Canberra and Perth only office markets to see rent growth in second quarter - CBRE Marketview

Contact

Canberra and Perth only office markets to see rent growth in second quarter - CBRE Marketview

New research from CBRE has shown nearly all major office markets experienced rent declines in the second quarter of this year.

Australia's east coast office markets have borne the brunt of COVID-19 economic impact during the second quarter of this year, mainly due to their large financial service sectors, CBRE says.

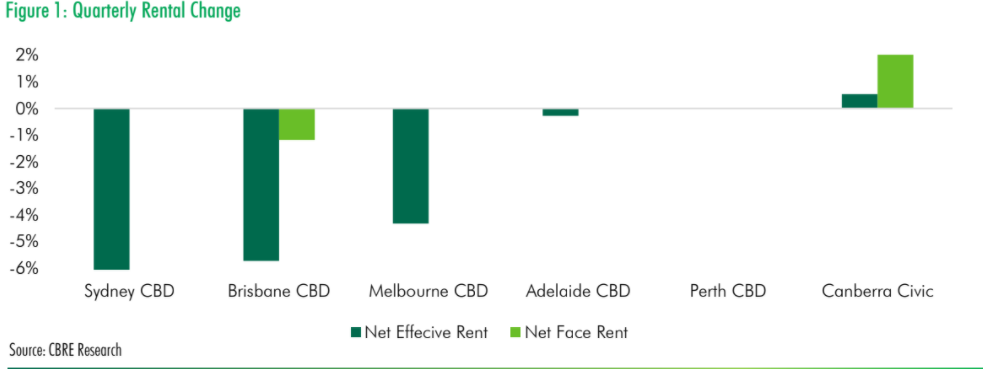

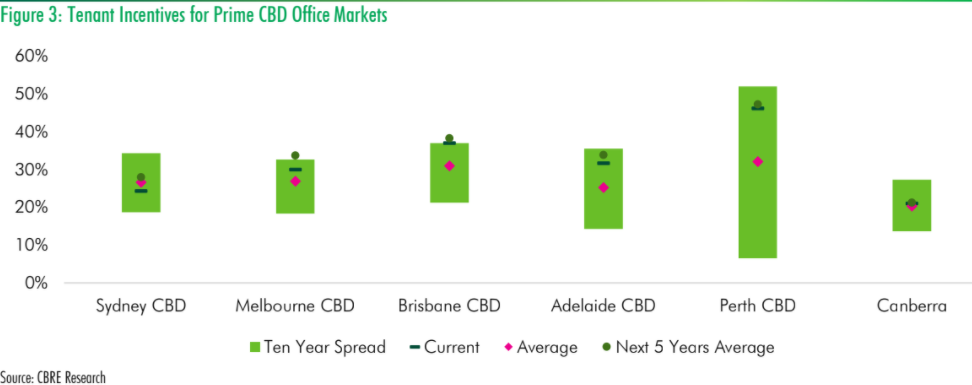

The firm's Office Marketview report for the second quarter shows there was rising incentives and declining net effective rent across all markets except Perth and Canberra, with Sydney having the largest fall in effective rents at over 6 per cent, followed by Brisbane and Melbourne.

Brisbane was also the only market to see net face rental declines.

According to CBRE, leasing activity saw a significant decline in April but rebounded in May, while the number of new leases struck remains low, despite increasing tenant enquiries.

The report indicates sales volumes were down 47 per cent compared to H1 2019, coming in at $4.7 billion.

Over the quarter, Melbourne has seen the most activity with the sales of Rialto Tower, 222 Exhibition Street and 436 St Kilda Road totalled to $912million.

Leasing enquiry levels for CBD office markets. Source: CBRE Research

CBRE Head of Office Occupier Research Joyce Tiong told WILLIAMS MEDIA vacancy in Sydney and Melbourne was rising as was available sublease space.

"Softer tenant demand amidst rising uncertainties is likely to see further increase in incentives, leading to weaker rental growth, especially in the larger markets like Sydney and Melbourne," she said.

"Sub-lease space is expected to continue to increase as occupiers offload space due to expected cost-cutting measures around staff numbers as a result of the ongoing economic uncertainty.

"Sydney and Melbourne sublease space has now exceeded the long-term average, and this will exert pressure on the already rising vacancy."

Click here to view the full report.

Similar to this:

CBRE launches office series interview podcast