How fashion retailers are changing their physical footprint - JLL report

Contact

How fashion retailers are changing their physical footprint - JLL report

JLL’s recent retail research paper, The Future of Fashion in Australian Shopping Centres outlines why the fashion sector’s physical footprint is shrinking and how much it will shrink by.

A new report from JLL has shown how traditional fashion store formats are transforming in response to consumer expectations and technology, creating opportunities for landlords, retailers and property managers to blend the offline with the online.

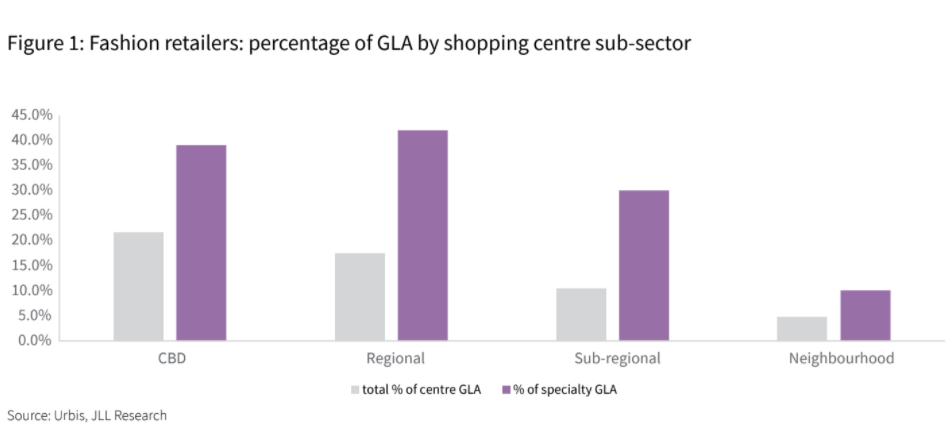

Historically fashion retailers have occupied the greatest portion of specialty store space across CBD, regional and sub regional retail assets.

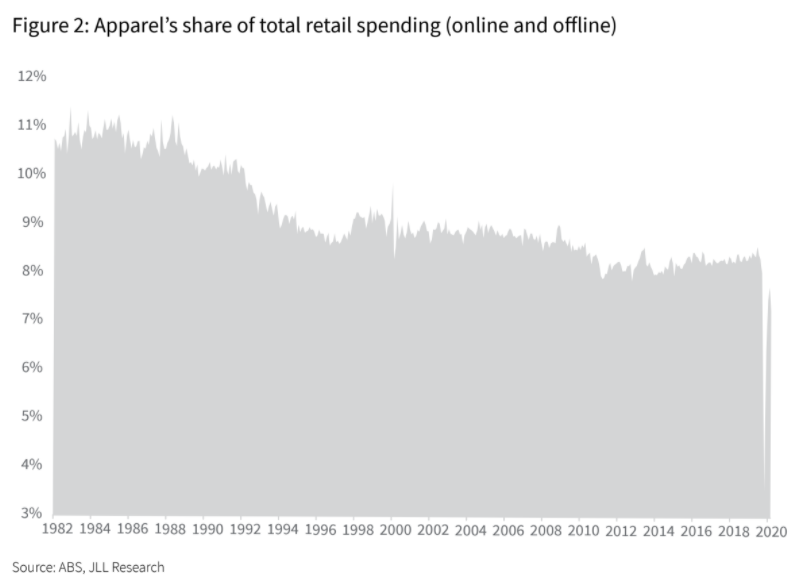

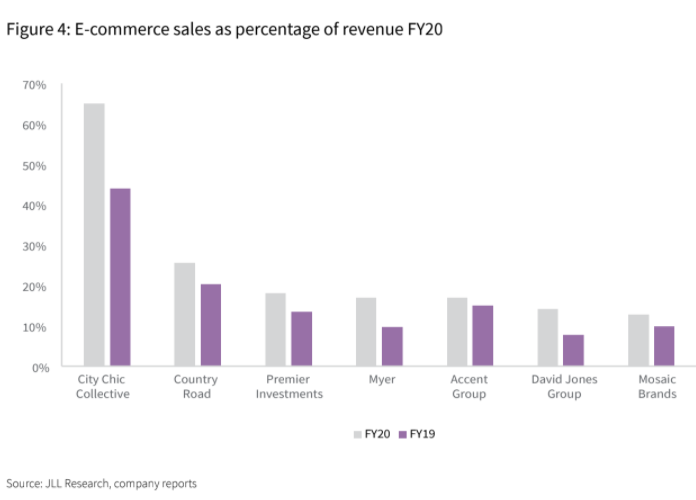

But JLL Senior Analyst Louise Burke said evolving trends in consumer spending, along with the challenges posed by e-commerce, supply-chain disruption and global fast fashion were changing the face of Australian fashion retail in shopping districts.

“Fashion is not completely leaving shopping centres, but it will be a smaller component and look entirely different as brands strive to provide convenience and experience," she said.

"Closing stores is simply not going to help the viability of some apparel retailers.

"Fashion is a highly competitive industry and many retailers have much broader supply chain and design issues.

"While some retailers need to right-size their network, stores provide visibility and play an important role in successful retail strategy, including maintaining cultural relevance.”

JLL's The Future of Fashion in Australian Shopping Centres report estimates that an overall 10 per cent net reduction in apparel store networks in Australia is a likely outcome over the next 12-months, with mid-market fashion operators expected to rationalise more significantly (over 20 per cent), while fast fashion, luxury and strong performing up-market retailers are likely to keep networks stable or moderately down-size (less than 5 per cent).

JLL Head of Retail, Property & Asset Management Tony Doherty said while it was inevitable that this would put pressure on specialty vacancy and rents in the near-term, it also presented opportunities for landlords to change their tenancy mix.

“The reduction in fashion stores means that there will be room for new retailers that will support the ongoing transformation and evolution of shopping centres," he said.

"New tenancy mixes will focus more on services, social interaction and experiences and will be more than only transactions.

“While medical and beauty services, as well as dining, will continue to be popular leasing options, as in recent years, we are seeing landlords open to non-traditional retail uses such as co-working, fitness studios and evolving entertainment concepts.

"Of course, the opportunity for potential office and mixed-use developments are also viable alternatives in some locations.”

Click here to download a copy of the report.

Similar to this:

Retail store closures lower in neighbourhood centres during COVID-19 - JLL

North Sydney media and tech trend 'could accelerate' as a result of COVID-19 - JLL

Retailers locking down space in Melbourne CBD ahead of eventual rebound - Cushman & Wakefield