Neighbourhood centres demonstrating resilience in 'challenging' retail landscape - Savills

Contact

Neighbourhood centres demonstrating resilience in 'challenging' retail landscape - Savills

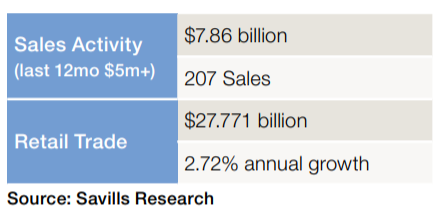

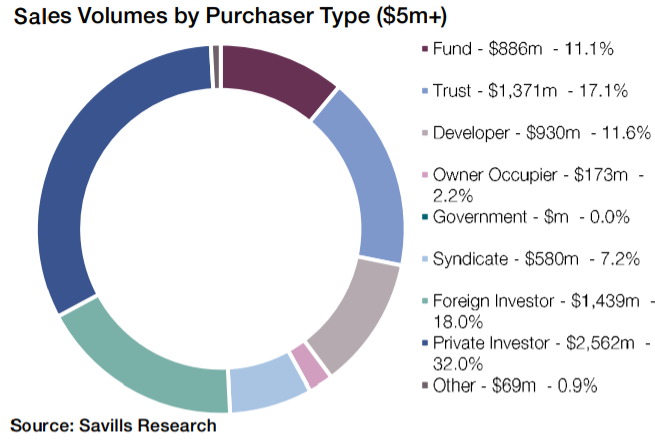

Savills Retail Market Quarter Time Q4 2019 report has revealed that while the landscape in Australia remains challenging, there had been an emergence of private investors and syndicates targeting neighbourhood shopping centres.

Growing activity from private investors and syndicates has helped Australia's retail sector navigate a challenging 12 months, according to Savills.

The firm's Retail Market Quarter Time Q4 2019 report has indicated that while easing monetary conditions are still not positively impacting and consumer and business sentiment, retail assets exposed to non-discretionary spending, particularly Neighbourhood centres "continue to demonstrate resilience" in the challenging retail landscape.

Savills Head of Research Phil Montgomerie said there was evidence to suggest the benign economic environment was creating opportunities.

"We have not seen evidence of shopping centres being sold due to financial stress, indeed we have seen an emergence of the private investor and syndicates taking advantage of sellers having differing financial objectives and returns expectations," he said.

Savills Retail Market Quarter Time Q4 2019 report - At a glance:

- Easing monetary conditions are still not positively impacting and promoting consumer and hence business sentiment.

- Retail assets exposed to non-discretionary spending, particularly Neighbourhood centres continue to demonstrate resilience in the challenging retail landscape.

- Private and Syndicate investors continue to actively buy centres, taking advantage of favourable lending conditions and perhaps displaying first mover advantage as asset prices meet revised investment return objectives.

"As such, price discipline is being observed and where appropriate, assets are being taken off the market and alternative redevelopment plans are being determined.

"Two REITs that were sellers through 2019, decided to do such after not being able to achieve their desired sale outcomes.

"Neighbourhood centres (especially those with higher exposures to non-discretionary spending and day-today living consumerism) are still a focus by Private Investor and Syndicates as they apply differing investment objectives."

Among the Super-Regional shopping centres to transacted in the December quarter trading at reasonable yields were 50 per cent of Westfield Marion which was sold by Lendlease at 5.5 per cent (buyer Singapore’s SPH REIT), and 50 per cent of AMP’s Booragoon, Perth including management and development rights at 4.75 per cent to Scentre Group.

A 50 per cent share in Westfield Marion (pictured) was sold Lendlease at 5.5 per cent yield. Source: JLL.

Mr Montgomerie said both centres had reasonable exposure to discretionary spending via fashion, yet both transacted at "stable levels".

According to the report, annual retail returns (MSCI December 2019) were relatively muted with +2.0 per cent total return, with an income return of +5.1 per cent, while capital growth was -3.0 per cent.

New South Wales and Victoria continue to be the drivers for retail nationally, (reflecting population densification, enhanced by immigration and state GDP), producing a total return of 4.0 per cent and 4.7 per cent respectively.

WA and Queensland reported -4.3 per cent and -2.1 per cent respectively, with meaningful falls in capital growth of -9.2 per cent and -6.9 per cent as weaker centres and country locations struggled.

Looking ahead, Mr Montgomerie said while economic conditions may continue to be challenging and retailers will consolidate and rationalise their footprints, “adaptive retail” would remain a focal point for the consumers’ dollar.

"Centres with exposure to densification, rising socio-economic conditions, access to mixed-use amenities such as apartments, offices, transport hubs and of course scarcity will continue to retain value and investors will continue to seek them out," he said.

"Some tenants will require an ongoing redevelopment schedule to continually attract the consumer spend."

Click here to download the full report.

Similar to this:

Strong interest in Woolworths assets expected as confidence in sector continues to rise - JLL

Charter Hall REIT shopping centre in WA sold for $16.1 million