Low vacancy/rents to drive Sydney and Melbourne office growth in 2020 - m3property

Contact

Low vacancy/rents to drive Sydney and Melbourne office growth in 2020 - m3property

Continued downward pressure on vacancy and concomitant rental growth will drive the Sydney and Melbourne office markets into the new year, according to a new forecast from m3property.

New research from m3property has forecast further falls in vacancy for the Sydney and Melbourne office markets in 2020 with investment from off-shore players tipped to play a key role in placing downward pressure on yields.

Vacancy levels are at near-record lows in both of the markets, due to improving demand coming from techs, co-working, and project/finance sector tenants.

m3property’s National Office Director Andrew Duguid said Sydney was expected to have a fairly tight market across the next couple of years, while Melbourne was in a similar situation.

At a glance:

- m3property has forecast further falls in vacancy for the Sydney and Melbourne office markets in 2020.

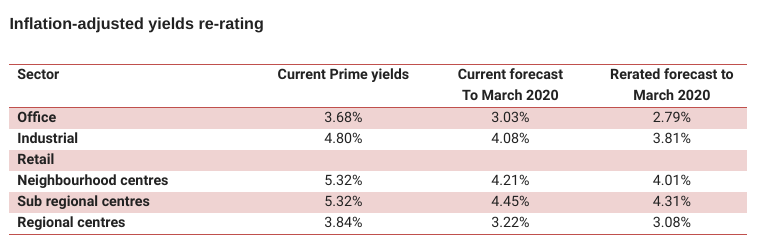

- In the Commercial Property Yield Re-rating white paper, released in August, the property company predicted a re-rating of yields, which it says the market now reflects.

- m3property has also predicted a further compression of yields in 2020.

"In 2020 we will see vacancy fall further in Sydney due to the limited delivery of new space (late 2020 and beyond) and the fact that much of it is pre-committed," he said.

"High levels of new supply will be delivered in Melbourne but much of this is pre-committed.

"Demand will drive rental growth of 6 per cent in Sydney and 6 per cent in Melbourne."

Source: m3property

Mr Duguid said the market had supported m3property’s view expressed in the Commercial Property Yield Re-rating white paper released in August which predicted a re-rating of yields.

"We forecast a view earlier this year that yields would see further compression," he said.

"That view has been borne out, particularly in the office sector, and it seems likely yields will continue to tighten into 2020."

The paper suggested that while yields appeared to have reached their peak, the low weighted average cost of capital, driven by debt of currently around 3 per cent, and the comparatively more attractive commercial property yields to other asset classes still on offer, had the potential to drive a re-rating.

Similar to this:

m3property lands highly regarded CEO

Commercial property yields a bright light in gloomy investment horizon, according to m3property

The importance of maintaining the public space of residential buildings and commercial businesses