Why childcare has been one of the country’s most resilient asset classes - CBRE

Contact

Why childcare has been one of the country’s most resilient asset classes - CBRE

What is fuelling the stability and ongoing investor interest in the childcare sector?

Australia’s Childcare sector

Australia’s childcare sector has experienced a steady rise in investor popularity over the past eight years. The asset class is now mirroring the evolution of healthcare real estate and being considered as more of a mainstream – rather than alternative – asset class. This follows a very active transaction period between 2021 and 2022, which saw the sector achieving yields as low as 4% in some parts of the country, stabilising at an average return of circa 4.75%.

Like all asset classes the childcare sector has seen some yield correction driven by a four-percentage point rise in interest rates in Australia. However, yields and transactional appetite have remained stable and highly competitive, providing an average return of circa 5.25-5.5%based on CBRE’s national sales result since May 2023.

But what is fuelling this stability and the ongoing investor interest in the asset class?

Drivers of demand

Based on CBRE’s analysis and active daily discussions with developers and investors across the industry, it has become clear that the key drivers of continued demand across the childcare sector are;

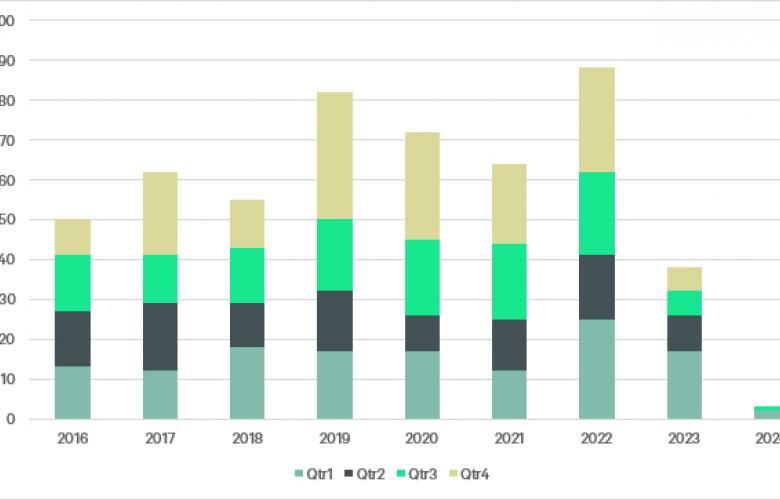

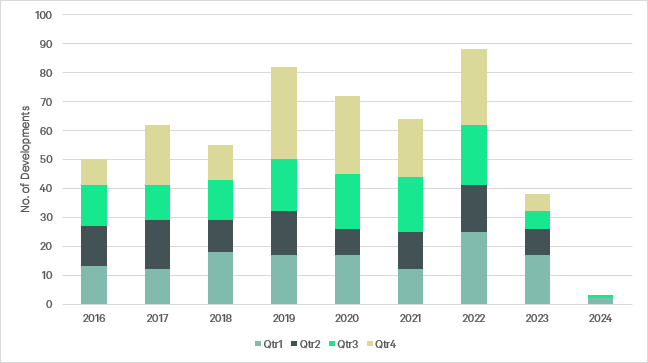

Decreasing investment opportunities / development volume

The pipeline of future childcare development opportunities is shrinking at a rapid rate. Much like many developments across the country, rising costs and land values are making many projects unfeasible until rents catch up. We are seeing this firsthand across our childcare leasing transaction volumes. While overall leasing transaction in 2023 are at record levels, the current and future supply of centres being developed and permits lodged is in decline. The graph below based on Victorian data is a real time case study of this impact.

Victorian Childcare Development Pipeline

As more investors become acutely aware of this decline, the window of investment opportunity is closing. With numerous high-quality centres marketed this year, buyers have seen this as potentially their last opportunity for several years to add a modern and long term leased asset to their portfolio. While older centres may still be marketed, these opportunities will not carry the same significant depreciation benefits that most buyers are seeking.

Sector stability and operator success

A key driver of investment into the sector Has been a consistent and increasing level of government funding to the industry, with further promised support underpinning the investor appetite for childcare centre investments.

The industry was also one of few which performed with continued strength over the course of 2019-2021 with minimal to no rent relief sought by tenants. This has helped fuel activity by existing owners to grow their portfolios.

Medium – Long-Term Investment analysis

Declining supply is leading to expectations that pricing will increase, as a result of a supply/demand imbalance, particularly if interest rates are lowered.

This is leading many short to medium term investors to purchase now with a view to potentially re-valuing their holdings in one to two years’ time as yields compress and rental increases take effect. This then allows for withdrawing equity for future investments or to realise capital growth.

Market analysis

An average market yield of 5.25%-5.5% has been derived based on Early Learning transactions by the CBRE Australian Healthcare & Social Infrastructure team.

Some notable transactions indicating the positive investor sentiment toward the asset class include the Victorian sales of 117 Kooyong Road, Armadale for $20,500,000 reflecting a yield of 4.5% and 321-323 Huntingdale Road, Chadstone, which sold for $9,000,000, reflecting a yield of 4.9%. Both sales occurred at the peak of Australia’s rate rises.

CBRE is committed to ensuring the successful transaction of childcare centres for all our clients and potential investors. To see how our team can help you achieve results in this resilient asset class, get in touch with our experienced Healthcare and Social Infrastructure team.