Surge in Sydney office incentives 'pushing down' effective rents - Cushman & Wakefield

Contact

Surge in Sydney office incentives 'pushing down' effective rents - Cushman & Wakefield

New research from Cushman & Wakefield has shown gross effective rents across the Sydney, Melbourne and Brisbane CBD office markets fell during the June quarter as landlords adjusted their expectations amid the COVID-19 lockdown period.

The COVID-19 lockdown has prompted a jump in office incentives across east coast CBD locations, bringing down effective rents, a new report has found.

Cushman & Wakefield’s quarterly Office Marketbeat indicates while face rents in the major east coast CBD office locations remained steady during the quarter, incentives have risen with Sydney recording the most significant increase.

During the quarter, Sydney CBD prime gross effective rents fell 8.6 per cent from $1,075 per sqm to $984 per sqm, with the average incentive rising from 21 per cent to 27 per cent quarter-on-quarter.

At a glance:

- Cushman & Wakefield’s quarterly Office Marketbeat has indicated gross effective rents across the Sydney, Melbourne and Brisbane CBD office markets have fallen during the June quarter as landlords adjusted their expectations amid the COVID-19 lockdown period.

- Sydney CBD prime gross effective rents fell 8.6 per cent from $1,075 per sqm to $984 per sqm, with the average incentive rising from 21 per cent to 27 per cent quarter-on-quarter.

- Incentives in Melbourne are now around 27 per cent higher than a year ago, as a large supply of new stock, as well as the softer leasing environment, put upward pressure on incentives.

Cushman & Wakefield also reports an almost 400 per cent month-on-month increase in leasing inquiries during June, following a softer period for the city's leasing market during April and May.

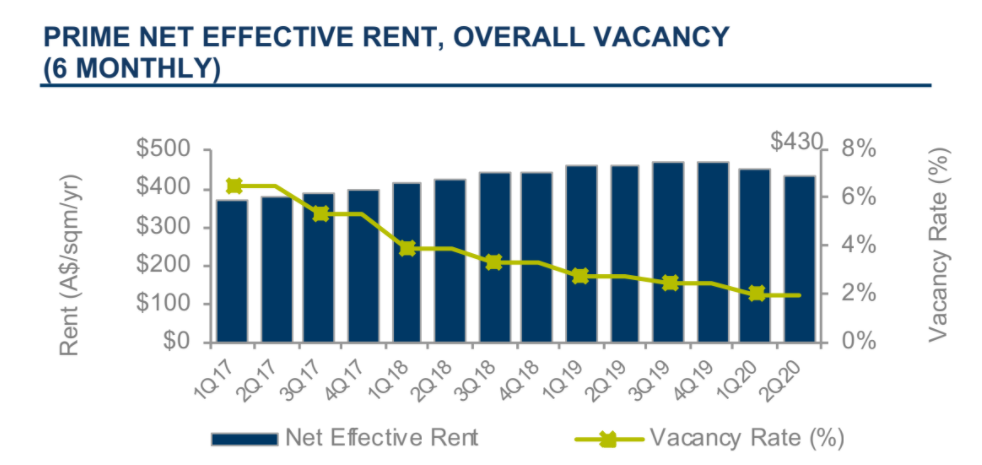

In the Melbourne CBD office market, prime net effective rents fell 5.4 per cent from $454 to $430 per sqm, with incentives climbing from 29 per cent to 33 per cent and no change to face rents.

A snapshot of the Sydney market across the past six months. Source: Cushman & Wakefield

Incentives in Melbourne are now around 27 per cent higher than a year ago, as a large supply of new stock, as well as the softer leasing environment, put upward pressure on incentives.

The Brisbane CBD office market remained relatively unaffected by COVID-19 in Q2, with prime gross effective rents falling just 1 per cent to $470 per sqm, representing a marginal uplift in incentives to 37.1 per cent and unchanged face rents.

Cushman & Wakefield research shows that the declining CBD rents are generally tracking changes to the official unemployment data.

The latest payroll data released by the Australian Bureau of Statistics indicates a 7.5 per cent decline in employment in New South Wales, 9 per cent in Melbourne and 5.7 per cent in Queensland between 14 March and 30 May.

How effective rent in the Melbourne market has changed in the past six months. Source: Cushman & Wakefield.

Cushman & Wakefield Head of NSW Office Leasing Tim Courtnall said the onset of COVID and the introduction of lockdown may have caused most Sydney tenants seeking office space to re-evaluated their timelines, but there had been a substantial uplift in new leasing inquiry levels in June as the NSW economy reopened.

“The pandemic has also boosted the relative attraction of metro and city fringe markets such as Parramatta, South Sydney and North Sydney," he said.

"These markets are benefiting from rising incentives in line with the CBD and significantly lower rents which appeal to tenants that may be looking to lower costs or adopt decentralisation strategies.”

Click here to view the full report.

Similar to this:

South Regional Business Centre in Brisbane sold for $35.25 million

Fortitude Valley office tower sold and settled for $94 million