandemic, with the report revealing investment activity in the nine months to Q3 2020 totalled $2b, down on the $4.6b recorded in Q1-Q3 2019.

CBRE expects the trend to continue for the remainder of the year, despite a rise in incentives and a softening of net face rents.

CBD Retail Buyer Profile.

Other key statistics included in the report include the fact that yields expanded a further 6bps for Prime CBD retail in the third quarter, totalling 35bps yield expansion since Q4 2019.

Yields also expanded 4bps for Regional Shopping centres, totalling 25bps since Q4 2019.

Click here to download a copy of the report.

Similar to this:

Australian suburbs 'set to bloom' from flex office offerings - CBRE Marketview

CBRE retail data highlights resilience of supermarkets

Western Sydney business-zoned sites proving hot property - CBRE