CBRE launch four more Victorian Childcare Centre’s for sale as The Wave of Early Learning success continues

Contact

CBRE launch four more Victorian Childcare Centre’s for sale as The Wave of Early Learning success continues

CBRE’s Australian Healthcare & Social Infrastructure business are poised to launch another notable tranche of childcare centres to the national investment market.

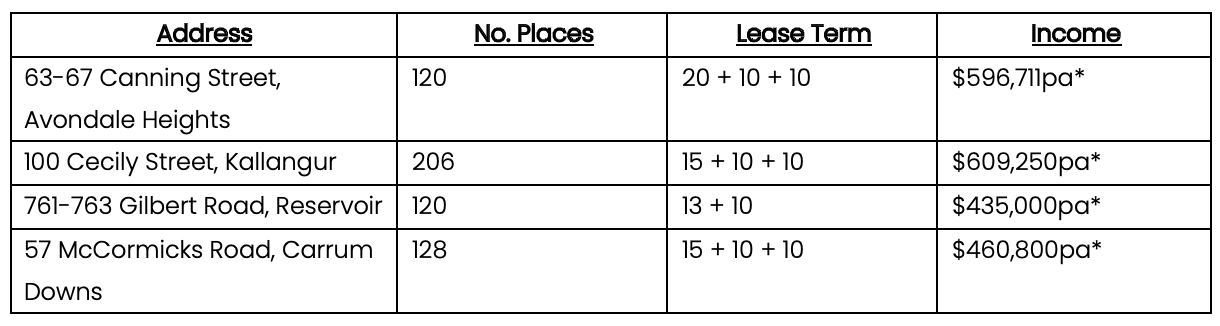

CBRE’s Australian Healthcare & Social Infrastructure business are poised to launch another notable tranche of childcare centres to the national investment market. With centres located across Victoria and Queensland the transaction is being managed by Sandro Peluso, Marcello Caspani-Muto and Jimmy Tat. All investments are being offered individually and reflect a range of varying fundamentals across a wide range of price points.

The listings continue a wave of strong momentum for the business who recently announced largest ever sale of a childcare centre in Victorian history. The Armadale childcare transacted for $20.5 million dollars and stood as a testament to the unwavering demand across the childcare and social infrastructure sectors especially from international investors.

Jimmy Tat said “With the ongoing property crisis in China, we have seen our enquiry numbers tripled over the past 12 months and a lot of it is flocking to childcare. Most of these investors have seen the childcare sectors resilience to the market downturn and have shifted their focus from traditional office and retail to what they believe and see as a more stable and secure investment to put their money. This has certainly been reflected with the last five of the seven CBRE Childcare sales, being international and local Chinese investor.”

Investors have shown a growing interest in this asset class due to its reputation for resilience and stability. The COVID-19 pandemic highlighted the crucial role these centres play in supporting working parents and caregivers, reinforcing their essential nature within the community. Consequently, the sector has attracted significant attention, with heightened interest from both institutional and private investors alike.

Sandro Peluso emphasises, “While childcare investments have traditionally appealed primarily to seasoned investors and REITs, investment across the sector has become increasingly popular, with a wider catchment of buyers. Over the past few years, buyer attention and market knowledge has increased substantially which has led a growing number of groups to turn their attention to what is fast becoming a “core” asset class.”

Furthermore, considering the escalating construction costs and limited pipeline of new developments, these listings present an enticing investment opportunity. Interested investors are invited to explore the potential for capitalizing on the stability and growth prospects”.

Marcello Caspani Muto: “We expect to receive interest from both domestic and international investment groups as many have now mandated that their portfolios include social infrastructure assets or have already created specific funds to target the sector.”

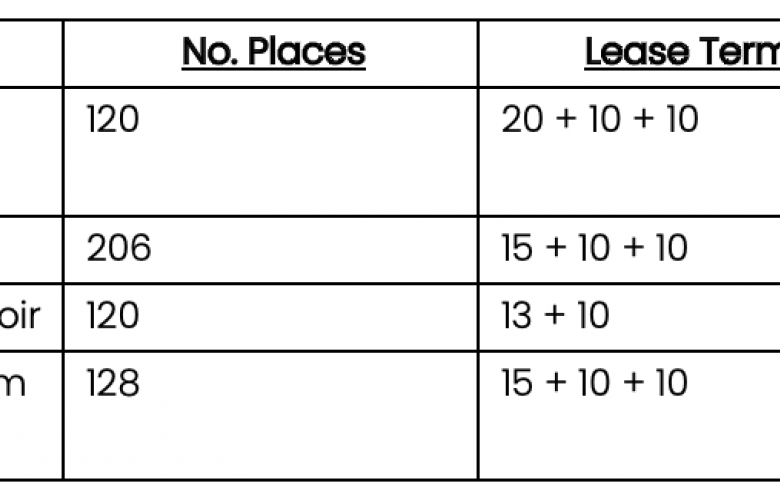

The childcare centres in Avondale Heights, Reservoir, Carrum Downs, and Kallangur (QLD) boast premium buildings that have been thoughtfully designed to cater to the unique needs of children and their caregivers. Equipped with state-of-the-art facilities and innovative learning spaces, these centres foster an environment that encourages growth, development, and a sense of security.

Moreover, these locations have experienced substantial growth and development, further enhancing the investment appeal. Avondale Heights, with its proximity to essential amenities and transport links, has seen a surge in young families seeking a tranquil suburban lifestyle without sacrificing urban convenience. Reservoir's vibrant community and excellent educational facilities make it a sought-after destination for young families looking for long-term residence options. Carrum Downs, situated in a thriving commercial precinct, provides excellent growth prospects, while Kallangur continues to flourish as a dynamic and well-connected suburb.

To request a copy of the Information Memorandum please contact one of the marketing agents via the contact details below.