Brisbane CBD rental market remains strong, with falling vacancy due to demand - Knight Frank

Contact

Brisbane CBD rental market remains strong, with falling vacancy due to demand - Knight Frank

The Brisbane CBD rental market is strong, with vacancy falling due to strong tenant demand, according to the latest research from Knight Frank.

The Brisbane CBD rental market is strong, with vacancy falling due to strong tenant demand, according to the latest research from Knight Frank.

Knight Frank Head of Office Leasing Queensland Mark McCann said tenant demand had continued to broaden in Brisbane’s CBD office market, with the market no longer reliant on the SME sector for deal volume.

“Leasing activity in now driven by the larger corporates and Government requirements,” he said.

“Top and mid-tier professional firms are increasingly locking in future premises decisions and taking advantage of the relatively greater choice on offer now than there will be in the next two years with very little new supply.

“After dominating market activity since 2019, smaller tenant activity may have peaked in the first half of 2023.

“While still an active portion of the market, the cost pressures of small business may be beginning to impact on the courage of these SMEs to commit to new leases.

“This is in complete contrast to larger businesses, where market-leading accommodation and appropriate green ratings are seen as essential parts of employee value proposition and retention.”

The Knight Frank research found that the proportion of leases to SMEs in terms of the total area leased had fallen to less than 10% this year, from 20% during 2020-2022.

It found that for 2023 to date, 30% of leasing activity by area was in tenancies of 10,000sq m-plus and a further 27% came from tenancies in the 5,000sq m to 10,000sq m range. This is representative of more widespread decision making from tenants of scale and greater pre-commitment activity.

Boosted by pre-commitment activity, the Professional, Scientific and Technical tenants accounted for 35% of recent leasing activity. The combined Government/Public Administration sector was 23%, with the State Government particularly active with 18%.

Knight Frank Partner, Research and Consulting Queensland Jennelle Wilson said underlying demand for the Brisbane CBD was forecast to remain sound through the medium term, and with little supply coming online, this would translate into further falls in the vacancy rate.

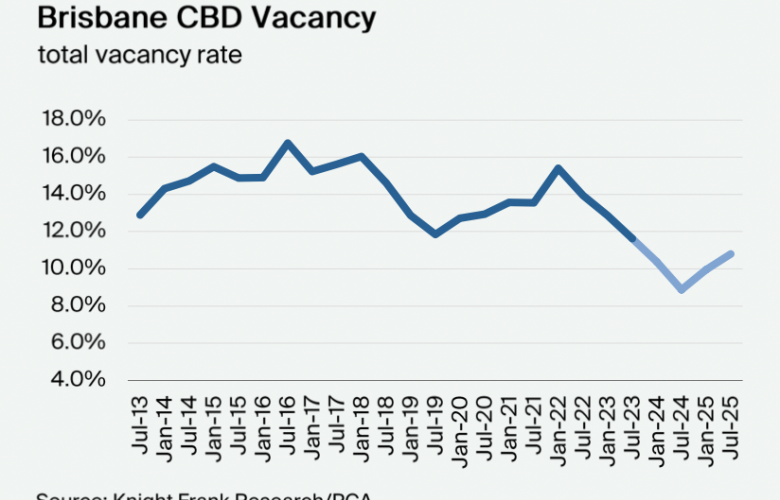

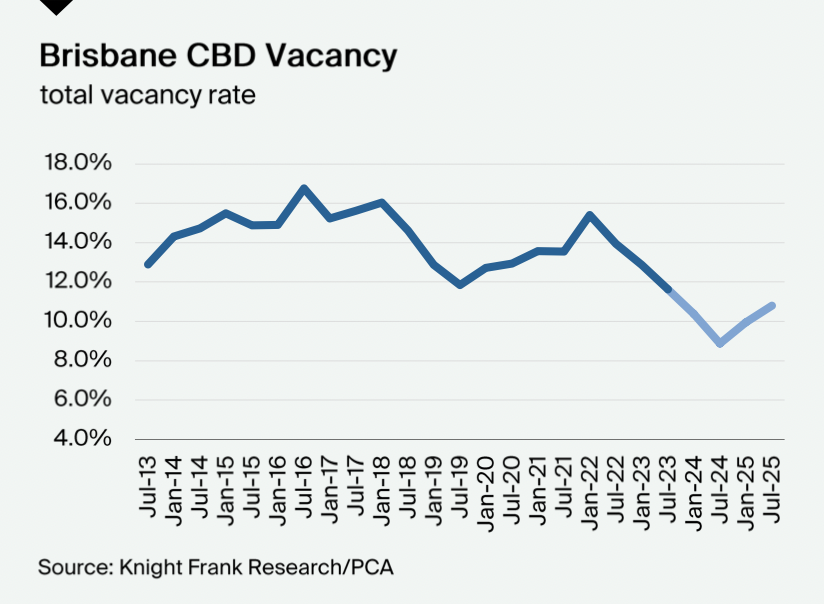

“Sustained demand and no new supply over the first half of 2023 has seen the vacancy rate fall from a recent peak of 15.4% in January 2022 to 11.6% in July,” she said.

“We expect the vacancy rate to dip to 8.9% by July 2024 before increasing again due to new supply from late 2024 in 2025.

“The expected lack of new supply during 2026 and 2027 will assist the vacancy to fall below 10% again and mid-term it will stabilise between 8.7% and 9.5%.”

