South East Queensland in need of more facilities for life sciences and innovation users to meet demand says Knight Frank

Contact

South East Queensland in need of more facilities for life sciences and innovation users to meet demand says Knight Frank

There is an opportunity for investors to build facilities of scale for life sciences* and innovation users in South East Queensland to meet demand, according to a new report from Knight Frank, Life Science and Innovation report.

There is an opportunity for investors to build facilities of scale for life sciences* and innovation users in South East Queensland to meet demand, according to a new report from Knight Frank.

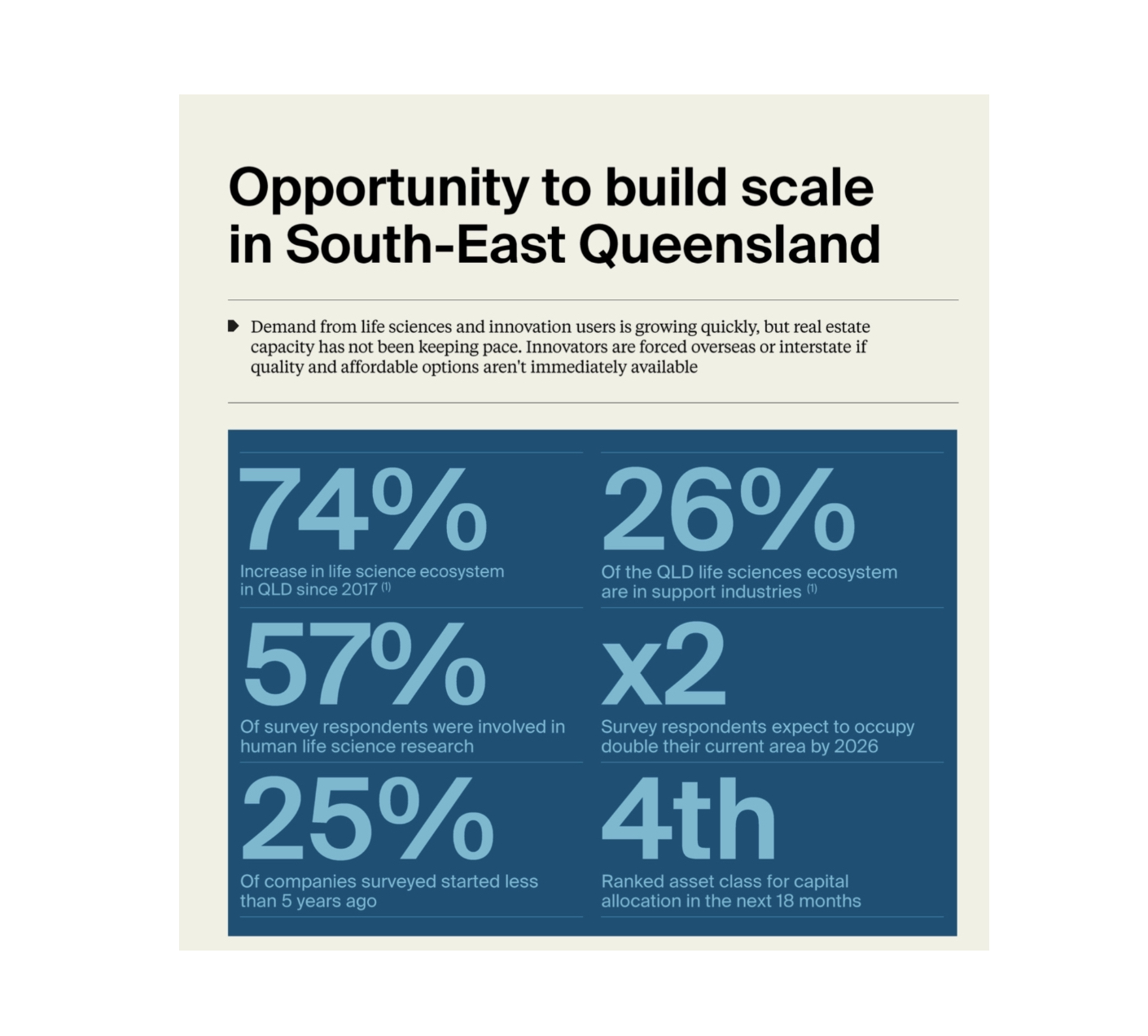

The real estate consultancy’s Life Science and Innovation report, which focuses on the opportunities and barriers to greater institutional investment in the sector in South East Queensland, found demand from users in the region is growing quickly, but real estate capacity has not been keeping pace.

