Australian suburbs 'set to bloom' from flex office offerings - CBRE Marketview

Contact

Australian suburbs 'set to bloom' from flex office offerings - CBRE Marketview

Core + flex workplace models will likely become the way of the future for many Australian office occupiers, providing the opportunity to retain a CBD presence while enabling a more agile “hub and spoke” office strategy and allowing greater flexibility for employees, according to new research from CBRE.

An emerging office model centred on employees being given the choice to work from multiple locations could soon result in suburban workspaces becoming more popular, CBRE says.

The firm's latest Marketview report charts the potential rise of Core + flex workplace models across the country, with flex operators impacted by the current COVID-19 environment expected to expand their horizons as occupiers seek out new workplace solutions.

CBRE Pacific’s Head of Advisory & Transaction Services for Occupier Business, Mark Slater said more office occupiers, especially ones operating out of large spaces, were predicted to adopt core + flex models to create a "truly agile" real estate portfolio.

At a glance:

- The rapid expansion of flexible space – which includes coworking centres and serviced offices – over recent years is now being followed by a COVID-induced recession that has reduced demand for office space, flex included.

- In June, Business Research Company estimates that revenue in the global coworking market is expected to decline 12.9 per cent in 2020, with recovery to 2023 at a compound annual growth rate of 11.8 per cent.

- CBRE forecasts flex operators impacted by the current COVID-19 environment expected to expand their horizons as occupiers seek out new workplace solutions.

“Flex operators have the ability to provide the 'spoke', giving access to short or long-term space which offers a high level of amenity, particularly in suburban locations that were often given less consideration prior to COVID-19," he said.

Flex space, including co-working centres and serviced offices, has expanded rapidly over recent years, driving 109,000square metres – or 31% - of net absorption in Australian office markets over 2018-19.

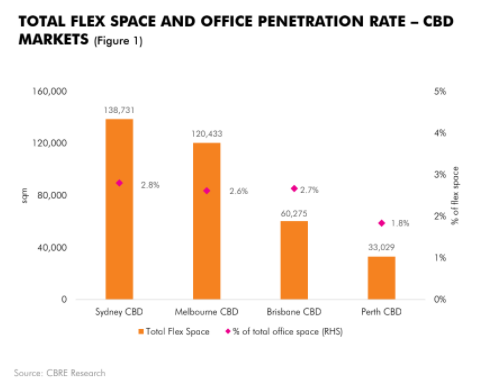

While Flex operators now occupy circa 353,000 square metres of office space in the Sydney, Melbourne, Brisbane and Perth CBD markets, widespread lockdowns over April and May saw footfall within flexible space centres plummet by 70-90 per cent.

Source: CBRE Research

According to CBRE, it is a situation still being faced in Melbourne, which is in the midst of Stage 4 restrictions.

Mr Slater said while other Australian cities have seen footfall improve since May, even in locations with the strongest recovery, footfall remained 10-20 per cent below 2019 levels.

“Truly flexible space gives occupiers the opportunity to dial up or dial down their portfolio size in lockstep with changing business demands and user preferences,” he said,

“Whilst we expect to see some contraction and consolidation, the economy will ultimately turn upwards and with this, the demand for office space will grow again.

