Ongoing demand expected for office assets in 2020 - Savills

Contact

Ongoing demand expected for office assets in 2020 - Savills

Savills' Quarter Time Office Q4 2019 Report has revealed Australia's office sector beat out retail and industrial to be the preferred asset type for investors in 2019.

A national yield compression cycle is expected to continue for Australia's office sector as "firm" demand is supported by limited supply, Savills Australia says.

The firm has released its Quarter Time National Office Q4 2019, providing a summary of the highlights for the sector while also looking ahead to the likely investment trends of the coming months.

According to the report, offices was the preferred asset for investment in 2019 with returns in the 12 months to December 2019 being recorded at 11.5 per cent (latest available MSCI data), followed by industrial at 11.3 per cent and retail at 2 per cent.

Savills Quarter Time Q4 2019 Office Report - At a glance:

- Savills expect that further cap rate compression can occur in Office (from both a capital and income growth perspective) as global interest rates remain low for longer.

- Savills tracked $24.91 billion of office transactions (>$5 million) over the 12 months to December 2019, with 52 assets greater than $100 million transacting (totalling $19 billion), demonstrating investor demand for high lease covenant quality office assets.

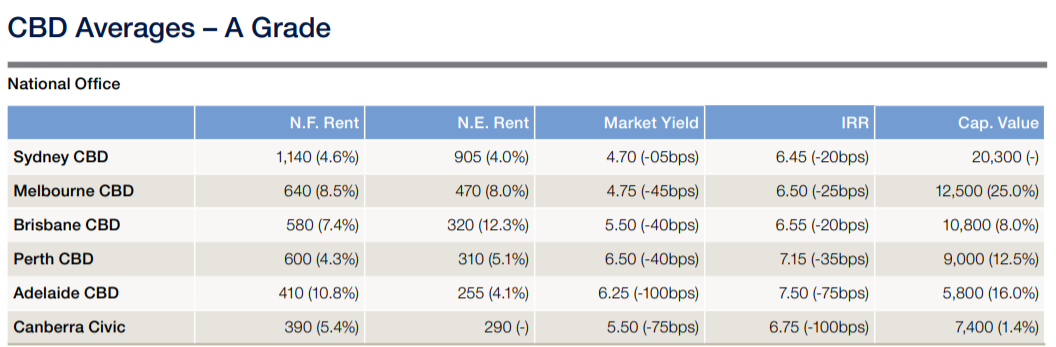

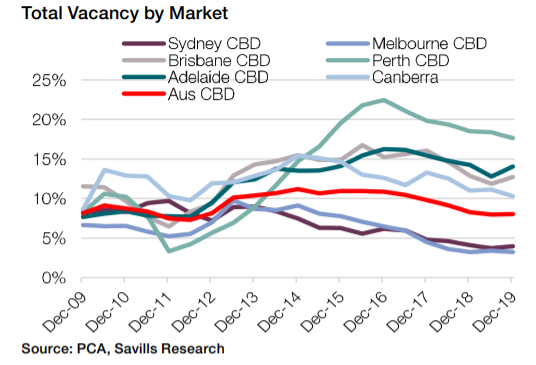

- Vacancy rates trended downwards throughout 2019 across all CBD’s, with Sydney and Melbourne sitting well below the Australian CBD average.

- NSW, Victoria and Queensland are the main destinations of capital.

Research data also suggests vacancy rates trended downwards throughout 2019 across all CBD’s, with Sydney and Melbourne sitting well

below the Australian CBD average.

Savills Head of Research Phil Montgomerie said while Sydney and Melbourne CBD markets were the preferred locations for capital, there was growing interest in North Sydney and Parramatta markets as Sydney tenants looked to diversify their locations and move office functions back out of the CBD.

"Melbourne was again the best performing CBD giving a total return of 13.3 per cent," he said.

Source: Savills

"Returns in Parramatta have fallen drastically over the last 12 months, with total returns now stabilizing at 9.7 per cent (down from highs of 20 per cent earlier in the year) which has been driven by falls in capital returns now at 4.0 per cent (down from 13.5 per in March 2019).

"We attribute this to these asset prices stabilising and returning to more sustainable capital growth levels."

The report indicates global investors were very active in the office market in 2019, accounting for 28 data or $7 billion of all transactions (over $5 million).

Mr Montgomerie said overseas buyers were expected to increase their profile in 2020, supported by relatively higher asset yields, low cost of debt and a near low Australian exchange rate.

"With office assets demonstrating a superior yield margin of around 4 per cent, whilst also providing income and capital growth outcomes, we expect to see ongoing demand for this asset class from domestic and foreign investors," he said.

"There are growing calls for greater government intervention via infrastructure spending into regional and metropolitan areas to stimulate the economy, as well as personal income tax cuts reform to encourage spending.

"The unintended consequence of the resulting low for longer interest rate environment is that investors (domestic and international) are aggressively chasing income-producing assets, particularly property assets with strong lease covenants, long WALE and low maintenance capex requirements meaning demand for quality A grade and Premium assets is high."

Click here to download a copy of the report.

Similar to this:

Iconic Teneriffe building for sale

South Australian commercial market set to continue momentum from record-breaking year