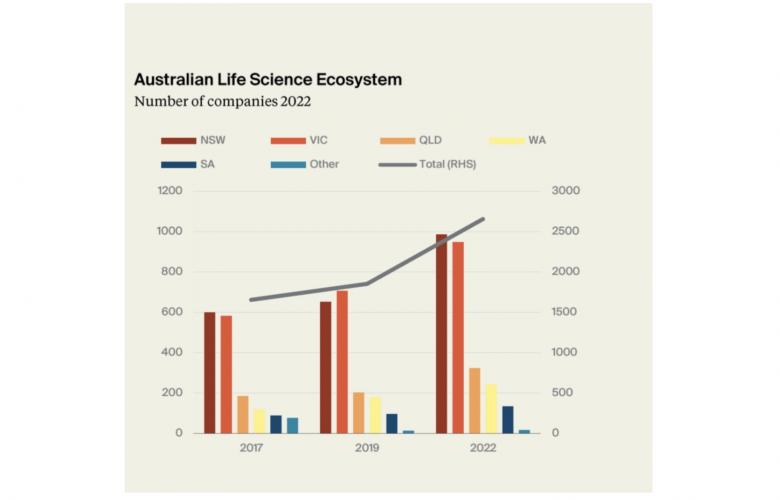

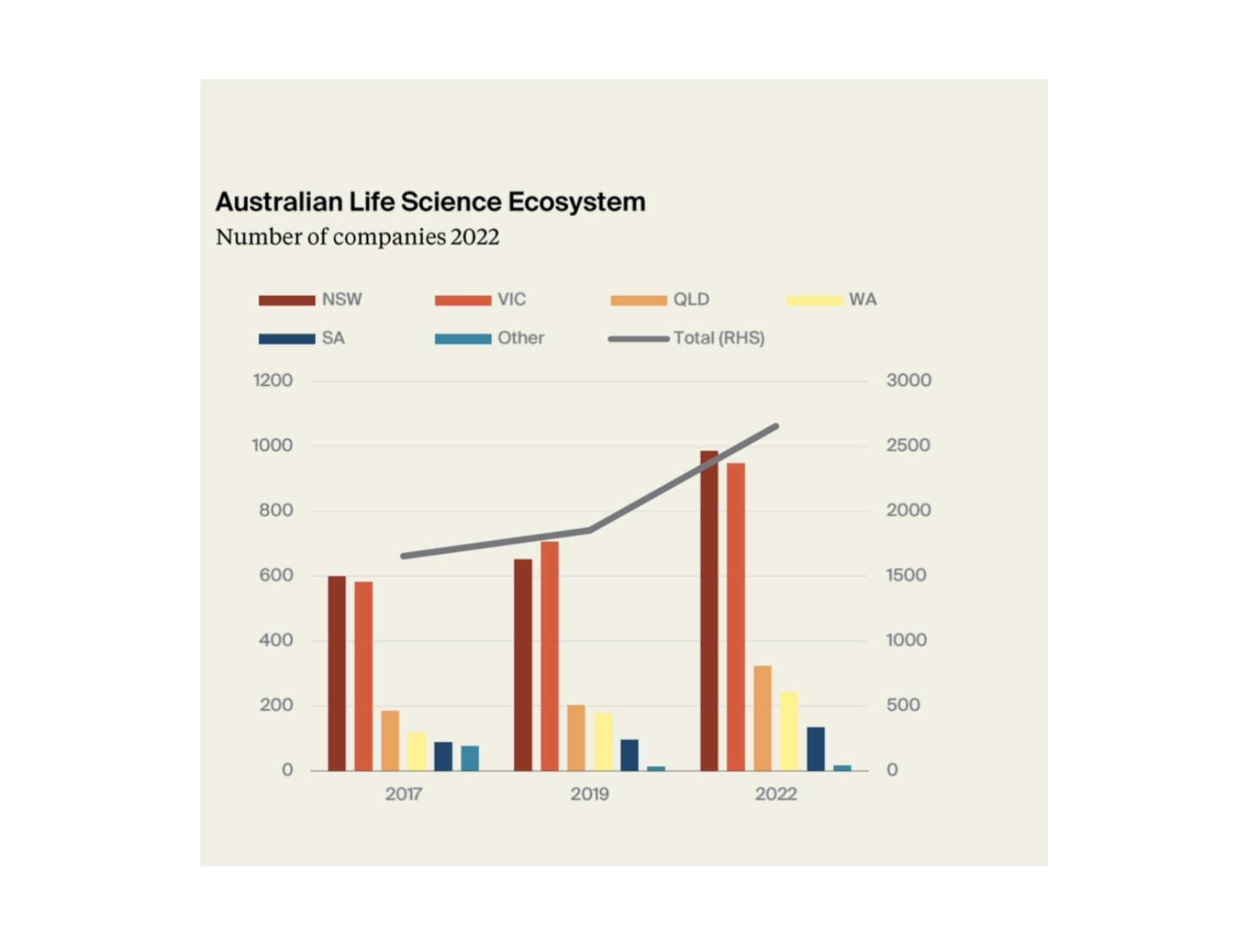

The research indicated there had been a 74 per cent increase in the life science ecosystem in Queensland over 2017 to 2022, ahead of the national growth of 60 per cent, according to a study published by AusBiotech.

Meanwhile, a recent survey of Queensland Life Sciences, undertaken in H1 2023 by Knight Frank in partnership with Life Sciences Queensland, found 25 per cent of companies surveyed started less than five years ago in Queensland.

The survey also found the state was emerging as a clear biomedical, biotech and medtech hub within the life sciences and innovation sector.

“The growth profile for the life sciences sector remains robust, but innovators in this space are forced overseas or interstate if high quality and affordable options aren’t immediately available, said Sam Biggins, Knight Frank’s National Head of Healthcare and Life Sciences.

“According to our survey the sector continues to grow, with more than half of respondents expecting to have a headcount of more than 50 personnel in five years, up from only 19 per cent at the current time.

“The average area occupied by survey respondents is also expected to more than double by 2026, which is accelerated by the expectation of around 35 per cent growth between 2022 and 2023.

“In tandem with this occupier demand we expect more real estate investment will come, with the life sciences asset class ranked fourth for capital allocation in the next 18 months behind Living Sectors, Logistics and Office, according to a recent Knight Frank poll.

“Private sector investment in built form is set to grow, initially aligned with a seed tenant or major research institution.”

