Second quarter figures show Australian office sector is moving into 'downturn phase' - JLL

Contact

Second quarter figures show Australian office sector is moving into 'downturn phase' - JLL

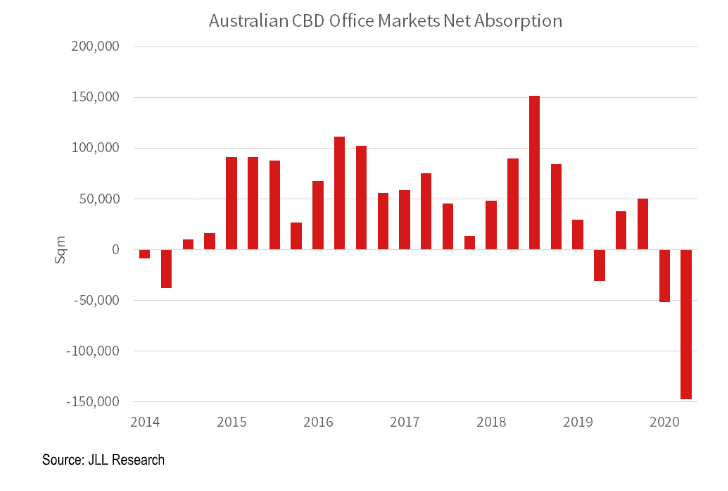

New research from JLL has shown all six of the monitored CBD office markets recorded negative net absorption in 2Q 2020.

The impact of an "unprecedented" 12 weeks for Australia's office market has been reflected in the latest figures from JLL, which show negative net absorption of -147,600 sqm was recorded over the second quarter.

The research, released this week, also indicates the national CBD office market vacancy rate increased by 1.8 percentage points from 8.4 per cent to 10.2 per cent in 2Q2020.

JLL Head of Research for Australia, Andrew Ballantyne said headcount reductions have been concentrated in the hospitality, retail, arts & recreation and construction sectors, but traditional office-using industry sectors have not been immune.

JLL National Office Research - At a glance:

- National CBD office market vacancy rate increased by 1.8 percentage points from 8.4 per cent to 10.2 per cent in 2Q20.

- Negative net absorption of -147,600 sqm was recorded nationally over the second quarter.

- All six of the monitored CBD office markets recorded negative net absorption in 2Q20.

“Policy measures have provided downside protection to the economy and the re-opening of the economy has occurred well ahead of expectations," he said.

"However, many organisations will struggle to find a pathway back to pre-crisis revenue levels and this will have an impact on office sector demand."

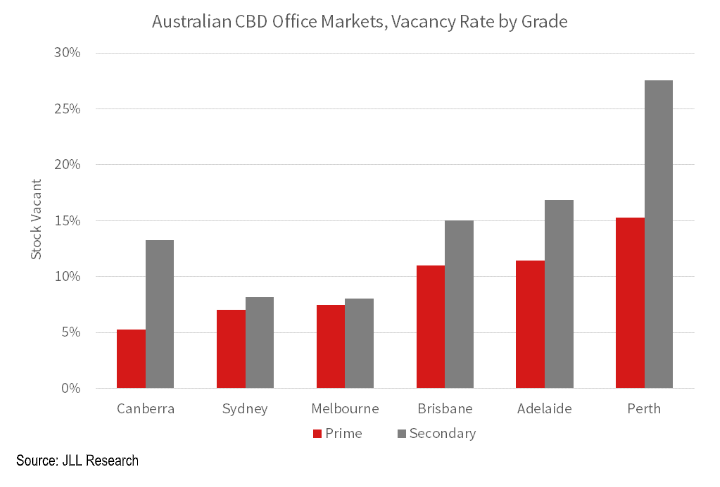

The Sydney CBD recorded -66,600 sqm of net absorption over the quarter and vacancy increased to 7.5 per cent in 2Q20. While vacancy increased across all grades, Premium (6.0 per cent) and A Grade (7.6 per cent) were significantly tighter than secondary (8.2 per cent) grade vacancy.

JLL Head of Leasing for Australia, Tim O’Connor, said Sydney CBD leasing enquiry had started to improve from a very low base as the state emerged from lockdown.

"The bulk of enquiry is concentrated in the sub 800 sqm cohort of the market and is seeking fitted space,"

The Melbourne CBD recorded -42,300 sqm of net absorption over 2Q20.

Mr O'Connor said while the completion of a number of new developments and the associated backfill space pushed the Melbourne CBD vacancy rate up to 7.7 per cent in 2Q20, the education (tertiary and vocational) sector had been one of the industry sectors most impacted by COVID-19.

"We have seen a number of institutions including RMIT and Monash University downsize their occupational footprint in the Melbourne CBD over Q2," he said.

The Brisbane CBD recorded -15,700 sqm of net absorption in 2Q20, with the headline vacancy rate increasing by 0.7 percentage points to 12.8 per cent over the quarter.

Over in the west, the Perth CBD recorded -10,500 sqm of net absorption over the quarter, resulting in the CBD vacancy rate moving out to 20.1 per cent in 2Q20.

Mr Ballantyne said JLL was "closely watching" the announcement of new infrastructure projects both domestically and overseas.

"The mining sector will be a direct beneficiary of new infrastructure projects and we may see an increase in project space over the latter part of 2020 and into 2021," he said.

Canberra recorded -8,200 sqm of net absorption over the quarter.

However, net absorption was positive over the 2019/20 financial year (26,200 sqm). The withdrawal of office stock for refurbishment led to the Canberra office market vacancy rate tightening to 8.2 per cent.

Mr O’Connor noted the number of cyber-attacks on public bodies and private sector organisations had increased over the past three months.

"The Commonwealth of Australia has already announced new funding into cybersecurity and the creation of new jobs," he said.

"The expansion of the public sector will be positive for the Canberra office market.”

The Adelaide CBD recorded -4,400 sqm in 2Q20, but positive net absorption of 15,300 sqm over the 2019/20 financial year, with the headline vacancy rate increased by 0.6 percentage points to 14.7 per cent over the quarter.

Mr O’Connor said while the work from home experience has shown it has a viable place in a modern flexible workplace strategy, the office re-entry had shown the importance of office space for collaboration, ideas generation and employee socialisation.

“The trajectory of Australia’s economic recovery will determine the employment outlook and demand for office space," he said.

"While a number of organisations will downsize and offer sublease space to the market, we expect to see increased leasing enquiry from organisations in the public sector, digital economy and healthcare sectors."

Similar to this:

Possibility of shorter pathway back to pre-COVID-19 commercial property sale volumes: JLL

Healthcare sector 'an important part' of office recovery - JLL