Australian office market responding to increased business confidence but Victoria situation may prove setback - Knight Frank

Contact

Australian office market responding to increased business confidence but Victoria situation may prove setback - Knight Frank

New research from Knight Frank has found the number of office tenants putting leasing requirements on hold has fallen since COVID-19 took hold in Australia, although the second wave of the virus threatens to disrupt the improving confidence.

Questions remain over the recovery timeline of Australia's office market despite new data showing increased confidence last month, experts say.

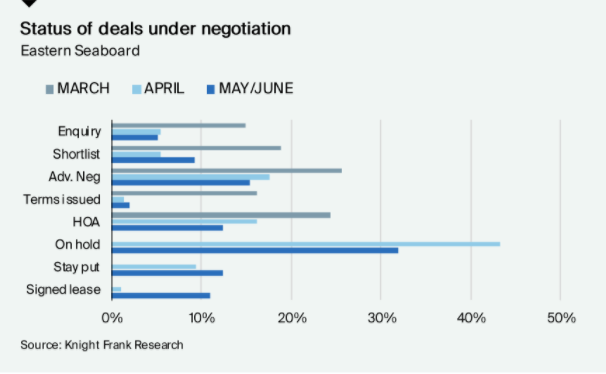

Knight Frank’s Office Market Insight for June 2020 found that 32 per cent of office leasing mandates across Australia’s main Eastern Seaboard markets had been put on hold for the period of May/June, down from 43 per cent in April.

The research also found 19 per cent of tenants that were progressing had reduced their size requirements.

Compared to March, when tenants remained engaged and were still proceeding with negotiations, 12 per cent of active mandates tracked in June have been withdrawn completely.

Knight Frank Office Insight for June - At a glance:

- The research found 32 per cent of office leasing mandates across Australia’s main Eastern Seaboard markets have been put on hold, with the share of deals on hold dropping from 43 per cent in April.

- 19 per cent of tenants that are progressing have reduced their size requirements.

- Many tenants are still adopting a ‘wait and see’ approach, but there is increasing activity in Australia’s office leasing market, with enquiry levels picking up in all capital cities with the exception of Melbourne in May and June.

But Knight Frank warns figure could pick up again due to the return to lockdown in Victoria.

Chief Economist Ben Burston said the COVID-19 crisis continued to disrupt office leasing momentum as businesses assessed the viability of remote working and responded with strategies to support business continuity.

“The drop in the proportion of leasing deals on hold is evidence that the unwinding of movement restrictions resulted in a partial restoration of business confidence during May and June,” he said.

Knight Frank Chief Economist Ben Burston. Source: Knight Frank

"While many businesses remain cautious, the data reveals an increased preparedness to make decisions regarding their office space compared to April.

“However, the reinstatement of restrictions in Melbourne comes as a further blow and we expect many businesses to remain cautious about making new lease commitments until there is greater clarity on the extent of the second wave and the evolution of fiscal support measures post-September.”

Knight Frank Partner and National Head of Leasing Andrea Roberts said many tenants were still adopting a ‘wait and see’ approach, but noted there increasing activity in Australia’s office leasing market.

“Enquiry levels are noticeably picking up month-on-month in all capital cities with the exception of Melbourne in May and June, with more than 60 per cent of enquiry in the sub-500 square metre market,” she said.

“Subleasing space continues to increase further as tenants assess their short-term space requirements due to social distancing guidelines, return to work expectations for 2020 and the adoption of remote working policies.”

Knight Frank Head of Office Leasing Andrea Roberts. Source: Knight Frank

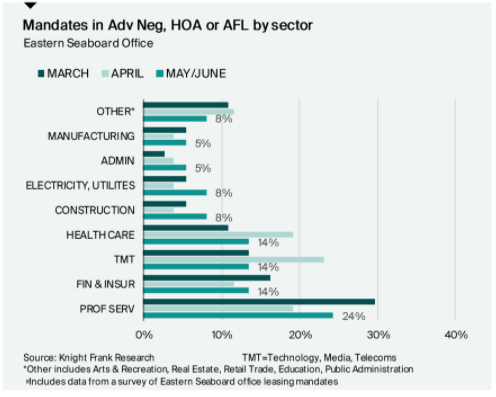

The Knight Frank research found Professional Services tenants now account for the biggest sector progressing with select leasing mandates after holding in April, with its share of deals tracked rising from 19 per cent in April to 24 per cent in June.

The tech sector also remains active in deal progression, accounting for 14 per cent of active mandates in advanced negotiation or at HOA or signed leases, despite being down from its 23 per cent share in April.

The Knight Frank Office Market Insight found that of the eastern seaboard capitals, Brisbane had the fewest deals on hold at 11 per cent in June, down from 30 per cent in April, and compared to 39 per cent in Sydney and 33 per cent in Melbourne.

“As select businesses have returned to the workplace in Brisbane, we estimate that occupancy rates in the city have increased to around 40 per cent,” said Ms Roberts.

“We have also seen an increase in signed heads of agreement in Brisbane to 21 per cent in June, led mostly by smaller occupiers.

“In Sydney, there is evidence of more enquiry coming through, with the share of tenants at enquiry stage rising from 5 per cent in April to 9 per cent in June, while those that have shortlisted has risen to 5 per cent.

“In Melbourne, we saw increased enquiry during May and June, however the recent return to lockdown conditions on July 8 has led to the majority of deals being put on hold again.

“Pleasingly though we are observing that metropolitan markets in Melbourne and Sydney are also reporting increased activity and inspections.”

Overall, Knight Frank believes Australia’s office market has fared better during COVID-19 than some overseas markets, with Knight Frank research finding the average occupancy is higher in Australia than across the key cities in the United Kingdom and United States.

Ms Roberts said Australia’s occupancy was about 43 per cent, slightly higher than the 40 per cent for the key cities in the UK and more than double the 20 per cent for the key cities in the US.

“Our highest office market occupancy rates are in Perth and Adelaide, where occupancy is at 70 per cent, followed by Canberra at 50 per cent, Brisbane at 40 per cent and Sydney at 30 per cent,” she said.

Click here to view the full report.

Similar to this:

Knight Frank announces new National Head of Office Leasing

Eastern Melbourne records yearly increase in commercial property sales value