Almost $55 million in property sold at Cushman & Wakefield auction

Contact

Almost $55 million in property sold at Cushman & Wakefield auction

Cushman & Wakefield has announced the sale of eleven commercial properties for a combined value of $53.59 million, during what it says is the largest national portfolio auction held in Sydney this year.

A portfolio of six Woolworths Caltex fuel and convenience assets was among the listings successfully transacted as nearly $55 million of property was sold at a Cushman & Wakefield auction.

The properties sold under the hammer for a total of $40.235 million, with the seventh asset in advanced stages of negotiation.

The broader portfolio also included a range of retail, childcare and medical assets located in Queensland and New South Wales.

At a glance:

- Cushman & Wakefield has announced the sale of eleven commercial properties for a combined value of $53.59 million at auction.

- The properties included portfolio of six Woolworths Caltex fuel and convenience assets, which sold for $40.235 million.

- Other assets in the portfolio included healthcare, food and retail properties in Sydney’s North Shore, Northern Beaches and a medical investment in Casino, New South Wales.

The auction, held by Cushman & Wakefield’s National Investment Sales team, achieved a 73 per cent clearance rate with the majority of assets in the portfolio being sold significantly above reserves.

In a further sign of yield compression, the Burwood Woolworths Caltex service station was sold for $8.9m at a near-record 3.71 per cent yield, and two retail properties in Freshwater recorded yields of 4.11 per cent and 4.28 per cent.

The portfolio attracted more than 950 inquiries heading into the auction, with more than 150 attendees attending the auction in-person in Sydney and Brisbane, and bidding also conducted via phone and online.

The properties were sold to a range of private and high net worth investors from local areas and interstate plus two funds management groups.

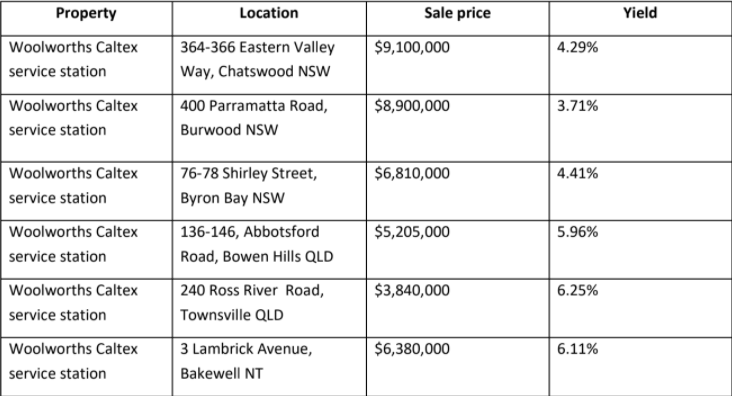

The Woolworths Caltex branded portfolio included assets in Chatswood, Burwood, and Byron Bay in New South Wales, Bowen Hills Brisbane and Aitkenvale Townsville in Queensland, and Bakewell in the Northern Territory.

All properties were sold with newly signed 15-year leases in place.

The sale prices ranged from $3.84 million to $9.1million, with yields between 3.71 per cent in Sydney, 4.41 per cent in Byron Bay, 5.96 per cent in Brisbane and 6.25 per cent in Townsville.

Other assets in the portfolio included healthcare, food and retail properties in Sydney’s North Shore, Northern Beaches and a medical investment in Casino, New South Wales.

Two Brisbane based childcare centres within the portfolio sold prior to auction.

Cushman & Wakefield’s Michael Collins, Aaron Dahl, Yosh Mendis, Geoff Sinclair and Tom Moreland managed the sale campaign, with the auction conducted by Damien Cooley from Cooley Auctions.

Cushman & Wakefield’s Head of National Investment Sales, Michael Collins, said the auction delivered an "outstanding" result for vendors, with most of the assets selling above reserve.

"Overall, investors sent an overwhelming signal about their confidence in the alternative real estate investment market," he said.

“The sale of six sites within the Woolworths Caltex branded portfolio is further evidence that the fuel and retail convenience sector continues to run hot.

"With an overwhelming level of interest in the portfolio and a large number of active bidders, these assets set the pace for a very competitive auction.”

He added private and high net worth investors had continued their active search for yield during the pandemic and were targeting defensive investment opportunities backed by high quality, long-term leases.

"The low yields recorded across many sites reinforced the yield compression we are seeing among these types of assets and reflective of the lower for longer interest rate environment," he said.

“In particular, the market for fuel and convenience retail property has been among the best-performing alternative asset classes, with values remaining highly robust throughout the pandemic.”

Similar to this:

Engineering firm Taylor Thomson Whitting signs lease for new look North Sydney offices

Retailers locking down space in Melbourne CBD ahead of eventual rebound - Cushman & Wakefield

Cushman & Wakefield secures NAB facilities management contract extension