Higher demand for data centres - CBRE Report

Contact

Higher demand for data centres - CBRE Report

The latest CBRE APAC data centre report shows a surge in data storage and processing requirements due to increased levels of remote working through the COVID-19 pandemic.

The CBRE 2020 Asia Pacific Investor Intentions Survey has recently been released and shows that 30 per cent of investors in the region are prepared to purchase data centres this year.

This is a large increase from 18 per cent which was recorded in 2019.

The report found end-user demand for APAC data centres remained robust in H1 2020, supported by the adoption of Big Data, Industry 4.0, Internet of Things, 5G and cloud computing.

At a Glance:

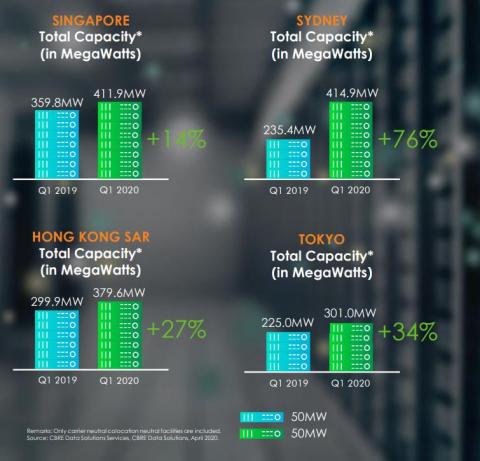

- Demand for APAC data centres has increased by 76 per cent in Sydney, 34 per cent in Tokyo, 27 per cent in Hong Kong and 14 per cent in Singapore.

- Surge in Sydney attributed to it being an attractive location to buy and shorter development times.

- The Government comprises the bulk of demand in Sydney.

There has also been a surge in data storage and processing requirements resulting from increased levels of remote working during the COVID-19 pandemic, which has also generated significant requirements for additional data centre capacity.

Total capacity in Asia Pacific Tier 1 markets, Q1 2019 vs Q1 2020. Source: CBRE

“Growth in the internet of things (IoT), working from home, online gaming and social media has increased the requirement for data storage in Australia," said Kate Bailey, Associate Director, CBRE Research, Australia.

"With more people working from home, there is an increase in demand for cloud storage, which is driving space demand in data centres."

The report also showed investment demand has strengthened this year as economic and property market volatility caused by the spread of COVID-19 prompts buyers to seek assets providing stable income streams.

Equity investment remains the preferred route into the sector, with recent transactions including the purchase of an 88 per cent stake in AirTrunk, a hyperscale data centre company based in Sydney, by a consortium led by Macquarie Asia Infrastructure Fund 2.

Top five preferred alternative sectors for investment. Source: CBRE

In the past financial year, Sydney recorded the strongest growth (76 per cent) in total IT capacity of the four Asia Pacific tier I data centre markets.

The surge in Sydney is primarily attributed to it being an attractive location for acquisition and a significantly shorter development time (6-8 months less) as compared to other tier 1 markets.

While the government comprises the bulk of demand in Sydney, growth is occurring across numerous verticals, including financial services, internet and technology, healthcare and education.

Many providers are benefitting from hyperscale providers such as Microsoft, Google and AWS, which are usually opting for colocation deployments rather than self-built facilities.

"There is currently huge demand for sites, with large requirements from data centre groups seeking opportunities in Sydney and Melbourne," said Cameron Grier, Regional Director, Industrial & Logistics.

To read more and to access the report click here.

Similar to this:

Covid impact flagged as potential 'cure' for Melbourne's vacant retail strips

Surge in Sydney office incentives 'pushing down' effective rents - Cushman & Wakefield