Rent growth in Adelaide CBD’s office market partially offsetting value softening for assets: Knight Frank research

Contact

Rent growth in Adelaide CBD’s office market partially offsetting value softening for assets: Knight Frank research

According to Knight Frank's latest Adelaide CBD Office Market Report, there were 10 transactions above $10 million settled in 2022, a 95% increase from 2021, with 60% of sales occurring before the cash rate rises.

The Adelaide CBD office investment market remains stable, with rent growth offsetting the extent of value softening, according to the latest research from Knight Frank.

The Adelaide CBD Office Market Report found 10 transactions above $10 million settled for office asset sales over 2022, reflecting a total sales volume of $531.14 million, which was a 95 per cent increase from $271.96 million in 2021.

Sixty per cent of these transactions occurred prior to the RBA’s first of eight consecutive cash rate hikes in 2022.

Several assets were transacted last year but settled – or are scheduled for settlement - this year, including 211 Victoria Square, which settled for $130.5 million in February, and pending settlements for 63 Pirie Street, 45 Pirie Street and 50 Hindmarsh Square. Including these assets in the total for 2022 would push the total sales volume to $807.38 million.

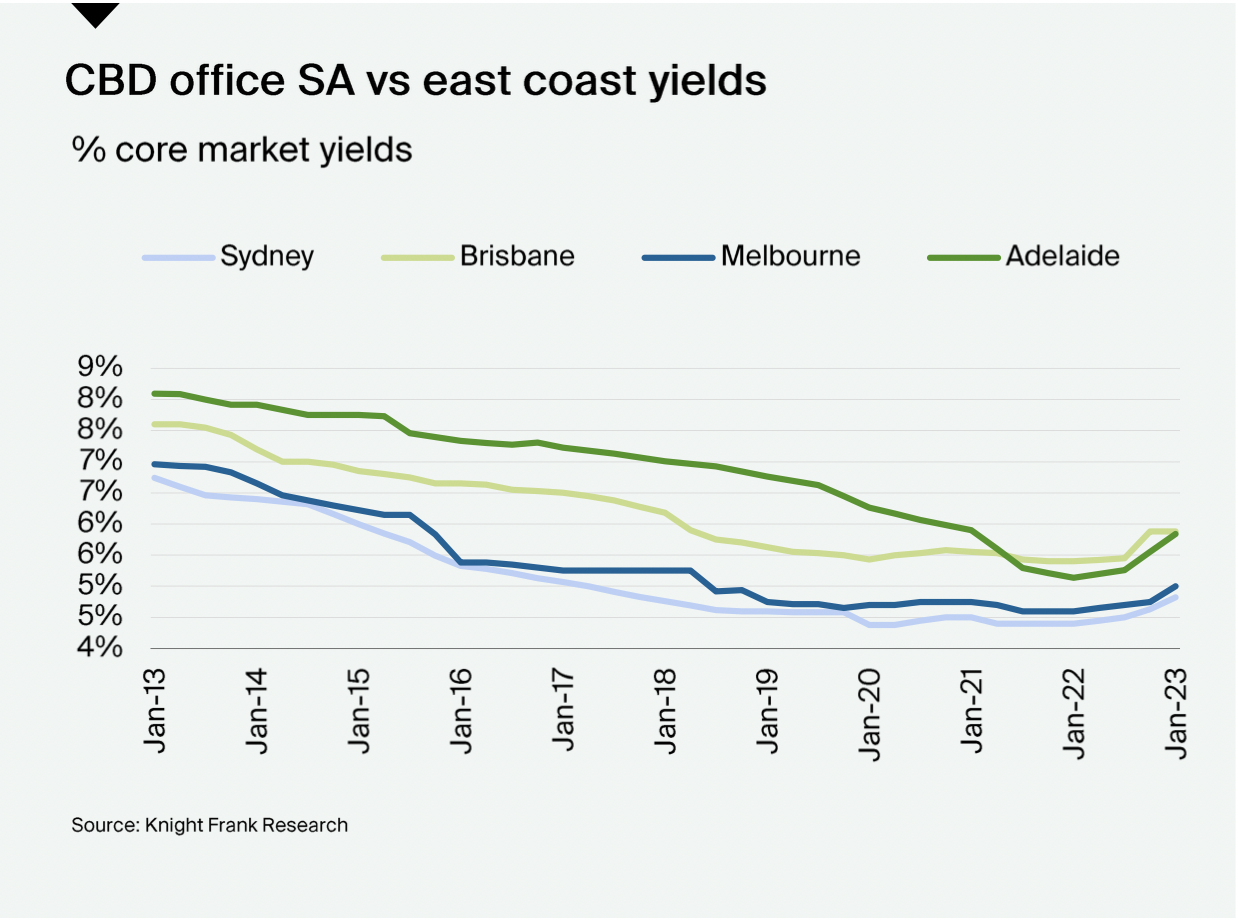

Knight Frank Partner, Research and Consulting Dr Tony McGough said as the cost of funding increased over 2022 average prime yields softened a further 58 basis points from 5.26 per cent in Q2 2022 to 5.84 per cent in Q4 2022.

