How depreciation can boost a farmer's cash flow

Contact

How depreciation can boost a farmer's cash flow

Price variation, market conditions, operational costs and extreme weather can all affect a farmer’s bottom line.

Commercial farming is rewarding but tough.

Of all commercial agricultural sectors, dairy farming is particularly challenging.

According to a CommBank Agri Insights report published in August 2018, growing operational costs and tightening market prices are putting pressure on Australian dairy farmers.

When looking at the cost of farming operations, 87 per cent of dairy farmers said the impact of rising costs was moderate or significant.

Given the current outlook, it’s important for dairy farmers to plan ahead in order to avoid financial hardship.

Claiming property depreciation deductions each financial year is a good way to do this.

Depreciation is a tax deduction for the gradual wear and tear of a building and the fixtures and fittings within it.

Visit BMT’s tax depreciation calculator for an estimate of the deductions you may be entitled to.

It’s often missed because it’s considered to be a non-cash deduction, meaning a farmer doesn’t need to spend money in order to be eligible to claim it.

The Australian Taxation Office governs legislation that allows owners of any income-producing property to claim depreciation each financial year.

Given the arduous nature of farming, there are accelerated depreciation rates available to producers, as well as specific rules for operations which classify as small to medium businesses.

Depreciation deductions can help boost a farmer’s cash flow and alleviate the pressure of farming during an unforgiving season.

Commercial case study

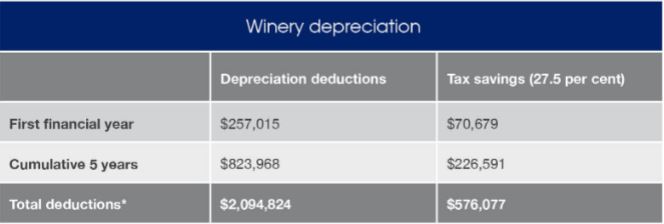

Let’s take a look at the typical depreciation deductions available to an owner of a dairy farm purchased for $1,450,000. The farm features assets like dairy yards, generators, fences, milking systems and milking sheds.

The following table highlights the first full year and total five year depreciation deductions available.

In the first full financial year, an owner of a dairy farm in this price range can claim between $71,000 and $97,100 in depreciation deductions. Over the first five cumulative years, they could claim between $275,000 and $376,000. By claiming depreciation, a farmer can reduce their taxable income by hundreds of thousands of dollars and boost their cash flow.

If you would like to learn how much you could claim from your agribusiness, simply Request a Quote or speak with one of our expert staff on 1300 728 726 today.

To learn more about BMT’s commercial capabilities, visit bmtqs.com.au/commercial-capability

This is a sponsored article.

Similar to this:

Five things to know about depreciation this tax time

Scrapping can boost a hotel’s cash flow - BMT Tax Depreciation

BMT still finding an average of $8,893 in depreciation deductions