The Knight Frank report found there are two new CBD assets under construction for delivery in late 2024 and mid 2025, and additional options for 2027-plus were emerging.

Knight Frank’s Brisbane CBD Office Market Report October 2023 found net absorption in the Brisbane CBD office market had remained elevated at 71,000sq m over the 12 months to July 2023, at 2.5 times the 20-year average and well ahead of the major southern cities.

Ms Wilson said that while net absorption would remain positive, the slowing economy and greater focus on costs would likely moderate demand moving forward, with the potential for corporate downsizing, which to date there had been little of in the Brisbane CBD.

She said the pace of economic growth nationally has slowed as the cash rate nears the peak level, but economic growth was forecast to remain resilient for Queensland with GSP growth of 3.2% in FY24 to be followed by 3.3% and 3.4% in the following years, according to Oxford.

Queensland employment growth has also been strong with 55,270 jobs created in the past 12 months and unemployment remaining tight at 4.1%, while the state had also recorded 2.3% annual population growth to Q1 2023, ahead of the national average of 2.2%.

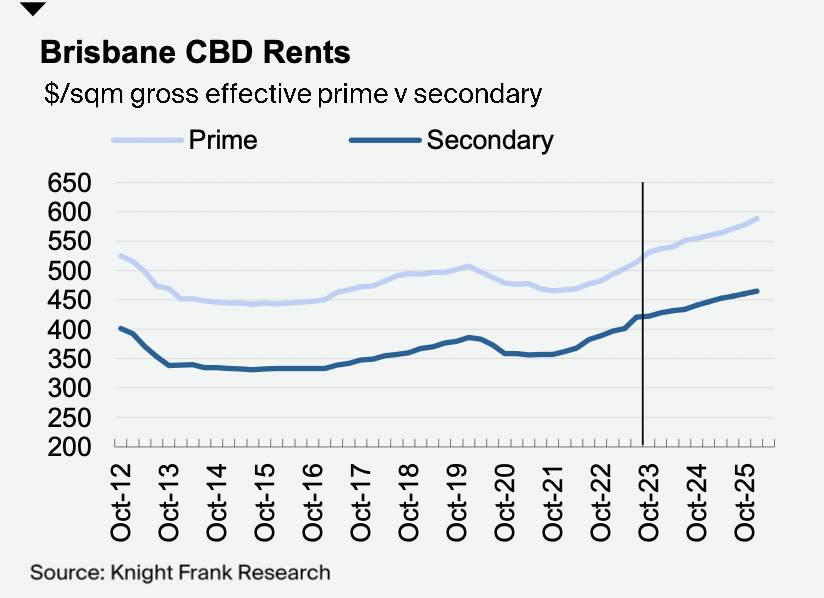

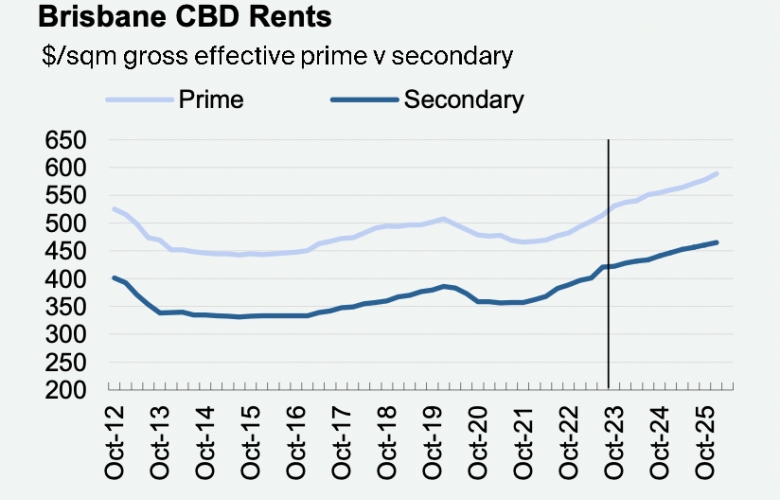

The Knight Frank research found that with the premium market clearly the tightest, with vacancy of just 4.4%, there was strong prime face rent growth of 7.3% over the 12 months to October 2023, with quality assets facing no push back from tenants on face rent increases.

Prime gross face rents grew to $885/sq m with incentives slightly lower at 40%, although still covering the tenant’s capital expenses.

There was 10 per cent effective rental growth for the prime market; the highest level of growth for some time.

The report predicted face rents would grow strongly for the rest of 2023 before slowing into 2024 as companies take a more conservative approach.

Prime gross face rents will increase 2.8% to October 2024 and a further 4.2% to October 2025.

Longer term momentum remains upbeat, with a forecast average uplift of gross face rents of 4.8% per annum over the coming five years. Incentives will tighten further but will stabilise at 38.5% to 40% over the next five years.

Meanwhile, sustained secondary demand has rewarded the refurbishment investment from owners and has continued to push gross face rents higher, rising by 8.6% over the year to October 2023 to reach $722/sq m. incentives are stable at 41.5% and are expected to remain a central part of the secondary market.

Secondary face rental growth will remain elevated through the remainder of 2023, but is close to reaching an affordability ceiling for increasingly conservative SMEs. Growth will moderate in early 2024 to the more normal range of 2.8% to 3.5% per annum over the next five years.