“We have seen a 71 basis point shift from the historic low of Q4 2021, with the spread to Sydney expanding 29 basis points from 73 basis points in Q2 2022 to a current spread of 102 basis points,” he said.

“This spread is enhanced by around 26 basis points when accounting for transfer fees with South Australia’s stamp duty exemption on commercial transactions, providing a genuine value proposition for the state.”

Knight Frank Director of Institutional Sales in South Australia, Max Frohlich said that despite the challenges facing financial markets globally - and Sydney and Melbourne tending to attract more attention because of their larger market size - there is still plenty of capital looking for a home in Adelaide’s office market.

“While changes in banking continue to dominate market sentiment, we are currently experiencing genuine engagement from equity investors, supported with debt solutions, looking for risk-adjusted investments in Adelaide.

“This is due to Adelaide’s affordability, stability and comparative advantage, with no stamp duty on commercial transactions.

“Our occupier market is also in good stead, and we are starting to see genuine rent growth roll through for existing high-quality accommodation on the back of the benchmarks set for the new developments at 83 Pirie Street, Festival Tower and 60 King William Street. This is providing a powerful counterpoint to recent outward yield shifts, to offset the extent of value softening.

“Looking ahead, higher funding costs for property investors are a clear risk to the outlook. However, financial markets now expect that the rate hiking cycle from the RBA is coming to an end and that interest rates will attenuate from here.

“While the full impact of the developments in the US and Swiss banking sectors are yet to play out, the RBA’s policy stance before these concerns emerged supported a possible cash rate pause in April.

These global developments have led to a tightening in financial conditions and have further solidified the likelihood of a pause.

“Due to this, we expect the spread between interest rates and yields to be partially restored over the next few months and that this will provide the market with renewed confidence going into Q2 2023.”

As of January 2023, the Adelaide CBD’s gross effective rents for prime stock increased by 2.49 per cent to $411/sq m, while secondary stock increased by 2.24 per cent to $274/sq m over the second half of 2022.

Knight Frank Head of Leasing South Australia Martin Potter said this year it was predicted there would be divergence in rental growth between new or refurbished and secondary stock.

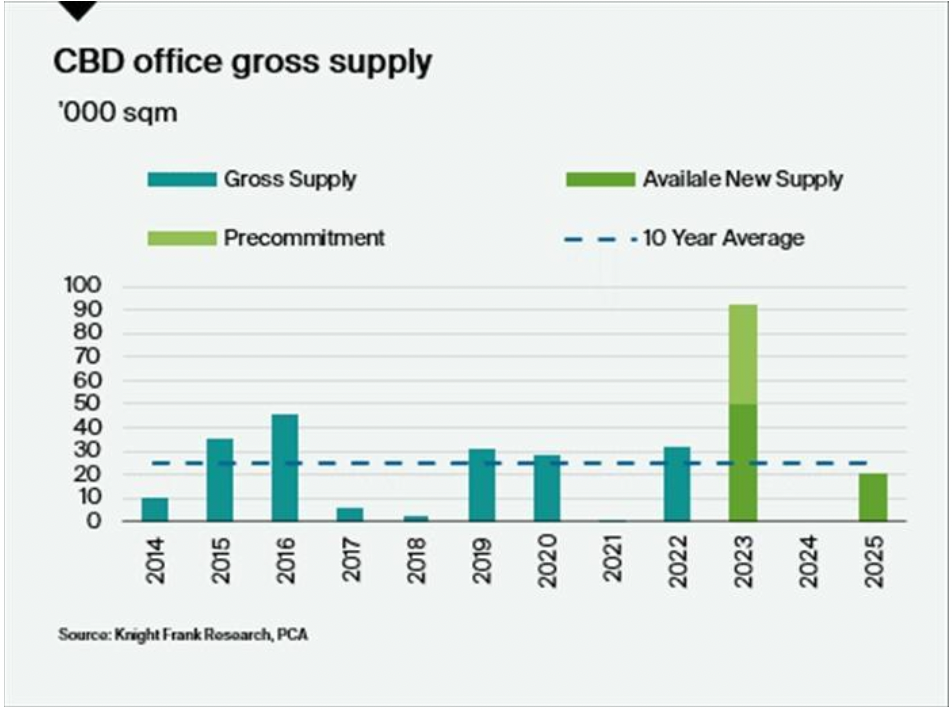

“A historic amount of supply of office space will be added to the Adelaide CBD in 2023, with 92,016 square metres set to enter the market, which is the largest anticipated supply over a one-year period since records began.

“A large proportion of this is already pre-committed, but we expect the vacancy rate to rise from the current 16.1 per cent in the CBD to 18.4 per cent by the end of 2023.

“Older generation prime and secondary stock will be in need of refurbishment to attract new tenants as ‘flight to quality’ remains a prominent factor.

“Despite economic uncertainty in recent years, the Adelaide office market has provide remarkably resilient in comparison to cities on the eastern seaboard, which can be partly attributed to sustained demand from government tenants and a diverse mix of small-to-medium enterprises.”