Strong investment activity across Australia's metropolitan office markets - JLL

Contact

Strong investment activity across Australia's metropolitan office markets - JLL

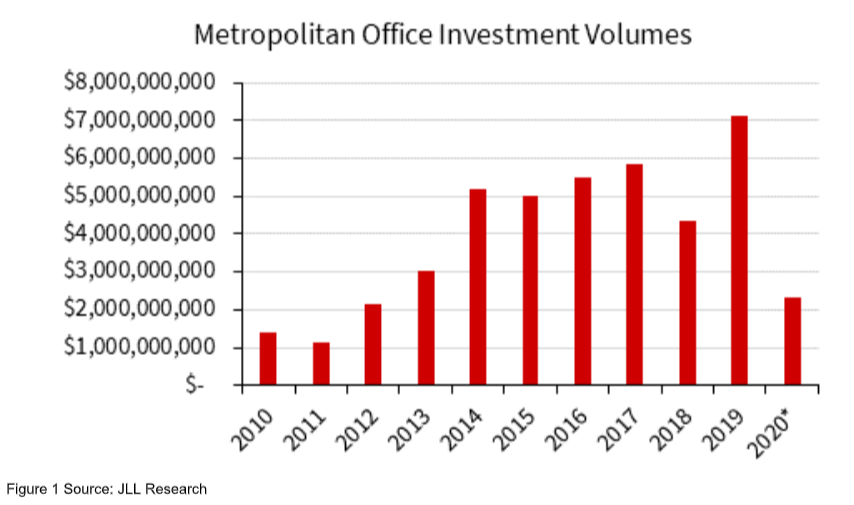

A more diverse range of capital sources is showing interest in metropolitan office markets, according to JLL.

JLL has reported that investment activity in Sydney’s metropolitan office markets has remained at firm levels through COVID-19.

The firm has recorded 17 Sydney metropolitan office asset sales (>$5 million) with investors gravitating to long WALE assets.

Nationally, there have been 47 commercial real estate assets sold in non-CBD office markets since the start of 2020, according to JLL Research.

Recent benchmark office transactions in Macquarie Park:

- Keppel Capital acquired Pinnacle Office Park at 4 Drake Avenue for $306 million.

- AEW acquired The Schneider Electric headquarters at 2 Banfield Road for $140.0 million

- Ascendas REIT purchased Macquarie Exchange for $167.2 million.

JLL’s Head of Capital Markets (NSW) Luke Billiau said the level of investor interest in metropolitan office markets was increasing.

"We are seeing capital sources that have traditionally only invested in CBD office markets explore the suburban office market investment thesis," he said.

“The unprecedented public transport infrastructure spending in NSW is improving the accessibility and connectivity of metropolitan office markets.

"The opening of the Sydney Metro Northwest improved the accessibility of the North-West corridor and expanded the workforce catchment zone for Macquarie Park as a result.

An artist's impression of MQX4 which was sold for $167.2 million. Source: Frasers Property Industrial“In an environment of risk aversion, capital is attracted to modern assets with strong covenants and long lease terms.

"A number of metropolitan office markets offer assets with these characteristics and is increasing the depth of the suburban office market buyer pool.”

JLL Australia Head of Research Andrew Ballantyne said recent metropolitan office deals in Australia reflected an extension of the investment mandate offshore capital sources have to the Australian office sector.

"It is important that investors understand the different characteristics and drivers of metropolitan office markets," he said.

“We believe the strongest performing metropolitan office markets will be those with key industry clusters, strong workforce catchments, good public transport infrastructure, retail amenity and connectivity with the CBD.

Mr Ballantyne said there were "very strong" reasons for why businesses cluster in specific locations.

"Ultimately, it comes down to proximity to customers, suppliers, the workforce catchment and other strategic relationships they may have," he said.

“In Macquarie Park, a number of reasons why healthcare organisations are based in the precinct is because of their strategic relationship with the university.

"The presence of large anchor tenants led to service providers co-locating in close proximity.

"For the NSW State Government, the decade of decentralisation policy has seen it underwrite Parramatta and Macquarie Park through the movement of specific departments or agencies."

Similar to this:

How fashion retailers are changing their physical footprint - JLL report

Retail store closures lower in neighbourhood centres during COVID-19 - JLL

Demand high for strong core office assets in Adelaide CBD despite COVID-19 - Knight Frank report