Third Quarter dealmaking jumps as investors turn to office, retail properties; Year-to-date deal activity sweeps past 2020 total

Contact

Third Quarter dealmaking jumps as investors turn to office, retail properties; Year-to-date deal activity sweeps past 2020 total

Deal volume for the first three quarters of 2021 reaches $43 billion, already eclipsing full year 2020 level. Benjamin Martin-Henry, RCA’s Head of Analytics, Pacific, said: “After a slow start to the year, the office sector is now flourishing.”

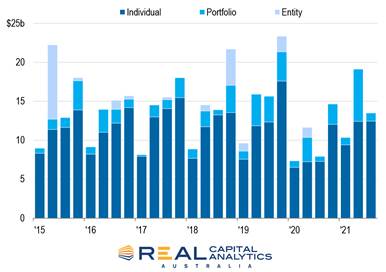

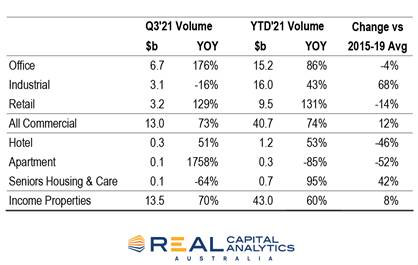

Australian commercial property sales activity gathered pace in the third quarter of 2021 to reach $13.5 billion, a 70% year-on-year jump over the subdued third quarter of 2020, the latest Australia Capital Trends report from Real Capital Analytics showed. This came as deals in the office and retail sectors increased.

For the year so far, sales of income-producing property reached $43.0 billion, up 60% versus 2020 and 8% higher than the average in the five years before the pandemic. With close to $7 billion worth of transactions awaiting settlement, the fourth quarter is shaping up to follow historical trends for investment activity and 2021 is likely to go down as the year of the megadeal.

Office And Retail Sectors Sees Resurgence

Office deal volume in the third quarter and for the year to date was well ahead of 2020, though a shade behind the pre-Covid five-year average, at $6.7 billion and $15.2 billion respectively. The biggest deal of the quarter and of the year so far was the NPS acquisition of Melbourne Quarter Tower for $1.2 billion. In Brisbane, Charter Hall acquired a 50% share in 275 George Street for $275 million.

Sydney office sales picked up after a record low year in 2020, reclaiming its traditional position as the number one market in Australia for offices. Notable deals in the third quarter included M&G Real Estate’s joint venture with Mirvac to acquire a 50% stake in the EY Centre at 200 George Street for $579 million.

In the retail sector, deal volume reached $3.2 billion, buttressed by sizeable transactions closing such as the Myer Melbourne selling to the Charter Hall Long WALE REIT and Abacus, as well as the Casey Central Shopping Centre selling to Haben and The JY Group for $225 million.

Benjamin Martin-Henry, RCA’s Head of Analytics, Pacific, said: “After a slow start to the year, the office sector is now flourishing. Volumes have eclipsed 2020 levels and are on par with pre-Covid averages as investors show renewed confidence in the sector. Retail is also doing well, and we are starting to see larger shopping centers transact as investors look to make big plays for quality stock.”

Industrial Sector Investment Levels Outperform Office Transactions For First Time

For the first nine months of the year, sales of industrial properties such as warehouses surpassed those of offices for the first time in Real Capital Analytics records at $16.0 billion. While sales in the third quarter were muted, the year-to-date deal volume was 68% ahead of the pre-pandemic five-year average. Increased adoption of online retailing has spurred demand for the logistics units and warehouses needed to store and distribute goods.

Benjamin Martin-Henry, RCA’s Head of Analytics, Pacific, said: “The industrial sector has blown away all kinds of records in 2021 and may finish the year as the number one asset class. While the market took a bit of a breather in the third quarter, 2021 will still go down as the year of industrial.”

Alternative Sectors Continue To Attract Investors

Investors continued to acquire assets outside the traditional core property sectors. In 2021, RCA has already seen record years for childcare, pubs and self storage assets, with what is traditionally the busiest dealmaking quarter of the year still to go. In 2020, data centres, student accomodation, services stations and medical offices all registered record annual deal volume.

Benjamin Martin-Henry, RCA’s Head of Analytics, Pacific, said: “The alternative markets have been getting a lot of interest as investors look for stable income streams in growing sectors. We have seen such a wide variety of assets trade: from childcare to car dealerships, nothing appears off the table.”

For more information contact Benjamin Martin-Henry via the contact form below.