Perth office sector showing resilience - CBRE

Contact

Perth office sector showing resilience - CBRE

A new CBRE MarketView Snapshot highlights how minimal new supply entering the Perth office market in 2022 and 2023 would help absorb the impact of COVID-19, in comparison to high supply pipelines in Sydney and Melbourne.

Perth’s office market could be sheltered from the full economic impact of COVID-19, with low levels of new supply and high exposure to the mining sector creating resilience in the sector, new research has found.

CBRE’s Senior Director of Office Leasing, Andrew Denny, said Perth’s office sector was in a relatively favourable position.

“Perth’s office markets are likely to perform better than the major eastern states markets given our high exposure to the strongly performing mining sector and low exposure to the under-pressure education, tourism and hospitality sectors,” he said.

At a glance:

- CBRE's latest Marketview Snapshot report has shown how minimal new supply entering the Perth office market in 2022 and 2023 would help absorb the impact of COVID-19, in comparison to high supply pipelines in Sydney and Melbourne.

- According to the report, the city has experienced "surprisingly strong" leasing activity, with good new enquiry, high levels of inspections, and a healthy level of negotiations occurring.

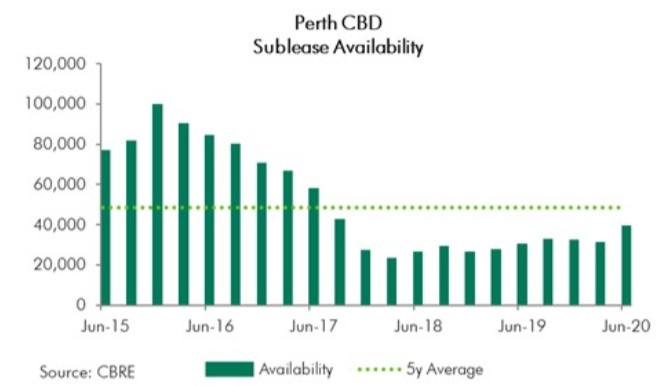

- The report also revealed CBD sublease availability increased from 29,900sqm to 38,000sqm during Q2, with June accounting for all the increase - a 27 per cent increase in sublease availability.

“There has been surprisingly strong leasing activity, with good new enquiry, high levels of inspections, and a healthy level of negotiations occurring.

"This has been evident from the start of June onwards with activity accelerating through June.

"This surge though may be a reflection of enquiry and negotiations that were put on hold during the main Perth COVID-19 period, now entering the market, and may not be sustainable moving into 2021.”

Mr Denny added the key indicator for the future health of the leasing market was the level of sublease space available.

"According to CBRE Research, CBD sublease availability increased from 29,900sqm to 38,000sqm during Q2, with June accounting for all the increase - a 27 per cent increase in sublease availability," he said.

“Although it is early days, at this stage this is only a relatively moderate increase in absolute sqm and not one for concern.

"By comparison, peak sublease post-resources boom was 100,000sqm in December 2015."

CBRE's research also showed occupancy levels in Perth’s CBD office buildings are nearing 60-65 per cent, with most tenants having returned to the workplace – the exception being the large corporate tenants, where many workers remain working from home.

Click here to view the full report.

Similar to this:

Record start to the year for Sydney office sales as investors spend $4.4 billion

Australian office sales boom in 2019 to hit $17.9 billion, the highest on record: CBRE