Covid impact flagged as potential 'cure' for Melbourne's vacant retail strips

Contact

Covid impact flagged as potential 'cure' for Melbourne's vacant retail strips

A new analysis from Richard Jenkins of consultancy firm Plan1 has found the current climate could trigger a rebirth of the local shopping strip as people rediscover their local stores and neighbourhood shopping precincts.

The could be a silver lining to rising vacancies across Melbourne's retail strips, according to a new analysis.

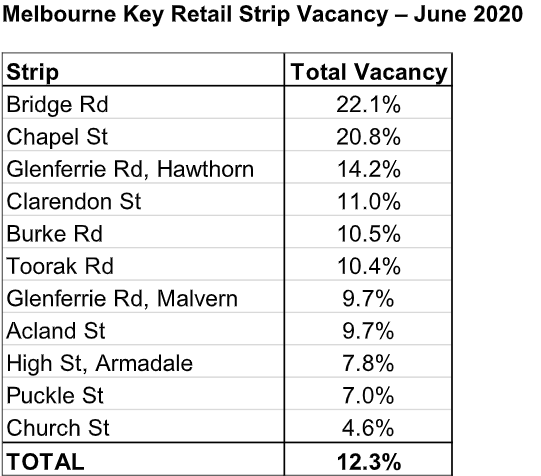

New research from consultancy firm Plan1 has found that leading fashion labels are abandoning Melbourne’s once-coveted retail strips with one in five shops now vacant in both Chapel Street, South Yarra and Bridge Road, Richmond.

According to the data, Chapel Street’s retail vacancy climbed to 21 per cent across June, surpassing the previous all-time high of 17 per cent, with Bridge Road holding the highest vacancy rate of the prime strips of Melbourne with 22 per cent of its shops vacant, also a record high for the strip.

At a glance:

- New research from Plan1 has shown one in five shops are now vacant in both Chapel Street, South Yarra and Bridge Road, Richmond.

- The data shows that while retail trade figures (which was released on Friday) rose over May 2020, the increase was driven by the easing of social distancing regulations with annual growth rates below the 10-year average and below levels recorded a year ago.

- Plan1 Co-Founder and Director, Richard Jenkins said the pandemic could potentially trigger a rebirth of the local shopping strip as people rediscover their local stores and neighbourhood shopping precincts.

Plan1 Co-Founder and Director, Richard Jenkins, said although the retail trade figures (which was released on Friday) rose over May 2020, the increase was driven by the easing of social distancing regulations with annual growth rates below the 10-year average and below levels recorded a year ago.

“Over the year to May 2020, Australian retail trade grew by 2.4 per cent, which was underpinned by spending in the food sector.

“The trend of slowing retail trade growth has also adversely impacted individual retailers with more than 800 stores closing as 10 retail brands fell into voluntary administration since the start of 2020.

Plan1 Co-Founder and Director, Richard Jenkins. Source: Plan1

“In addition, online retail trade in Australia continues to take a larger share of overall spending.

“As at May 2020 online sales made up 10.1 per cent of total retail sales with Australian online sales having grown by 73 per cent over the year.

"Australian consumers have spent approximately $31 billion online over the 12 months."

But Mr Jenkins told WILLIAMS MEDIA it was not necessarily all bad news for Melbourne's retailers, with COVID-19 potentially triggering a rebirth of the local shopping strip as people rediscover their local stores and neighbourhood shopping precincts.

“There is an opportunity for shops located on local strips as during COVID 19 many retailers have established stronger connections with their local customers which if handled correctly, will result in a permanent change, given the challenges facing other precincts such as the CBD or large shopping centres," he said.

“While the challenges of the retail sector are not new, retailers have to continue to evolve to respond to new normal, having already seen the impact of the growth of online spending.

Source: Plan1

“Retailers of the local shopping strips will need to continue to adapt to how customers want to shop.

"There is an opportunity for stores of the local neighbourhood to be a trusted destination for customers who want to stay local, shop safely and conduct transactions seamlessly through this pandemic.”

Martin Ginnane of retail advisory firm Ginnane & Associates works with various local governments to assist their strip centres evolve.

He said investment demand for strip retail assets remained solid, despite the elevated vacancy levels and soft retail trading conditions, with transactions demonstrating yields between 3.5 per cent and 5.0 per cent for properties on prime strips

"As the market returns to a “new normal”, localised businesses will be at the forefront," he said.

“It is imperative over the next 12 months that Local Governments work closely with small to medium-sized business to ensure that there is an immediate framework for to help 'now' and a longer-term strategy to move forward ensuring the pain and difficulty business experienced that during COVID is not allowed to become a malaise that damages business growth.

“Celebrating what is local, valued and safe will be the new mantra for 2021 and beyond.”

Similar to this:

Eastern Melbourne records yearly increase in commercial property sales value

Decrease in Chapel Street commercial property sales value

Increase in Eastern Melbourne commercial property sales value