Frasers Property Australia tops GRESB global rankings again

Contact

Frasers Property Australia tops GRESB global rankings again

Frasers Property Australia has been acknowledged as Global Sector Leader in two categories in the GRESB rankings.

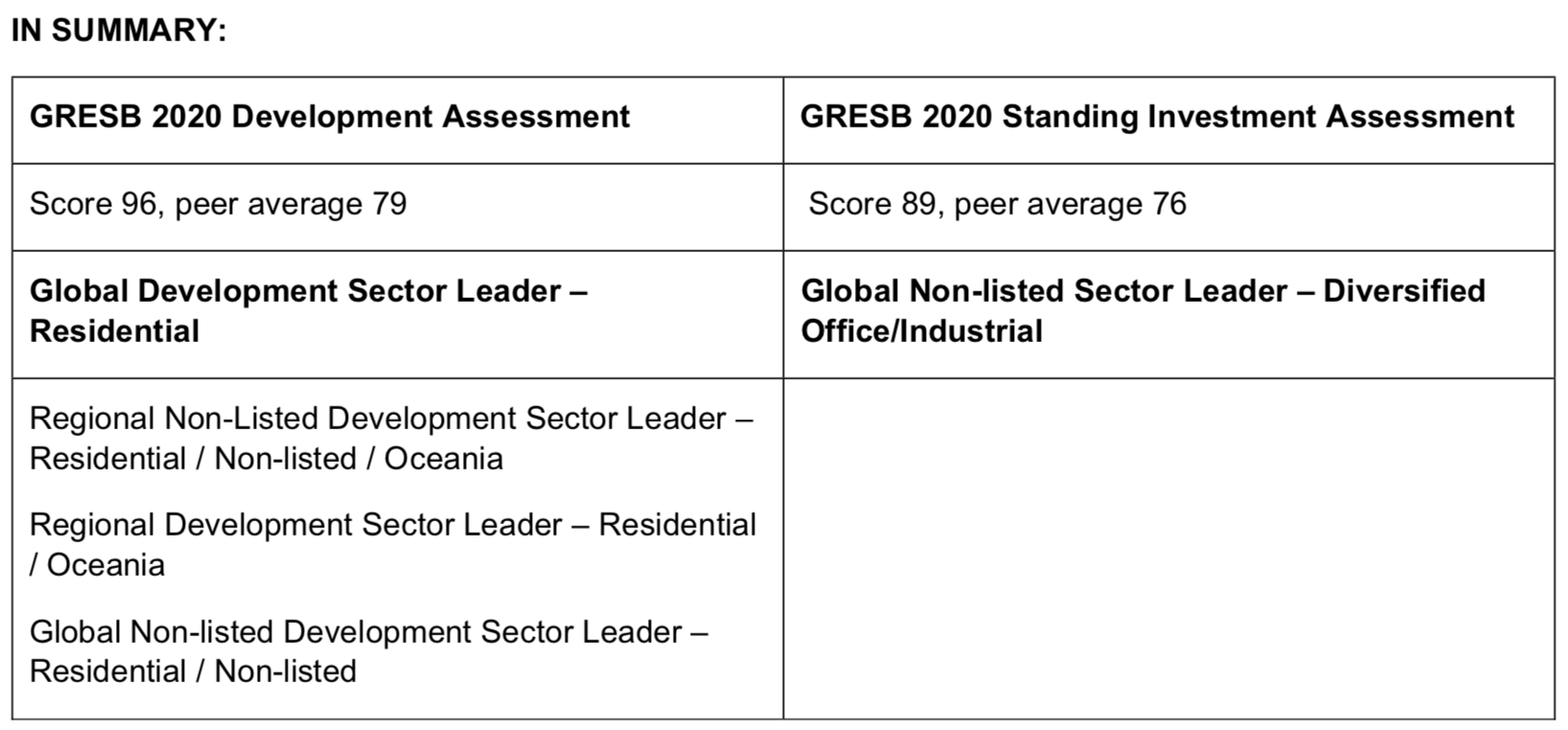

Frasers Property Australia has been acknowledged as Global Sector Leader in two categories in the GRESB rankings unveiled today, being named the Global Development Sector Leader – Residential (including Frasers Property Industrial development activities) and the Global Non-listed Sector Leader – Diversified Office/Industrial, in combination with Frasers Property Industrial.

It is the ninth consecutive year Frasers Property Australia has competed with a growing international field of real estate companies in these categories and the second year it has won Global Leadership categories.

In the 2020 GRESB Real Estate Assessment released today, Frasers Property scored 96 out of 100 in the Development Assessment compared to a peer average score of 79, and 89 out of 100 in the Standing Investment Assessment compared to a peer average score of 76.

Anthony Boyd, Chief Executive Officer, Frasers Property Australia says the GRESB rankings are a reflection of the company’s consideration of environmental, social and financial sustainability in all operational and management facets of its business.

“We are very proud to maintain our international leadership status and we have achieved these meaningful project and asset outcomes because sustainability is embedded across our entire business,” Mr Boyd says.

“In addition to our existing projects and achievements to date, our future plans include targeting carbon neutral for the commercial elements of Central Place Sydney and aspiring to deliver the world’s most sustainable shopping centre and first Living Building Challenge® certified retail development at Burwood Brickworks in Melbourne. These examples are not isolated; more and more, these ambitions are part of our broader business strategy at Frasers Property Australia,” he says.

The GRESB Sector Leader Awards Program recognises real estate and infrastructure companies, funds and assets that have demonstrated outstanding leadership in sustainability.

GRESB Assessment Restructuring

In December 2019, GRESB shared long-standing plans to restructure the GRESB Real Estate Assessments with the intention to provide a more consistent approach between Real Estate and Infrastructure Assessments and to improve alignment with other reporting standards and frameworks.

The 2020 restructuring included the introduction of separate Management, Performance, and Development Components for the Real Estate Assessment. In additional to the structural changes, the number of indicators was reduced, and several indicators were simplified.

Importantly, GRESB made it mandatory to report aspects of the Performance Component at the asset level. The data validation and scoring methodology were also adapted to fit asset level reporting. Although challenging for many participants, asset-level data reporting sets the stage for increased granularity in data analytics – including the ability to investigate physical and transitional climate risks, advanced property type benchmarking, standardisation of performance metrics across geographies and property types, and stronger validation quality controls for the reported data.

As a result, the 2020 GRESB Assessment structure fundamentally changed, establish a new baseline for measuring Performance. The split between Management and Performance Components brings a stronger focus on consistent data collection and reporting. GRESB advises against a direct comparison between 2020 GRESB Scores and prior year results. Changes to the 2020 Assessment produced inconsistent impacts to scoring regardless of geographic region, property type or investment strategy.

Simialr to this:

Frasers Property Industrial and ESR Australia complete Nissan head office in Victoria

Frasers strengthens its Berrinba industrial estate with 6.7ha land purchase

How fashion retailers are changing their physical footprint - JLL report