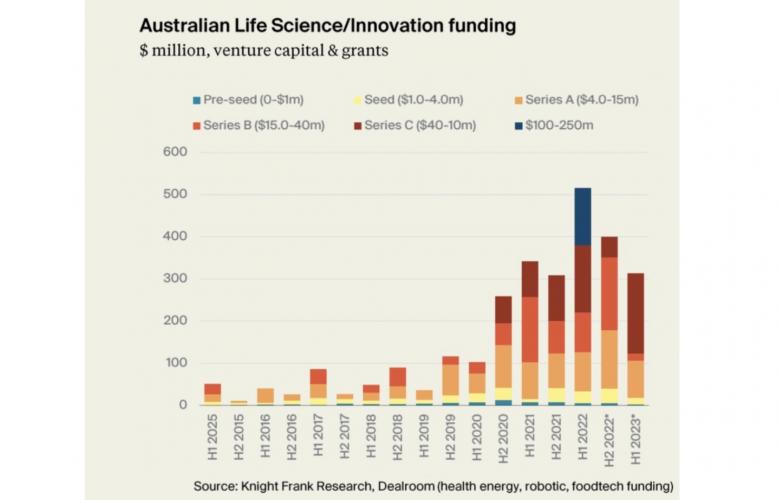

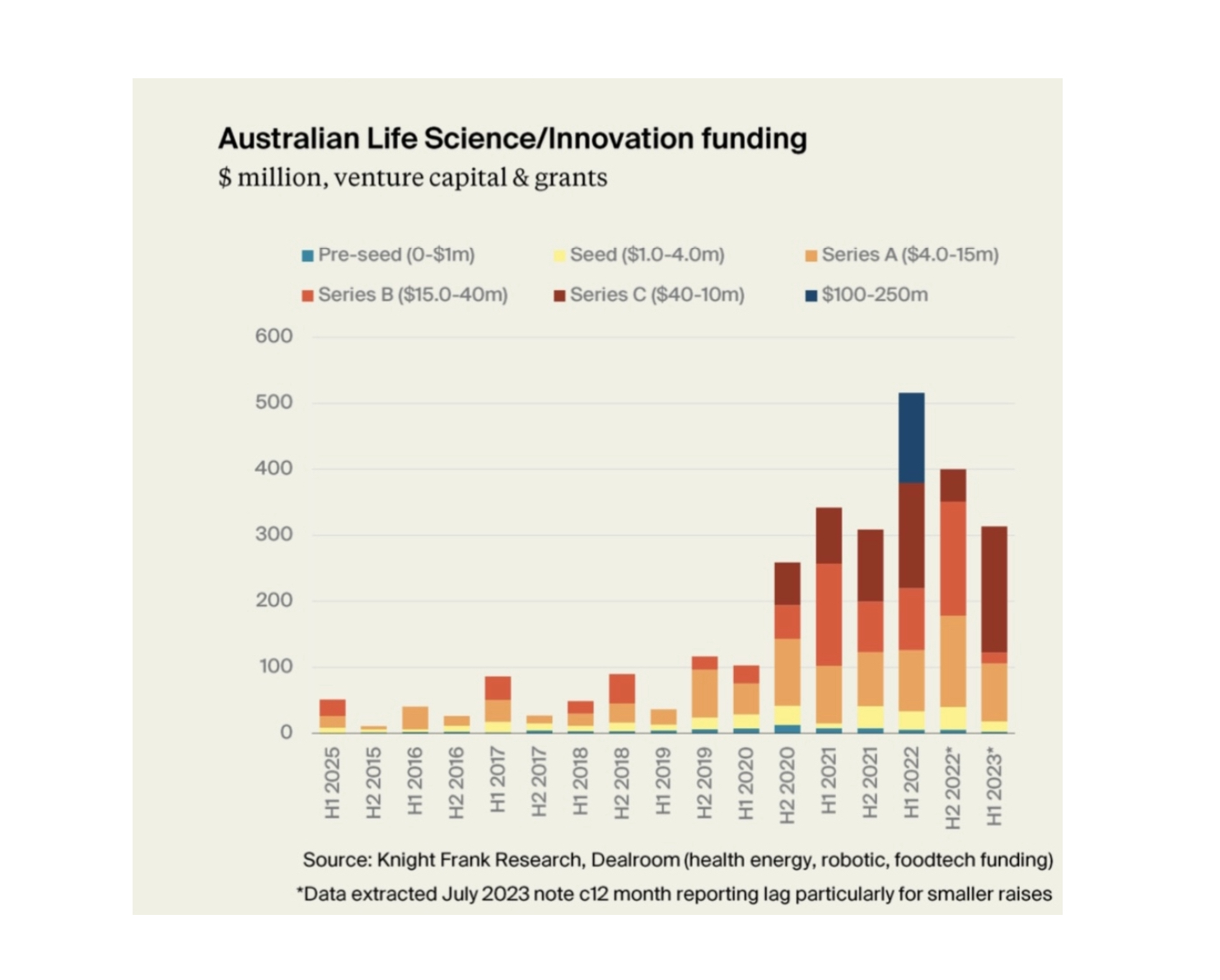

Knight Frank Partner, Research and Consulting in Queensland and report author Jennelle Wilson said both government and private sector funding into life sciences research and discovery had accelerated since 2020.

“This has facilitated the growth of research undertaken in Australia with the goal to make us less reliant on offshore supplies of essential medications and chemicals,” she said.

“Queensland is home to only 12 per cent of Australia’s life science ecosystem entities, with 26 per cent in support industries.

“This is well below the Australian average of 30 per cent, highlighting the need for more support services in the Sunshine State.

“While Australia and Queensland have long been recognised centres of innovation, the lack of venture capital funding, access to clinical trials, talent and infrastructure shortages, plus the smaller population base has seen many innovations lost overseas for commercialisation.

“However, there is an emerging keen focus on the translation of knowledge through to commercialisation and “bench to bed” initiatives.

“The Federal Government’s Medical Research Future Fund will provide up to $20 billion in long-term funding to enhance local health outcomes including the $750 million Clinical Trials Activity Initiative and the $200 million Clinical Researchers Initiative.”

The Knight Frank Life Science and Innovation report found of the entities surveyed, 78 per cent either had their sole office or headquarters based in Brisbane, while a further 16 per cent were subsidiary offices and six per cent were a satellite office of a global entity.

More than three-quarters of survey respondents indicated they were planning for space and equipment requirements more than six months ahead, with more than one third saying they needed to plan more than two years in advance,

When looking for a suitable space, life science and innovation users indicated a suitable-sized space and flexibility, with the ability to scale up on location, were key locational requirements, ranking ahead of specialised plant and equipment requirements.

“Co-location and collaboration are seen as essential accelerators, with co-location with academia with most common and sought after,” said Ms Wilson.

For more information on the Knight Frank, Life Science and Innovation report contact Sam Biggins via the below contact details: