Lingering issues for secondary office markets in Perth, Brisbane, Adelaide and Canberra: report

Contact

Lingering issues for secondary office markets in Perth, Brisbane, Adelaide and Canberra: report

Improvements in prime office vacancy rates have masked an underlying issue in many of Australia’s major CBD markets, says CBRE

The secondary office markets in the Perth, Brisbane, Adelaide, and Canberra CBDs are suffering from high levels of vacancy, and have recorded zero or negative net effective rental growth over recent years, a new report has found.

The latest CBRE Viewpoint report reveals that secondary markets in Sydney and Melbourne have performed well because of strong economic fundamentals, low vacancy rates and increased demand for office space in conjunction with strong white-collar employment growth,

But CBRE Senior Research analyst, Aiden Bresolin said it was a different story in Perth, Brisbane, Adelaide, and Canberra.

"Some secondary buildings in these locations are now virtually untenable or have a high vacancy of 40 per cent+ and require extensive refurbishment to be brought up to a modern standard," he said.

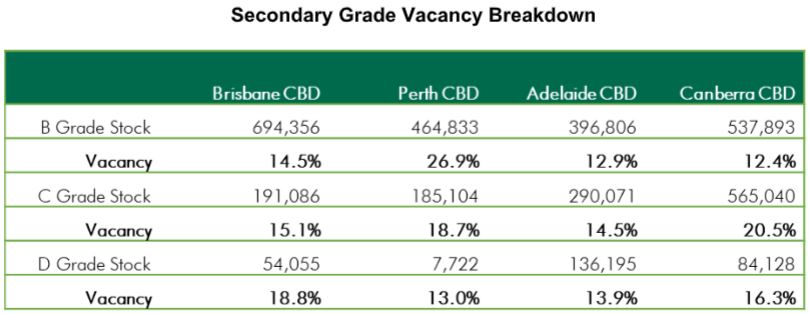

Secondary grade is a broad term for B, C, and D grade office buildings.

Typically, these assets are characterised by smaller floorplates than their prime counterparts, lower energy efficiency and ageing design causing staff retention issues when combined with location and lack of amenities

Markets across Australia differ in the proportion of prime to secondary stock.

For instance, Adelaide has the highest proportion of secondary stock to prime; however, in terms of total secondary stock, Canberra has over 1.2 million sqm, which is almost greater than Adelaide CBD’s total supply of office space.

Source: CBRE

In terms of historical trends, the spread between prime and secondary office vacancy has reached a near-record high in both Perth and Canberra, indicating tough conditions in secondary markets.

CBRE’s report highlights various “strategies that owners can adopt, including refurbishing secondary buildings or repositioning them to an alternative use such as residential apartments or hotel", although Mr Bresolin noted that the lull in residential markets had made the latter a less desirable option at present.

“B grade office stock remains popular amongst investors because these buildings have a lower price point, are higher yielding and often have value add potential through refurbishment, whereas C and D grade assets present more of a challenge and higher risk, with attributes that make them difficult to modernise to meet the requirements of today’s tenants,” he said.

“Redevelopment of these assets seems inevitable but can only occur when financially viable and the waiting game might be the best solution.”

Click here to download a copy of the report.

Similar to this:

Adelaide office market to deliver superior returns - CBRE

Sydney and Melbourne leading two-speed office economy, says LJ Hooker