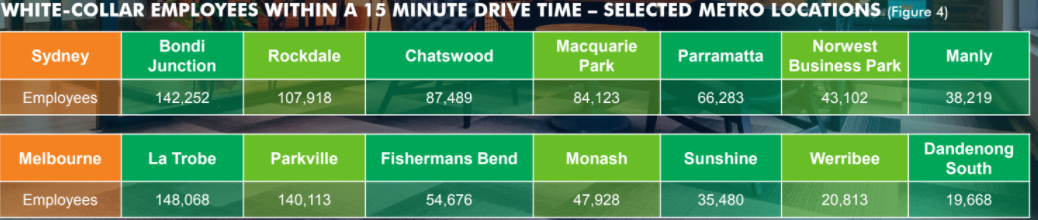

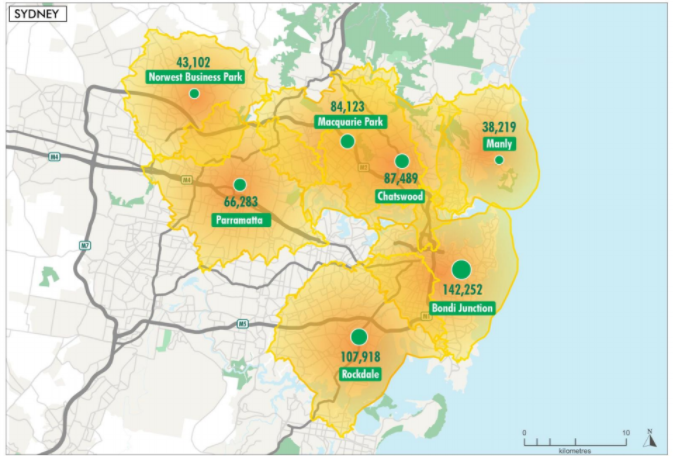

White-collar employees within a 15-minute drivetime from suburban Sydney locations. Source: CBRE Research

"It’s in this environment, that on-demand and flex space will augment the needs of organisations that put their pre-COVID space expansion plans on hold as occupiers return to the workplace.”

Mr Slater added that, in the long-term, flex operators that survived the downturn would be well-positioned to accommodate the next evolution in working strategies – including flexible and remote working, and hub and spoke models.

“We also expect that landlords will become larger players in the provision of flex space through their own offering or partnering with operators.”

CBRE’s report reveals the Sydney and Melbourne locations that are slated to experience an increase in flex offerings in coming years, including opportunities in Sydney’s south and east, and innovation clusters in Melbourne.

While flex operators already exist in some suburban locations, these are predominantly smaller, niche operators, with larger operators having tended to prefer CBD locations which draw larger pools of employees.

Bradley Speers, CBRE Australia Head of Research, said while the Greater Sydney Commission’s Three Cities plan would lead Greater Sydney to evolve westward over coming decades- as Parramatta and the Olympic Peninsula filled out and the Western Sydney Airport began operation- locations east and south of the Sydney CBD would provide a larger pool of white-collar employees within a short commute time.

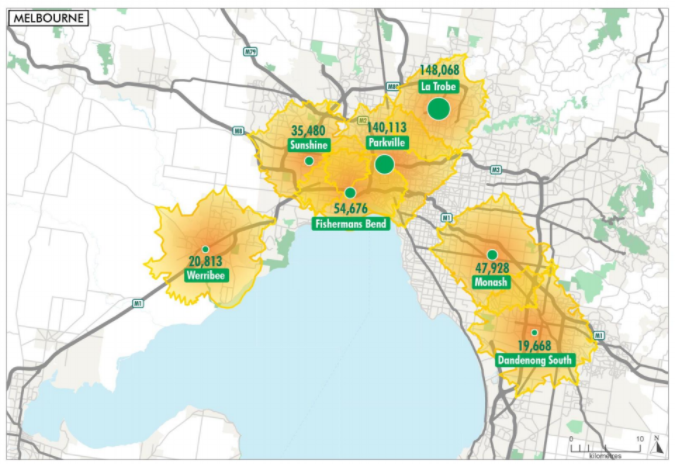

White-collar employees within 15-minute drivetime from suburban Melbourne locations. Source: CBRE Research

“Flex operators looking to expand should consider commercial centres in Bondi Junction and Rockdale, with 142,252 and 107,918 white-collar employees within a 15-minute drive, respectively – as well as the more established suburban office markets of Parramatta, Chatswood and Macquarie Park,” he said,

In Melbourne, the report flags La Trobe and Parkville as upcoming flex hubs, each with a far higher number of white-collar employees within a 15-minute drive than the other suburban locations tested for the report, with 148,068 and 140,113 commuters, respectively.

These two locations are National Employment and Innovation Clusters as identified by the Victorian Planning Authority and will house a diverse range of ‘smart’ jobs in the fields of research, health, technology, IT and business services.

Mr Speers said startup companies would be a large feature of these locations, providing opportunities for flex operators to accommodate short-term tenant requirements but also provide space for company growth,.

“An interesting revelation from discussions with flex operators interviewed for this report was that footfall in suburban locations has held up better than in some CBD locations, presumably due to some users wanting to avoid public transport and employees gravitating towards flexible work arrangements, opting to work from home and remote more regularly," he said.

Click here to view the full report.

Similar to this:

Cyber security firm sets up headquarters at Perth office tower - CBRE

Western Sydney business-zoned sites proving hot property - CBRE