West Melbourne office asset sold to complete $60 million portfolio - CBRE

Contact

West Melbourne office asset sold to complete $60 million portfolio - CBRE

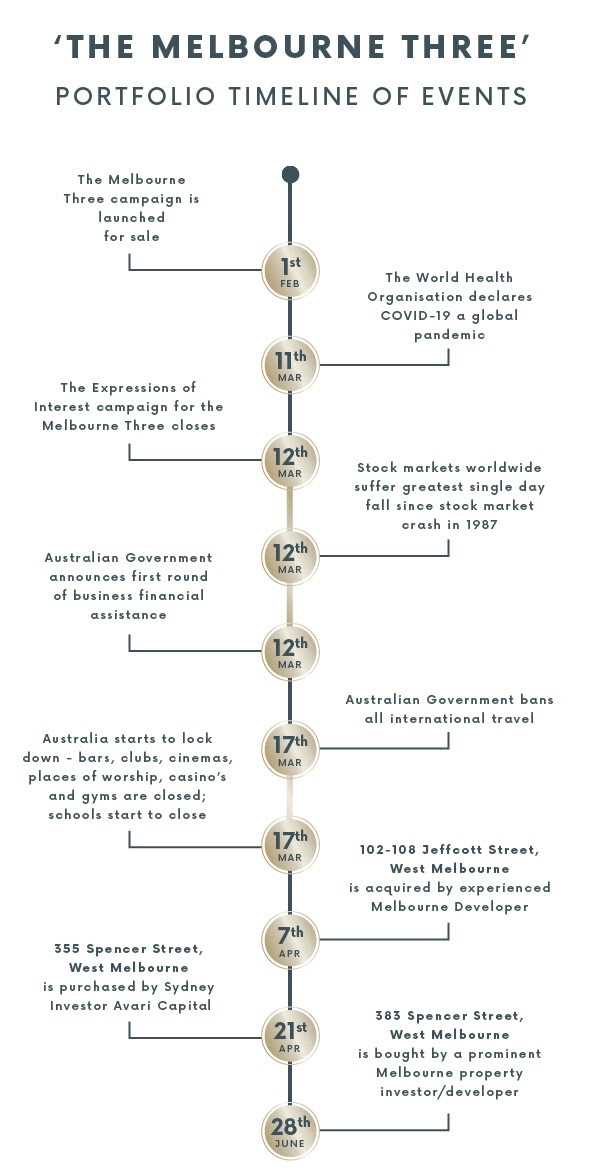

An office asset at 383 Spencer Street, West Melbourne has been sold by CBRE’s Josh Rutman, Scott Orchard, David Minty and Scott Hawthorne, signalling the last of three neighbouring properties to be transacted by the agency.

The sale of a West Melbourne office asset to finalise a major portfolio transaction signals "ongoing confidence" in Melbourne’s commercial property market, CBRE says.

Comprising an 80 per cent vacant, three-level office building, 383 Spencer Street was snapped up for close to $7 million by a private Melbourne-based investor.

The deal follows the earlier sales of a vacant two-level warehouse at 102-108 Jeffcott Street and a seven-storey former warehouse building at 355 Spencer Street to separate investors and developers.

Source: CBRE

It is the last of three neighbouring properties to be sold by CBRE on behalf of a trio of high-profile owners, taking the total sales tally to around $60 million.

The combined total represents a circa $20 million uplift on the price paid for the sites in 2015 by Probuild founder Phil Mehrten, developer Ozzie Kheir and developer Frank Palazzo.

CBRE’s Josh Rutman, who brokered the transaction for 383 Spencer Street with Scott Orchard, David Minty and Scott Hawthorne, said the deals highlighted that, despite the current climate, strong results were still being achieved for strategically positioned commercial assets.

“While some investors have more optimistic short-medium views than others, this latest sale and the competition from different buyer groups highlights that certainty is well and truly returning to the market,” he said.

Since the pandemic was announced in early March, Mr Rutman said his team has sold 23 commercial properties in Melbourne for a combined total of more than $220 million.

Source: CBRE

Mr Rutman said the makeup of these properties indicated investors were looking past the current market conditions.

"About 60 per cent of these transactions involved office buildings and 90 per cent of the assets had significant levels of vacancy," he said.

“This is a leading indicator of investor appetite for high-risk assets, with groups deciding to take a long- term view on the leasing market and future tenant demand after the COVID-19 health crisis."

Similar to this:

Frankston office sold to Collective Capital for $20 million - CBRE

Emergency Communications Facility sold to Hellenic $25.93 m CBRE

St Kilda Road office sale results in 30 per cent uplift from 2017 transaction