Nearly two-thirds of capital market deals have progressed or been completed since March - Knight Frank

Contact

Nearly two-thirds of capital market deals have progressed or been completed since March - Knight Frank

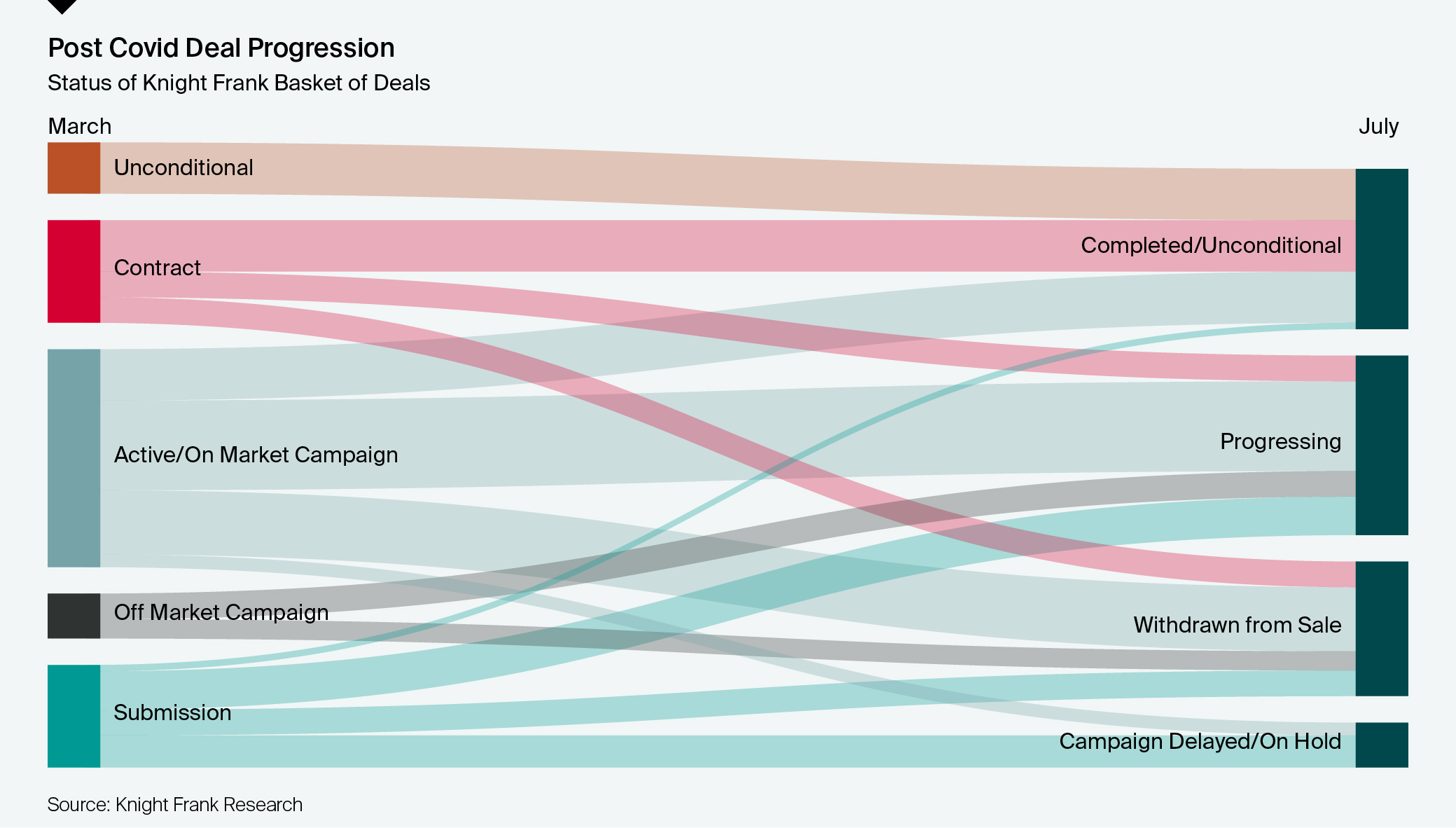

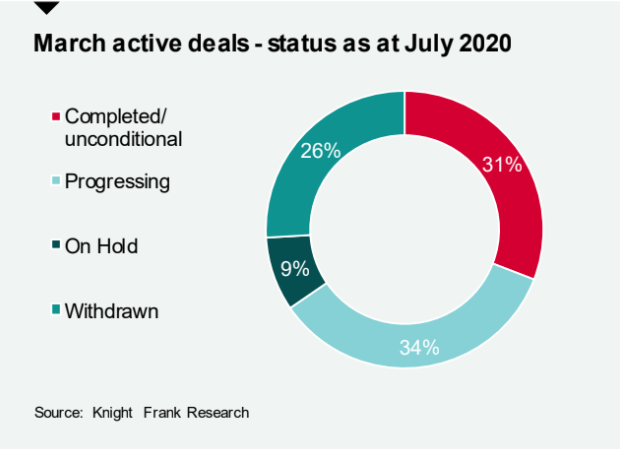

Knight Frank’s Capital Market Insight August 2020 found 31 per cent of deals underway in March have now settled or are unconditional, while 34 per cent are progressing, and just under 9 per cent have been put on hold.

Deals across Australia’s Eastern Seaboard capital markets are progressing in spite of COVID-19, albeit with reduced turnover, according to the latest research from Knight Frank.

The firm's Capital Market Insight August 2020 found 31 per cent of deals underway in March have now settled or are unconditional, 34 per cent are progressing and just under 9 per cent have been put on hold.

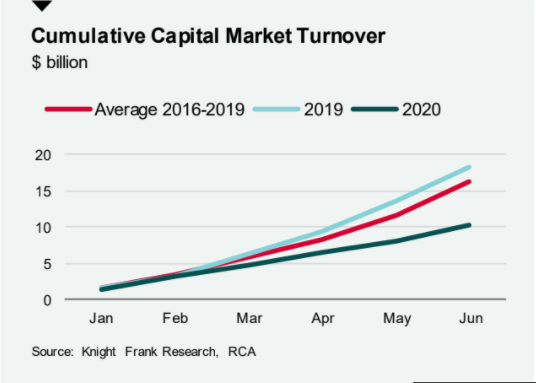

However, the report also reveals the total turnover across the office, industrial and retail markets over the first half of 2020 was just $10.37 billion, 43 per cent below the $18.26 billion recorded over the same period in 2019.

Knight Frank Capital Market Insight August 2020 - At a glance:

- Industrial has been the most resilient sector, with turnover during the first half of 2020 only down by 10 per cent on the same period in 2019

- Brisbane had seen the highest levels of completions at 46 per cent, followed by Sydney and then Melbourne

- Smaller deals have been easier to transact, with a 56 per cent completion rate for transactions under $5 million.

Knight Frank Chief Economist and Partner Ben Burston told WILLIAMS MEDIA core real estate would remain highly sought after but greater priority would be given to stability and length of income, creating a shift towards prime assets that can easily adapt to social distancing and cater to changing occupier requirements.”

"The pandemic had clearly reshaped the investment landscape in recent months and resulted in a large drop in liquidity," he said.

"However, unlike the last broad-based market downturn during the global financial crisis, there is little evidence of distress resulting from excessive leverage and the large drop in long term interest rates is providing a significant offset to the pressure on income.

