Carramar Village sold for $33.5 million to set new Perth benchmark

Contact

Carramar Village sold for $33.5 million to set new Perth benchmark

CBRE’s Anthony Del Borrello and Richard Cash have overseen the largest shopping centre sale in Perth for 2020, with Carramar Village in the city’s northern suburbs changing hands for $33.5 million.

A national investment syndicate has acquired a shopping centre in Perth's northern suburbs for $33.5 million, marking the biggest transaction of its kind for the city this year.

Built circa 2009, the 5,353sqm Carramar Village is situated approximately 28km north of the Perth CBD, on the northwestern corner of Joondalup and Cheriton drives.

The centre is anchored by Woolworths and features 17 specialty stores, including a Priceline Pharmacy and the Healius Medical Centre.

The property also includes 2,500sqm of developable land.

At a glance:

- Carramar Village shopping centre in Perth's northern suburbs has been sold to a national syndicate for $33.5 million.

- CBRE’s Anthony Del Borrello and Richard Cash negotiated the sale on behalf of Canute Global Investments at a yield of 6.20 per cent and rate per square metre of $6,257.

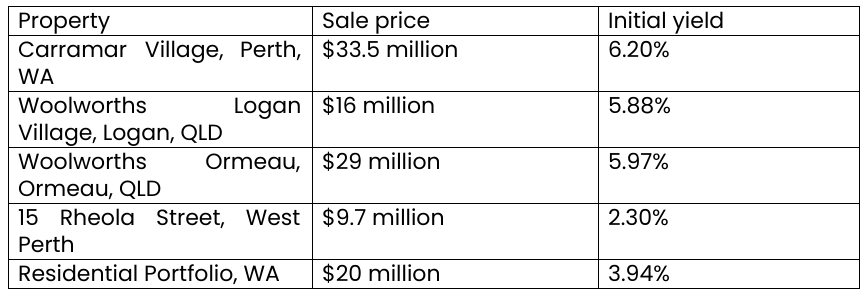

- Carramar Village was marketed for sale as part of a portfolio of four other assets based in Western Australia and Queensland, including three shopping centres, an office building and residential offering.

CBRE’s Anthony Del Borrello and Richard Cash negotiated the sale on behalf of Canute Global Investments at a yield of 6.20 per cent and rate per square metre of $6,257.

Mr Del Borrello said the successful transaction was the result of several months of negotiations.

“Negotiations were conducted throughout a very challenging period in Australia due to COVID-19, with restrictions and regulations changing at a rapid rate," he said.

Source: CBRE

"The contract negotiation took patience and tenacity."

He added the transaction highlighted the investment appetite that still existed for quality retail assets.

“We’ve seen additional pent up demand due to the lack of quality assets that have come to market this year because of the global pandemic,” he said.

Source: CBRE

“Furthermore, the demand for non-discretionary and convenience neighbourhood shopping centres continues to be strong due to the defensive and recession-proof nature of this asset class.”

Carramar Village was marketed for sale as part of a portfolio of four other assets based in Western Australia and Queensland, including three shopping centres, an office building and residential offering.

Neighbourhood retail trumps market with sales topping $110m

New research from CBRE indicates buyer appetite for WA neighbourhood retail centres remains buoyant, with 2020 sales topping $110 million as investors shift focus to less risk adverse assets.

Nationally, neighbourhood centres accounted for one third of total retail transactions in the first half of 2020 – compared to 16 per cent in 2019. The trend was reflected in WA, with neighbourhood centre sales accounting for 61 per cent of the $145 million worth of sales this year.

CBRE’s Anthony Del Borrello said neighbourhood centres typically offered attractive WALEs and secure covenants – with minimal exposure to discretionary spend.

“Transaction activity in WA this year has been mainly focused on those core non-discretionary assets that have lower occupancy risk – such as supermarkets, pharmacies, hardware, and to a slightly lesser extent, service stations,” he said.

“In contrast, prior the current downturn, investor demand gravitated towards slightly larger centres that offered diversity of income and rental growth.

"Now, however, that diversity contains more risk, which is underpinning the shift in flight to quality.”

Other major neighbourhood centre transactions in WA year-to-date include Woolworths Greenfields $32 million, Carnarvon Central for $16.1 million, and Halls Head Shopping Centre for $6.3 million.

Mr Del Borrello said the majority of recent transactions were to syndicate investors – an indication that this type of investor was now willing to reduce their return metrics in order to compete with private investors for securely leased assets.

“Non-discretionary based retail assets with strong income profiles are being recognised as strategic and relatively secure investments, which is driving buyer interest from a range of groups, particularly syndicate investors.”

Another pocket of the retail market showing resilience is large format retail – a trend supported by strong home improvement, entertainment, home office furniture spending.

According to CBRE data, preliminary retail trade figures for May 2020 saw household goods retailing up 30 per cent year-on-year.

WA recorded the largest large-format sale nationally in the second quarter of 2020, with Midland Megaplex in Perth transacting for $58 million.

Anecdotally, investor demand for large format retail centres is stable and expected to remain one of the most resilient categories in 2020-2021.

Similar to this:

CBRE retail data highlights resilience of supermarkets

Oakleigh childcare investment sold for $8 million through CBRE