Retail sector to be a key focus for investors in 2020 - JLL

Contact

Retail sector to be a key focus for investors in 2020 - JLL

JLL has released its Australian Shopping Centre Investment Review and Outlook 2020, predicting increased activity from offshore investors, syndicators and opportunistic property funds management groups on the buy side, as major institutions selectively divest.

The divestment of assets from institutional owners and the emergence of new capital sources could characterise Australia's retail landscape in 2020, JLL says.

According to the firm’s annual Australian Shopping Centre Investment Review and Outlook 2020, the retail sector will be a key focus for investors seeking to take advantage of the more attractive pricing and depth of opportunities available.

JLL Joint Head of Australian Retail Investments, Jacob Swan, said institutional owners with large existing retail portfolios continued to revise their investment strategies and were likely to selectively divest assets in 2020.

“While retail investment volumes were light in the first half of 2019 ($1.8 billion), we saw a real change in momentum in the back half of the year ($4.5 billion) which saw 2H activity rise to the levels seen over the last five years," he said.

“REITs are transitioning from a long term historical strategy of accumulating retail assets to a more selective approach to portfolio construction.

“There is also likely to be a growing shift towards the re-classification of sub-sectors (such as regional and sub-regional) which may have implications for valuations, performance benchmarks and the pricing of risk by investors."

Deep pool of capital remains in 2020

Joint Head of Australian Retail Investments, Sam Hatcher, said a range of dynamic new capital sources were emerging to absorb institutionally-owned assets, driven by the opportunistic timing, attractive yields relative to core office/industrial and the longer-term potential for re-development and re-positioning.

“A fragmentation of ownership will continue to occur in the retail sector as major owners become more selective towards the assets they retain in their portfolios and as new players build scale in the sector," he said.

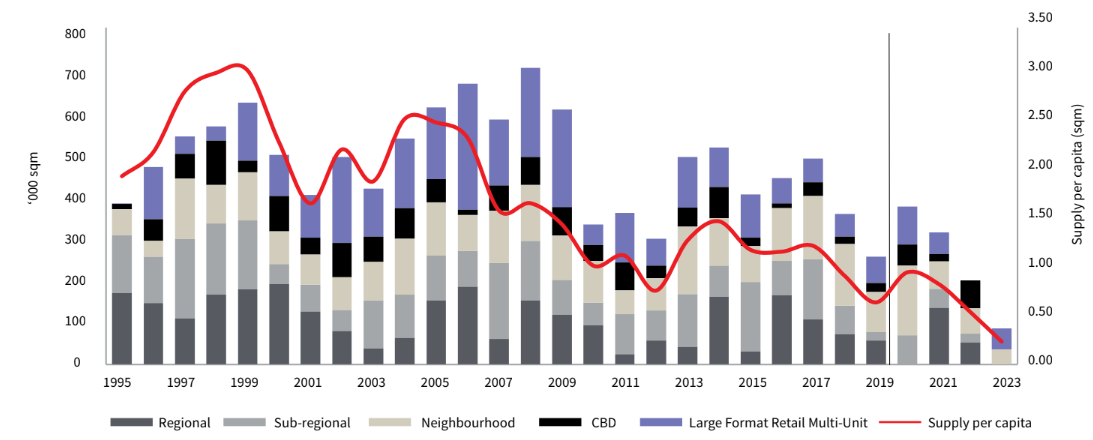

Shopping centre completions by sub-sector. Source: JLL

“Properties with strong underlying land value and long term future development potential are highly sought by investors."

Mr Hatcher said while there had been less liquidity for larger centres, there was a consistently deep pool of capital for non-discretionary anchored centres and single-tenant retail assets.

“Freestanding supermarkets and Bunnings Warehouses with strong covenants and long leases have continued to attract investor interest," he said.

“In addition, retail assets in metropolitan areas with development potential remain highly sought after."

He added private investors were expected to be active in 2020.

“The fact that private investors were net buyers in 2019, for the first time after six consecutive years as net sellers, is significant," he said.

"Private Investors were net buyers in 2008, 2009 and 2010 when asset pricing was attractive.

“Private capital is opportunistic and is acquiring assets to take advantage of the depth of opportunities available.

"Demand is also strong for core retail assets, particularly for neighbourhood shopping centres in metropolitan locations and for single-tenanted retail assets with long leases."

Click here to download the report.

Similar to this:

Brisbane and Perth buck national office downturn to finish 2019 on a high: report

Melbourne remains tightest CBD office market in the country- JLL

The sleeping giant disrupting Melbourne’s office space market