Knight Frank National Head of Agency Ben Schubert. Source: Knight Frank

"This means that the outlook over the next 12 months is very much tied to the strength of the economic recovery and the performance of the occupier market."

Knight Frank National Head of Agency Ben Schubert said practical limitations and knocks to confidence meant while transactions were taking longer to complete post-COVID-19, deals were being done.

“While not all of the deals in progression will necessarily come to fruition, it has been encouraging to see transactions continuing to progress through the COVID-19 impacted period,” he said.

“There was a notable improvement in confidence and activity across Australian markets during May and June, but we have seen a slowdown since the second wave emerged in Victoria in early July.

“While more than a quarter of assets on the market in March have now been withdrawn, there have been new campaigns commenced, with 15 new asset disposals underway in July, which have emerged since March.”

Knight Frank National Head of Capital Markets Paul Roberts said Brisbane had seen the highest levels of completions, followed by Sydney and then Melbourne, with deal levels appearing to mirror the lockdown level in each city.

Knight Frank National Head of Capital Markets Paul Roberts. Source: Knight Frank

“To date, Brisbane has been fortunate to have less time under restrictive lockdowns than its southern counterparts, which has buoyed activity,” he said.

“The level of completions in the Brisbane market sits at 46 per cent, with only 21 per cent reported as being withdrawn from the market.”

The Knight Frank research found smaller deals in the capital markets of Australia’s Eastern Seaboard were dominant, with sales of $5 million or under having a 56 per cent completion rate for deals underway in March, a trend Mr Roberts said was unsurprising.

“Smaller transactions are more likely to involve local parties, private investors and owner occupiers, all of which have been more nimble in a challenging environment,” he said.

Click here to view the full report.

Similar to this: